ETF Complete Guide

A Beginner's Guide to ETFs

When you invest in stocks, do you repeat this process every time?

Analyzing whether each stock is worth buying…

Dealing with uncertainty about when is the best time to trade…

Repeating this process again and again and again…

Until we build a diversified portfolio.

Of course, this might be considered the "correct" investment strategy, but it can be time-consuming and exhausting.

What if you're short on time or lack expertise? Does that mean you can't invest? Not at all!

Today, we'll introduce you to an investment tool - ETFs - which may help you save time and effort while investing.

We've spent countless hours researching and gathering information to bring you sharper insights in just 10 minutes. Let's get started.

1. What is an ETF?

Just in case someone is still unfamiliar with the concept of an ETF, let's quickly explain.

An ETF(Exchange Traded Fund) invests in a variety of assets like stocks, bonds, and commodities.

Unlike traditional mutual funds, ETFs can be traded on an exchange just like stocks, which means their prices are readily visible and trades can be executed quickly. However, this characteristic also means that ETFs can be more volatile than average mutual funds.

It's important to note that ETFs don't always track their underlying index perfectly due to 'tracking errors.' These occur when an ETF's performance deviates from its underlying index or asset due to various factors such as trading rules, fee structure, and margins. In general, higher fees may result in a higher tracking error.

2. What are the different types of ETFs?

While ETF types may differ across markets, we'll focus mainly on U.S. stock market ETFs in this discussion. The U.S. stock market is one of the most developed and mature markets, with a vast selection of ETFs available and active trading that makes it easier for investors to choose between them.

Choosing an ETF that is suitable for you can be daunting, especially with over 3,000 options available in the U.S. market alone. That's why it's important to understand the different types of ETFs and how they're classified.

ETFs can be classified by asset class, fund attributes, leverage ratios, and more.

Asset class

ETFs invest in a diverse array of asset classes, which can include stocks, commodities, bonds, foreign currencies, real estate, volatility, and mixed assets.

Within each asset class, there are many subcategories. For example, under the stock asset class, some ETFs specialize in market indices, industry sectors, stock options, and preferred stocks.

To help narrow down your choices, you can start by selecting your desired asset class when you visit an ETF summary page.

ETF attributes

ETFs are classified into two types: passive and active, each with different investment objectives.

Passive ETFs aim to track the performance of a specific index, meaning that investing in a passive ETF is similar to investing in the index it follows. Passive ETFs can track various indices, including market or industry indices, as well as bond or commodity indices.

In contrast, active ETFs strive to outperform the market or benchmark index and achieve higher returns. As a result, fund managers of active ETFs are typically more actively involved in managing their investment portfolios. Although active ETFs may offer higher potential risks and returns than passive ETFs, they also tend to have higher management fees.

Leveraged ratio

When going through an ETF list, you might notice some ETFs with names containing "short/inverse (negative leverage)" or "1.5X/2X/3X". These are leveraged ETFs. You don't need to use your margin account. By investing in these ETFs, you can invest in related indices or assets with leverage.

For instance, if you invest in a 3x leveraged ETF on the Nasdaq 100 index and the index closes up by 1% for the day, the ETF would rise by 3%. Conversely, a 3x short ETF on the Nasdaq 100 index would drop by 3% under similar conditions.

The potential return of leveraged ETFs may sound tempting, but they might not be the right fit if you lack the familiarity of exactly how they work or are not comfortable with the high level of risk associated with them.

Why? Because leveraged ETFs operate on a mechanism known as rebalancing, which implies that the ETF's leverage is based on the daily performance of the related index or asset.

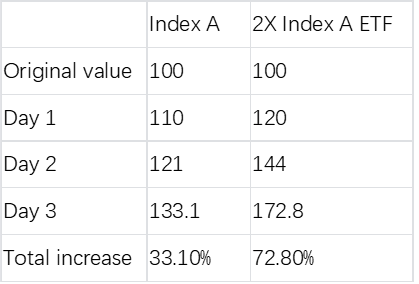

For example, let's say that Index A initially begins at 100 and experiences continuous growth of 10% over three days, resulting in a total increase of 33.1%. If there were a 2x leveraged ETF for Index A with a starting value of 100, the ETF would increase by 20% each day due to its rebalancing mechanism, resulting in a total increase of 72.8%.

Therefore, leveraged ETFs can help amplify returns in a situation where an index or asset is experiencing extreme strength. However, such scenarios are relatively rare. Market trends aren't always so clear-cut, and the future is unpredictable. During times of market volatility, how would leveraged ETFs perform?

Actually, they can just as easily increase the risk of losses. For instance, suppose Index B started at 100 and experienced alternating gains of 10% and losses of 10% over six days, resulting in a decline of 2.97%. If there were a 2x leveraged ETF for Index B with a starting value of 100, it would experience a decline of 11.53% over the same period.

