Auto Currency Exchange

1. What is Auto Currency Exchange

When purchasing USD-settled products (such as US stocks, US options and some Singapore stocks), if you use USD margin financing buying power and your account holds Singapore dollars, the excess amount will first use USD margin financing. After the settlement date, if there's still a USD deficit, the system will automatically convert your SGD to USD through the Auto Currency Exchange service to reduce margin interest.

Example:

If you use USD margin financing buying power to purchase US stocks at 3:00 PM ET on May 14, 2025 (which is 3:00 AM Singapore Time on May 15), the USD requirement will settle on May 15 ET. After 9:00 AM Singapore Time on May 16, the Auto Currency Exchange Service will complete the process.

2. What are the benefits of Auto Currency Exchange

-

Streamlined Trading Process Trade directly in your margin account, no need to exchange USD in advance.

-

Efficient Use of Funds Combine your USD and SGD balances to maximize available funds and enhance flexibility.

-

Lower Costs Prioritizes the use of USD. If your USD is insufficient, it uses SGD automatically. Margin interest applies only when both balances are insufficient.

3. How to check Auto Currency Exchange amounts

Auto Currency Exchange calculates your USD deficits from the previous settlement day, and then uses your available SGD cash to repay them.

-

If your SGD balance is sufficient, the full USD deficit will be repaid.

-

If your SGD balance is insufficient, all available SGD will be converted, leaving the remaining USD deficit.

