Funding is beginning to be more cautious about tech stocks

Today, the world is looking for the reason for the sudden collapse of Nvidia's stock price!

Overnight, US stocks staged another night of horror. After the S&P 500 and NASDAQ reached record highs in the intraday period, they turned their heads downward. By the close, the Dow fell slightly by 0.18%, the S&P 500 index by 0.65%, and the NASDAQ by 1.16%.

The latter two indices are clearly more intense than the Dow's pullback, and the reason behind this is a large negative line suddenly caused by the “first stock in the universe” Nvidia.

On Friday, Nvidia once surged 5%, and its stock price climbed to 974 US dollars/share. At one point, the total market value was close to Apple, but the intraday dive suddenly plummeted 5.55%, stopping at 7 Lianyang, the biggest one-day decline in nine months. The market capitalization evaporated 130 billion US dollars overnight, making it one of the biggest single-day market capitalization declines in US stock history.

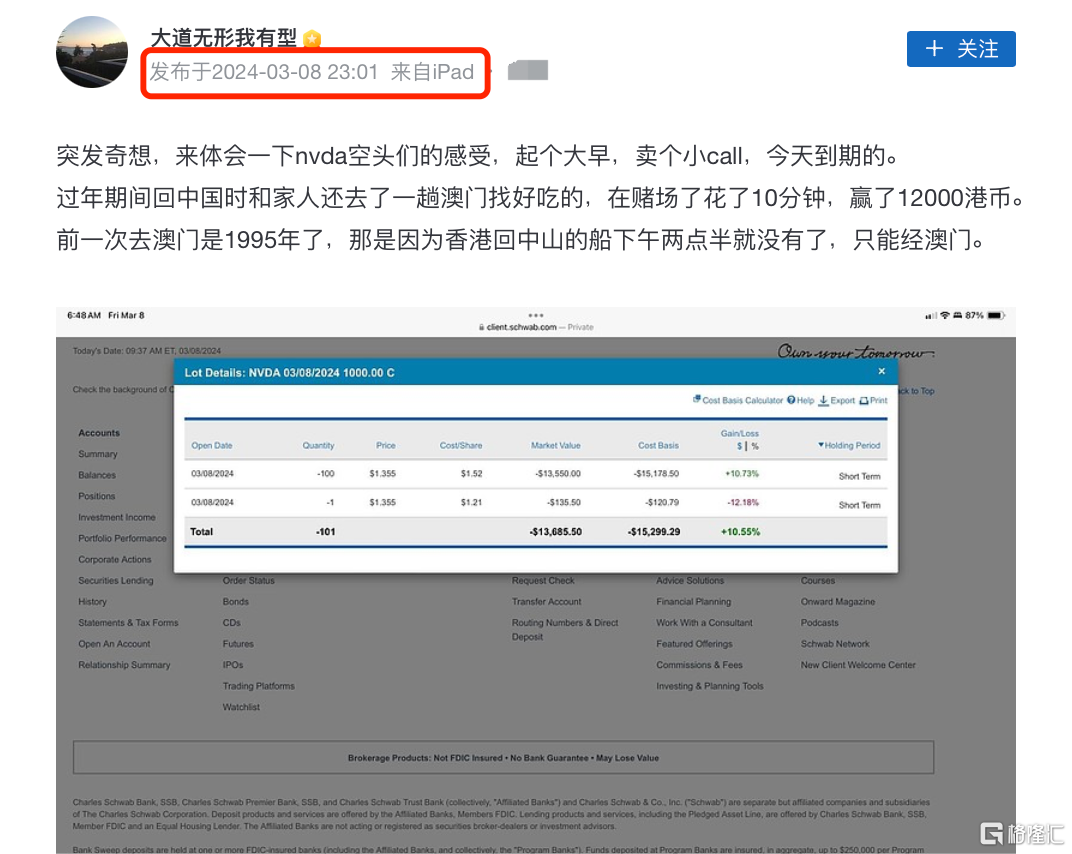

Surprisingly, before Nvidia's stock price dived (March 8, 23:29), Duan Yongping sold Nvidia's call for bullish options and seemed to have successfully made a profit on the “Three Vision Pro”.

(The content of this article is a list of objective data and information and does not constitute any investment advice)

Of course, Duan Yongping is not underestimating Nvidia. The call that was sold this time expired on the same day. There were no opinions; it was just entertainment. He had a whim and made a cameo appearance on Nvidia's “Big Short” character.

Coincidentally, the market now seems to assume that options caused Nvidia's sudden collapse.

1

Nvidia plummeted, options hot?

Nvidia fought fiercely last night. From a 5% increase to a 5% drop, the turnover reached 103.5 billion US dollars. After the market, it continued to drop 2.77% after the market.

Most market opinions are that Nvidia's stock price changed due to the exercise of a large number of Nvidia call options on Friday.

When options market makers sell call options, they need to buy stocks at the same time to hedge risks. Once a call option is exercised, the stock will be sold.

With Nvidia's stock price soaring, a large number of investors poured in to buy Nvidia's bullish options, and options market makers had to continue to buy Nvidia at the highest point. For market makers, the previously sold Nvidia call options lost money, and there is an incentive to reduce losses by smashing the market.

Another situation is that Friday is the option expiration date. A large number of investors chose to sell Nvidia's call on this day, so market makers had to close their spot long positions on the stock, causing the original stock Nvidia stock to fall.

Of course, these two factors may reinforce each other. It is possible that market makers smashed the market first, causing panic, and a large number of investors also followed the call to sell, causing the stock price of original stock Nvidia to move and fall.

