Practical Options Trading Strategies

Long Butterfly

A Butterfly Spread is an options trading strategy in which you simultaneously buy and sell four calls or puts of a particular security with the same expiration but three different strike prices.

There are two long butterfly strategies: long call butterfly and long put butterfly.

Take a long call butterfly as an example. You can consider a long call butterfly when you expect a security move near a specific price level and want to limit your risks.

Strategy breakdown

The long call butterfly strategy involves trading four options of the same underlying asset.

● Buy a call1

● Sell two call2s

● Buy a call3

Call1, call2, and call3 have the same expiration but different strike prices.

Strike price: call1 < call2 < call3, call2 - call1 = call3 - call2

The higher and lower strikes are equal distances from the middle price.

Understanding

The long call butterfly strategy consists of selling two calls with a middle strike price, buying one call with a lower strike price, and buying another with a higher strike price.

Generally, the middle strike equals the market price of a security, and the lower and upper strike prices (wings) are the same distance from the middle strike price. Also, all calls have the same expiration date.

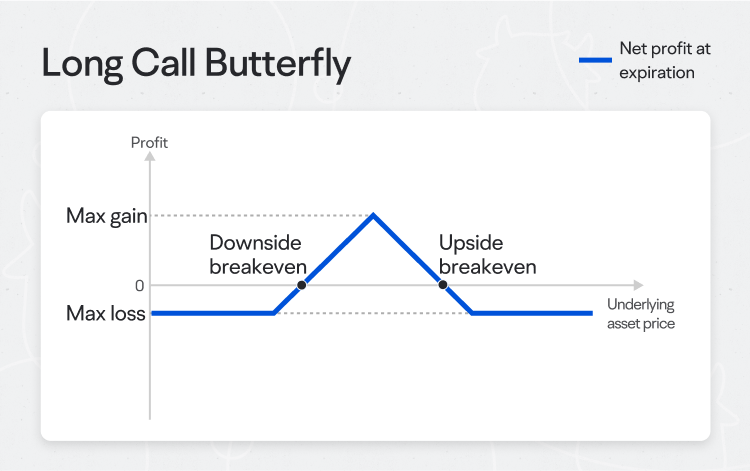

This strategy has maximum potential profit and limited risk before the option contracts expire. You can get the maximum profit if the asset's price equals the middle strike price at expiration.

When using this strategy, you should pay attention to the cost (including commissions) because it includes at least four option trades. It is important to ensure a favorable risk/reward ratio.

Gain & Loss

● Breakeven

Upside Breakeven = Lower Strike + Net Premium Paid

Downside Breakeven = Higher Strike - Net Premium Paid

● Max Gain

Max Gain = Higher Strike - Middle Strike - Net Premium Paid

● Max loss

Net Premium Paid

Example

Suppose a stock called TUTU is currently trading at $52.

You expect its price will not change significantly before expiration. So you decide to implement a long call butterfly:

● Buy a $6 TUTU call with a strike of $48

● Sell two $3 TUTU calls with a strike of $52

● Buy a $2 TUTU call with a strike of $56

(The following calculations do not include transaction costs.)