Furthermore, leveraged ETFs often include futures or swap contracts in the

ir portfolios. To avoid significant deviations from their underlying benchmarks, fund managers must frequently trade these contracts, which can result in fees that are deducted from the ETF's net assets.

This is why we just said that if you invest in ETFs to save time and effort, leveraged ETFs may not be suitable for you because they are not designed to be held for a long period of time. However, if your goal is to capture short-term trading opportunities, leveraged ETFs can be a tool to help magnify potential returns.

Differences between ETFs and ETNs

There is another similar investment instrument to ETFs called ETN (Exchange-Traded Note) that can easily be confused with ETFs due to their similar names. However, it's essential not to trade ETNs as if they were ETFs because they are fundamentally different investment products.

Both ETFs and ETNs track the performance of an underlying asset and are traded in the securities market. The primary difference between them lies in the fact that ETFs hold corresponding assets or related futures and options, while ETNs do not hold any underlying assets.

But the question is, how do ETNs track their underlying assets? ETNs are unsecured debt instruments where the issuer commits to making payments based on the price of the underlying asset during a specific period. In other words, they are more similar to bonds than stocks.

So which choice is more suitable for you, ETFs or ETNs? Since ETNs don't own physical assets, their prices are calculated purely based on the current price of the underlying asset, resulting in almost zero tracking error compared to ETFs. Moreover, ETNs allow investors to invest in smaller and more niche assets that aren't accessible through ETFs.

However, due to their lack of physical assets, ETNs don't pay dividends to investors. Additionally, ETNs generally carry higher potential risks than ETFs. When the market fluctuates dramatically (which could trigger delisting conditions in some ETN contracts) or the issuer faces bankruptcy risks, your ETNs may become worthless after being forced to redeem or delisted.

Considering these risks, for investors who don't necessarily have time to evaluate individual stocks, choosing ETFs might be a viable option. ETFs on the market can meet many investors needs depending on their investment goals and risk tolerance. However, if the underlying asset you want to invest in is only available through ETN, it is recommended that you spend more time carefully reading the prospectus regulations and monitoring the issuer's credit rating before considering an investment.

3. Trading costs and fees

Finally, we come to a crucial part that most everyone is concerned about - the trading costs and fees of ETFs.

They can be divided into three categories: commissions and transaction fees, operational expenses related to ETF management (including management fees, custody fees, etc.), and bid-ask spread.

Non-US residents also need to pay dividend taxes.

Commissions and Transaction Fees

Just like trading stocks, buying or selling ETFs incurs commissions and transaction fees for each order executed. As a result, this cost has a more significant impact on high-frequency traders. Specific charges are determined by each individual broker.

Expense Ratio

OER refers to the percentage of the annual operational expenses related to ETF management relative to the fund's assets. For example, let's say you hold an ETF worth $10,000, and the ETF's expense ratio is 0.1%, then you need to pay $10 annually. This fee isn't deducted in a lump sum at the end of the year, but instead, it's subtracted from the fund's net assets every day you hold the ETF. Suppose your investment in the ETF earns zero returns after one year. In that case, you will see your holding value gradually decrease from $10,000 to $9,990 over that period. If you invest for more than one year, this fee will compound over time like a snowball. Therefore, the longer the investment horizon, the more attention you need to pay to the expense ratio because slight differences can lead to vastly different final returns.

Bid-Ask Spread

This may be a trading cost that many investors overlook, but for frequent traders, this factor may be more critical than expense ratios. The bid-ask spread amount varies for each ETF, but ETFs with lower trading volumes typically have larger bid-ask spreads.

For example, let's assume two ETFs that track the same underlying asset and have a current price of $10.

ETF A has a management fee of 1%, but a bid-ask spread of $0.02, while ETF B has a management fee of 0.5% and a bid-ask spread of $1. Suppose both are bought for 100 shares and held for one month, with both ETFs having a similar performance of 10% in returns while the bid-ask spread remains constant.

If sold at that point, disregarding other factors, which ETF would have a higher final return?

The answer is ETF A because when factoring in the bid-ask spread (ETF A's spread being 0.2% and ETF B's spread being 1%), ETF A's return would be $1,086.8 while ETF B's return would be $1,083.5.

Dividend withholding tax for non-US residents

Lastly, if you are a non-US resident, a dividend withholding tax of 30% will automatically be deducted from your ETF's dividends each time they are paid (no payment is required as the tax will be deducted before the dividends are credited to your account). This tax is levied by the US government.

When we trade ETFs, the fee structure is as follows:

Now that you've learned almost everything you need to know about trading ETFs, all that's left is to understand the trading process. It's a straightforward process, and as long as you have a securities account, it's very similar to trading stocks. Finding the ETF you want to trade is crucial, but we'll cover that topic in another article.