Singapore REITs Dividend Performance [2018-2023]

5 REITs in Singapore Market

Key Takeaway

Indicates REITs' dividends from FY2018 to FY2022 (as of 16 October 2023) in Singapore with historical yearly distribution and 5-year Average Dividends yield, including Ascendas REIT Dividend, Mapletree Industrial Trust Dividend, CapitaLand Integrated Commercial Trust, Keppel DC REIT Dividend, Frasers Centrepoint Trust Dividend.

In the year 2023, Singapore's real estate investment trusts (REITs) will continue to be an investment option for investors seeking income. Over the past decade, REITs in Singapore have consistently provided dividends/distributions to their investors, in fact REITs in Singapore are mandated to pay out at least 90% of their income as dividends.

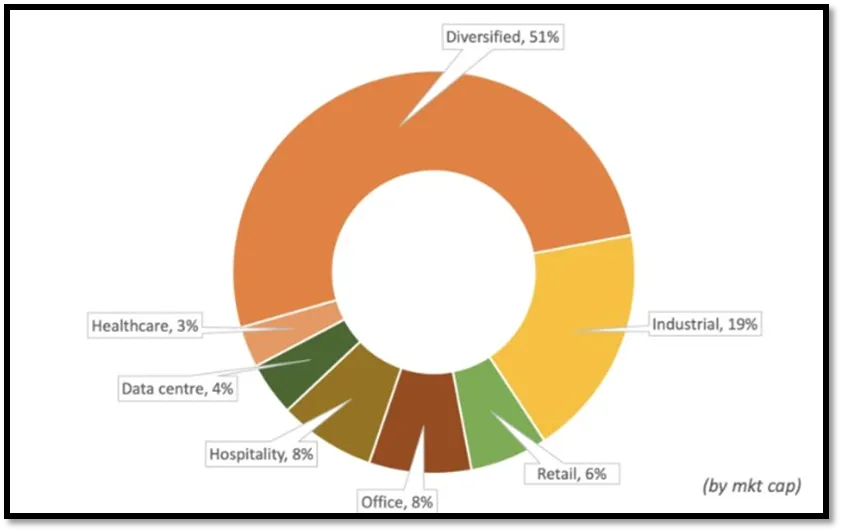

Retrieved from SGX Research Chartbook: REITS & Property Trusts (June 2022)

Images provided are not current and any securities are shown for illustrative purposes only.

What are REITs?

REITs, or real estate investment trusts, are investment vehicles that own and manage income-generating properties. They allow investors to participate in the real estate market without directly owning properties. REITs generate income through rental payments from tenants and distribute portions of their earnings as dividends to shareholders.

Click to check guideline: How to invest REITs in singapore

1. Ascendas REIT Dividend (SGX:A17U)

-- Distribution History --

FY 2022 Dividend: S$ 0.15798

FY 2021 Dividend: S$ 0.15258

FY 2020 Dividend: S$ 0.14688

FY 2019 Dividend: S$ 0.11490

FY 2018 Dividend: S$ 0.16035

#The above information Distribution per Unit, source from CapitaLand Ascendas REIT - Distribution

-- Relevant Data --

5-year Average Dividend yield: 4.00%

Currently Price (18 July 2023): SGD 2.79

Payout Ratio: 86.47%

Enterprise Value: SGD 18.51 billion

# The above data as of FY 2022, from Yahoo

# Click here to check News & Forum discussion

CLAR, formerly known as CipitaLand Ascendas Real Estate Investment Trust (Ascendas Reit), is the first business space and industrial real estate investment trust listed in Singapore. It was listed on the Singapore Exchange Securities Trading Limited (SGX-ST) in November 2002. With a strong focus on tech and logistics properties in developed markets, CLAR has grown to become a global REIT anchored in Singapore.

2. Mapletree Industrial Trust Dividend (SGX: ME8U)

-- Distribution History --

FY 2022 Dividend: S$ 0.1357

FY 2021 Dividend: S$ 0.1380

FY 2020 Dividend: S$ 0.1255

FY 2019 Dividend: S$ 0.1224

FY 2018 Dividend: S$ 0.1216

#The above information Distribution per Unit, source from Mapletree Industrial Trust - Distribution History

-- Relevant Data --

5-year Average Dividend yield: 4.64%

Currently Price (18 July 2023): SGD 2.26

Payout Ratio: 82.03%

Enterprise Value: SGD 9.02 billion

# The above data as of FY 2022, from Yahoo

# Click here to check News & Forum discussion

Mapletree Industrial Trust is a Singapore Exchange Main Board-listed Real Estate Investment Trust (REIT). The trust's primary investment strategy involves investing in a diversified portfolio of real estate used mainly for industrial purposes in Singapore, income-producing real estate primarily used as data centers worldwide beyond Singapore and related assets.

3. CapitaLand Integrated Commercial Trust (SGX: C38U)

-- Distribution History --

FY 2022 Dividend: S$ 0.0522

FY 2021 Dividend: S$ 0.1040

FY 2020 Dividend: S$ 0.0869

FY 2019 Dividend: S$ 0.1197

FY 2018 Dividend: S$ 0.1150

#The above information Distribution per Unit, source from CapLand IntCom T Dividend - Distribution History

-- Relevant Data --

5-year Average Dividend yield: 4.42%

Currently Price (18 July 2023): SGD 1.98

Payout Ratio: 51.33%

Enterprise Value: SGD 22.6 billion

# The above data as of FY 2022, from Yahoo

# Click here to check News & Forum discussion

CapitaLand Mall Trust made its debut on SGX-ST in July 2002 and later changed its name to CICT in November 2020 after merging with CapitaLand Commercial Trust. CICT's portfolio consists of high-quality, income-producing assets primarily used for commercial purposes such as offices and retail spaces, located mainly in Singapore.