In options, there is a phenomenon called GAMMA Squeeze (gamma squeeze). Investors rush to buy call options, causing market makers to hedge the underlying stock by buying stocks, thereby driving up the stock price. While this can be seen as a catalyst for a bull market, it can also cause volatility due to excessive speculation. Once the amplitude of the call option is too high, the gamma squeeze process will be exhausted, causing the stock to fall sharply.

Some netizens pointed out that the script for Nvidia's current decline is the same as SMCI of 2.16. The gamma squeeze of options caused the stock price to soar all the way up. Currently, Nvidia's bullish options have accumulated a large amount of chips around 820-850. On the last day, market makers and sellers will definitely frantically smash the market to reduce losses.

According to reports, Nvidia's total trading volume on Friday reached 4.073,400, of which put options accounted for 37.28% of the total volume, and call options accounted for 62.2%. As of the close of the day, Nvidia's open positions (that is, options contracts that are not traded or exercised) totaled about 4,5095 million.”

Notably, when Nvidia traded for $960.33. There was a large change in bullish options, which topped the list with a turnover of 204,000 copies, reaching a scale of 425 million US dollars.

What do you think of Nvidia's upcoming stock price?

2

Will Nvidia continue to rise or pull back?

Netizens' comments on this were nothing more than a “reverse car to pick someone up,” and it can be seen that everyone still has full confidence in Nvidia. Judging from the performance of the US stock “Seven Sisters” in 2024, three of them began to show exhaustion; the one that can play best is Nvidia.

Even after Friday's decline, the stock is still up more than 70% in 2024, making it the third-largest company in the S&P 500 after Microsoft and Apple. Now everyone is waiting for the day when Nvidia's market capitalization surpasses Apple's.

At a time when Nvidia's stock price was skyrocketing, retail investors also fervently poured into Nvidia-themed leveraged ETFs. The GraniteShares 2x Long NVDA Daily ETF (NVDL) and T-Rex 2X Long NVIDIA Daily Target ETF (NVDX) both recorded record net monthly inflows in February.

Among them, NVDL inflows of US$236 million in February, the ETF's largest inflow since its establishment in 2022. The net monthly inflow record was once again broken in the first six days of this month, and the scale has increased sevenfold from US$200 million at the beginning of the year to US$1.41 billion. According to LSEG Lipper data, this Wednesday, NVDL's net inflow reached 197 million US dollars in a single day.

Of course, Nvidia's changes and falls. Apart from the options factor, the cumulative increase in its own individual stocks is too large, and there is a certain demand for profit settlement of capital.

Jordan Klein (Jordan Klein), an analyst at Mizuho Securities, believes: “Semiconductor stocks have always been “overbought, and when they start to subside, you'll see quantitative machines sell, then retail concerns, and it just accelerates.”

Meanwhile, the mixed February non-agricultural data released on Friday night and the February CPI data to be released next week all had some disturbing factors in trading sentiment. Generally speaking, before major economic data is released, the degree of market volatility will also increase.

3

“mixed” non-agricultural data for February

Another copy of non-agricultural data, the total amount of which exceeded expectations

The number of people employed on non-farm payrolls in the US increased by 275,000 in February, again exceeding expectations of 200,000. However, the unemployment rate unexpectedly rose to 3.9%, higher than market expectations of 3.7%, and wage growth also slowed, and the labor force participation rate remained at 62.5%.

Meanwhile, the Ministry of Labor lowered the total non-farm payrolls data for December of last year and January of this year by 67,000 people.

After the data was released, US bond yields declined, gold continued to reach new highs, and Bitcoin hit another record high, hitting 70,000 US dollars for the first time. The US dollar has recorded its longest continuous decline since October last year.

“If we actually see that the unemployment rate has bottomed out and rising and wage growth is slowing down, then this will obviously push the door to interest rate cuts even more,” said Charles Hepworth of GAM Investments.

Ian Lyngen (Ian Lyngen) of BMO Capital Markets said that the weak wage data is worth noting. “If nothing surprising, this latest news on wage inflation reflects Powell's message that the first rate cut is imminent.”

The door to cutting interest rates seems to be getting wider. Even US President Joe Biden can't hold back and talk about the election campaign in Philadelphia. It is expected that the Federal Reserve will cut interest rates.

ECB President Lagarde also previously hinted that interest rates would be cut in June. Meanwhile, information continues to circulate that the Bank of Japan is preparing to raise interest rates in March.

The information revealed behind recent aberrations in global asset prices requires alarm.

The reason behind the collective high of gold and Bitcoin may be due to early pricing of the Federal Reserve's interest rate cut, but it also means that there is still plenty of liquidity in the financial system.

If we look at the long-term dimension, they all say that the price of gold and the US dollar was inversely related, but gold repeatedly reached new highs during the period when the Federal Reserve raised interest rates violently. Of course, some people would say this is related to geographical factors.

Naturally, there is no doubt about this, but behind it are two completely different forces, old and new, looking for an anchor for asset pricing. Will the “oil dollar” become a “gold dollar,” “Bitcoin dollar,” or a “chip dollar”?

In the short term, capital is beginning to be more cautious about technology stocks. Bank of China strategists quoted EPFR Global data and wrote that in the week ending March 6, approximately $4.4 billion was withdrawn from technology funds.

As a final reminder, next week, in addition to the US CPI data for February, next Friday will also usher in the “Four Witches Day”. At that time, stock futures and stock options will also be held. Index futures and index options expire at the same time. Market makers and traders will drastically adjust their portfolios, and the degree of market volatility will also increase.

Matt Maley, chief market strategist at Miller Tabak + Co., said: “In our opinion, there is no doubt that there are quite a few 'bubbles' entering the market in the short term. Investors should use the next week or so to raise some cash and take some defensive measures.”