What are Support and Resistance

Key takeaways

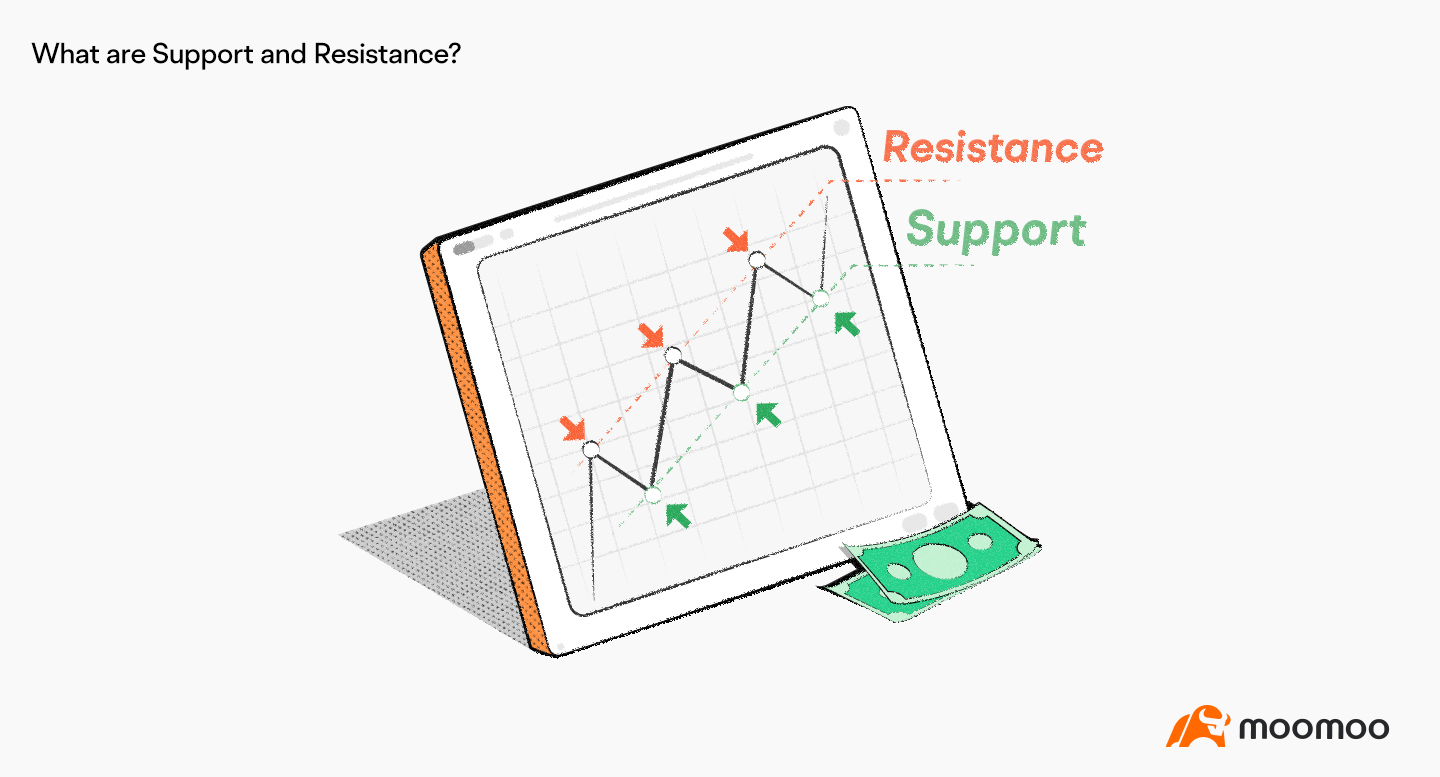

Support is a price level where potential support may stop a downtrend.

Resistance is a price level where potential resistance may reverse an uptrend.

Three factors to refer to when identifying support and resistance: historical prices, previous support and resistance, and technical indicators.

Understanding support and resistance

Support and resistance are two concepts commonly used in technical analysis.

Support refers to a price level where there’s potential support to stop a downtrend.

Resistance is a price level where there’s potential resistance to reverse an uptrend.

Support and resistance usually appear under the following circumstances.

Moving averages, such as the 5-day, 10-day, and 20-day moving averages, create support and resistance.

In an intraday trendline, the high and low points form support and resistance.

When a gap opening happens (i.e., the opening price is substantially higher or lower than the previous day's closing price), an upward gap serves as support and a downward gap functions as resistance.

Support and resistance can also be found in existing ascending or descending channels.

How to identify support and resistance

Several factors can be referred to when we’re identifying support and resistance: historical prices, previous support and resistance, and technical indicators.

In a moving average chart, the nearest moving average above a high price provides short-term resistance while the nearest one below a low price creates short-term support. Increasing volume with price breaking through resistance presents a bullish signal, whereas rising volume with price breaking through support suggests a bearish signal.

In an intraday trendline, opening, closing, high, and low prices all form corresponding short-term support or resistance. Day traders could draw the trendline on the 1-min time frame to identify resistance and support.

In terms of a gap opening, an upward gap provides support and a downward gap resistance.

In an existing ascending channel, connecting high prices can help identify resistance; in a descending channel, connecting low prices can help identify support.

Summary

Support and resistance analysis is an entry-level strategy for investing in the stock market, which can be used to help set stop-loss and take-profit targets and determine entry and exit points. However, as there’re many other factors affecting stock prices, and support and resistance are often broken, we need to take the overall market situation into consideration before deciding the effectiveness of the two price levels.