4. Keppel DC REIT Dividend (SGX:AJBU)

-- Distribution History --

FY 2022 Dividend: S$ 0.10214

FY 2021 Dividend: S$ 0.09851

FY 2020 Dividend: S$ 0.09170

FY 2019 Dividend: S$ 0.07612

FY 2018 Dividend: S$ 0.07324

#The above information Distribution per Unit, source from Keppel DC REIT - Distribution History

-- Relevant Data --

5-year Average Dividend yield: 3.30%

Currently Price (18 July 2023): SGD 2.23

Payout Ratio: 63.65%

Enterprise Value: SGD 4.83 billion

# The above data as of FY 2022, from Yahoo

# Click here to check News & Forum discussion

Keppel DC REIT focuses on investing primarily in real estate assets that generate income and are used for data center purposes, as well as other real estate and assets that support the digital economy. The trust invests in a diversified portfolio of colocation, fully-fitted, shell and core assets, and network assets through its investment in debt securities, which enhances the diversity and resilience of its portfolio.

5. Frasers Centrepoint Trust Dividend (SGX:J69U)

-- Distribution History --

FY 2022 Dividend: S$ 0.12227

FY 2021 Dividend: S$ 0.12085

FY 2020 Dividend: S$ 0.09042

FY 2019 Dividend: S$ 0.12070

FY 2018 Dividend: S$ 0.12015

#The above information Distribution per Unit, source from Frasers Centrepoint Trust - Dividend History

-- Relevant Data --

5-year Average Dividend yield: 4.59%

Currently Price (18 July 2023): SGD 2.18

Payout Ratio: 96.73%

Enterprise Value: SGD 5.96 billion

# The above data as of FY 2022, from Yahoo

# Click here to check News & Forum discussion

Frasers Centrepoint Trust (FCT) focuses on retail properties, including suburban malls and shopping centers. It has a presence in Singapore's retail market. FCT is managed by Frasers Centrepoint Asset Management Ltd., a real estate management company and a wholly-owned subsidiary of Frasers Property Limited.

Additional Choice: Moomoo Cash Plus 5.8%* p.a. Guaranteed Returns for 30 days

Growing your money through Moomoo Cash Plus campaign. The campaign is about Moomoo Cash Plus 5.8%*p.a. Guaranteed returns for 30 days.

Rewards

Reward A:

5.8% p.a.guaranteed return: The difference to be made up by Moomoo SG will be calculated based on the amount held by a user every day. Daily Bonus = Amount Held * (5.8% p.a. - Fund's Yield on the Day) / 365. The additional bonus (i.e. difference between 5.8% p.a. and the underlying fund return) will be credited in lump sum to your Moomoo SG universal account as cash rewards within seven business days after the 30-day period ends.

Cash rewards will be given in SGD regardless of the underlying fund chosen. For users who have invested into CSOP USD Cash Fund, the SGD equivalent currency cash rewards credited will be based on exchange rate of 1.34.

During a negative 7-day yield period, the position in either funds invested will be liquidated. Users will still be entitled to the full 5.8% p.a.cash rewards guaranteed by Moomoo SG.

Reward B:

S$5 cash coupon: After a new user subscribes at least S$100 to any funds under Moomoo Cash Plus within seven days after their initial deposit, the system will automatically send them a S$5 cash coupon within three working days. The cashback will arrive in the client's account within three working days. Each user can only redeem the reward once.

Download the moomoo app, and Sign Up now to get this special offer of guaranteed 5.8% p.a. for 30 days.

Rules

New users who make their initial deposit of any amounts after July 1, 2023, 00:00 (SGT) can enjoy a 5.8% annualized yield on any underlying funds of Moomoo Cash Plus. The 5.8% annualized yield is only valid for 30 days. Max subscription amount into any funds under Moomoo Cash Plus for this campaign is S$ 80,000 for each user. Minimum subscription of SGD 0.01.

E.g., If the first fund, Fullerton SGD Cash Fund chosen by a new user has a 3.9% annualized yield return, Moomoo SG will make up the difference to ensure a 5.8% annualized yield for 30 days after the client's first subscription.

Where the fund chosen has returns higher than 5.8% annualized yield, full annualized yield as per the underlying funds returns will be given accordingly.

New users who subscribe at least S$100 into any underlying funds of Moomoo Cash Plus within seven days after their initial deposit can receive a S$5 cash coupon.

Note: New clients can buy either the SGD fund or the USD fund, but the promotion only applies to the first fund they choose, i.e., they can only enjoy a 5.8% annualized yield on the first fund they buy. If clients buy two funds at the same time, the promotion will apply to the one with the higher subscription amount.

Other terms and conditions

These terms and conditions, rewards and offers are organized by Moomoo Financial Singapore Pte. Ltd. (「Organiser」), a subsidiary of Futu Holdings Limited. By taking part in this Campaign, you agree to be bound by these Campaign Terms and Conditions, existing terms and conditions in the customer agreement, and the decisions of Moomoo Financial Singapore Pte. Ltd. in relation to and in connection with this Campaign.

For the complete terms and conditions, check here.

Disclaimer

The above information is based on public market data as of 18 July 2023. It is not a financial advice, recommendation or solicitation to buy or sell financial products. Investors should conduct their own research and consult a financial advisor before making an investment decision.