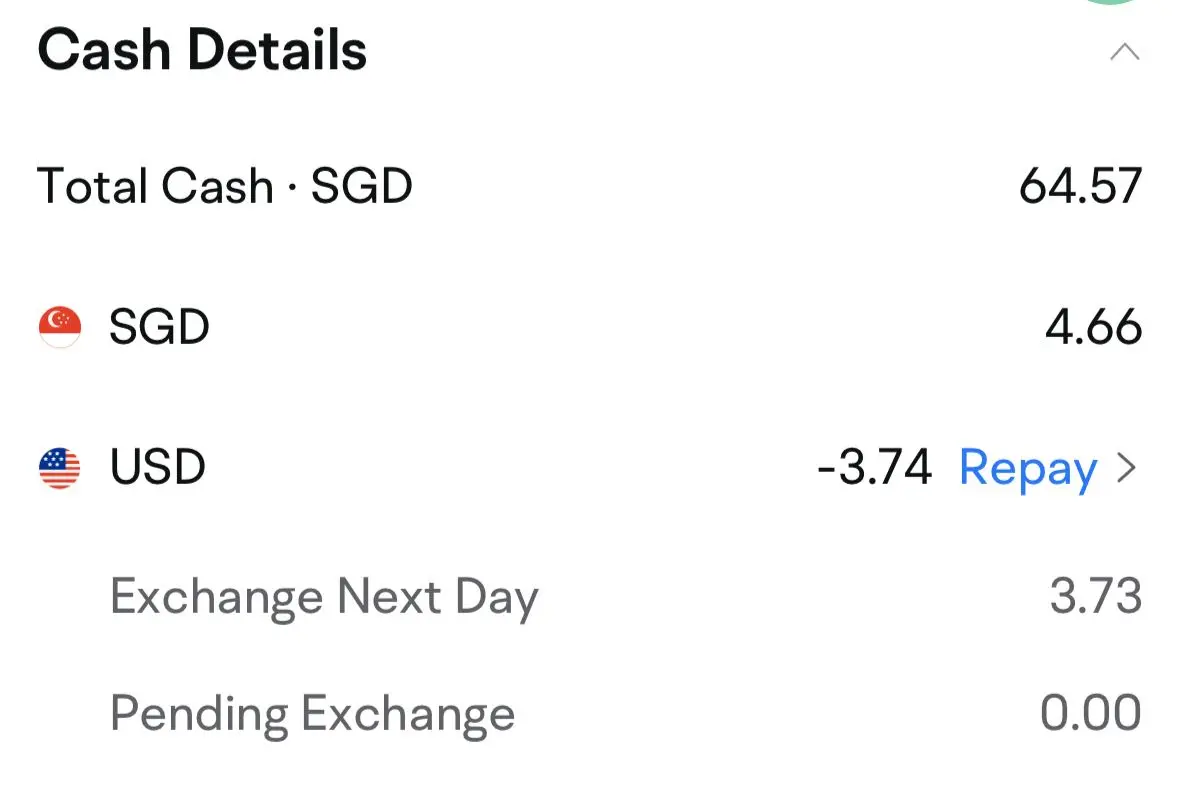

You can view USD deficits under: Accounts > Tap an account > Net Assets > Cash Details

-

Exchange Next Day: USD deficits from today's settlement will be automatically converted after 9:00 AM Singapore Time tomorrow.

-

Pending Exchange: USD deficits from tomorrow's settlement or later will be converted after 9:00 AM Singapore Time the day after settlement.

For example, the amount shown in Exchange Next Day on May 15, Auto Currency Exchange will complete the exchange after 9:00 AM Singapore Time on May 16.

Please note that these amounts are your USD deficits. Actual exchange amounts depend on your SGD balance and will reflect the final Auto Currency Exchange results.

4. How to enable or disable Auto Currency Exchange

-

Mobile: Me> Settings > Accounts & Positions > Auto Currency Exchange

-

Desktop: Settings > Trading > Auto Currency Exchange Note: Auto Currency Exchange service will be unavailable if financing is turned off.

5. When does turning off Auto Currency Exchange take effect

If you turn the Auto Currency Exchange function on or off before 9:10 a.m., the change will take effect at the next scheduled automatic conversion.

6. Supported currencies and exchange rates

-

Currently, Auto Currency Exchange is only supported for USD margin financing using SGD balances.

-

Exchange rates are set by the upstream exchange channel.

-

You can check the rates in the app under Fund Details or Statements.

7. Are there fees for Auto Currency Exchange

-

No additional fees are charged for the Auto Currency Exchange service.

8. Notifications and records

When the Auto Currency Exchange is complete, you'll receive a notification. You can also view all records in the app by going to Accounts > Tap an account > History > Fund Details.

Note: If the Fund Details are not shown automatically, you can tap Order History to switch between Order History and Fund Details.

9. What's the difference between Auto Currency Exchange and SmartSave

Auto Currency Exchange and SmartSave operate independently at different times.

When you have SmartSave enabled but Auto Currency Exchange is off:

If you trade using your Cash Plus buying power, we check for deficits daily at 6:00 AM and 8:00 AM Singapore Time and redeem your Cash Plus holdings of the same amount to cover.

-

Redemptions can only repay deficits in the same currency automatically.

-

For cross-currency deficits, you need to manually exchange currencies after the redemption arrives.

Example: On May 15 at 8:00 AM, your account has:

-

1,000 USD deficit

-

0 SGD cash

-

1,000 SGD and 500 USD in Cash Plus

Then:

-

500 USD from Cash Plus is redeemed first, leaving a 500 USD deficit.

-

Suppose the rate is 1.4008 SGD/USD, then 700.40 SGD from Cash Plus is redeemed.

-

After receiving the SGD redemption proceeds, you must manually convert 700.40 SGD to USD to settle the remaining deficit. If not, you will incur a margin interest charge of 500 USD.

With both SmartSave and Auto Currency Exchange active: After 8:00 AM, you will receive you SGD redemption proceeds from Cash Plus, Auto Currency Exchange automatically converts SGD to USD at 9:00 AM to cover USD deficits.

Overview

- 1. What is Auto Currency Exchange

- 2. What are the benefits of Auto Currency Exchange

- 3. How to check Auto Currency Exchange amounts

- 4. How to enable or disable Auto Currency Exchange

- 5. When does turning off Auto Currency Exchange take effect

- 6. Supported currencies and exchange rates

- 7. Are there fees for Auto Currency Exchange

- 8. Notifications and records

- 9. What's the difference between Auto Currency Exchange and SmartSave

- No more -