Source: Guojun Macro Research

Authors: Dong Qi, Tian Yuduo, Chen Liqing

In the short term, even if some commodity prices soar "short", but the liquidity risk is limited. In the longer term, the risk may increase in the event of a subsequent market collapse.

By combing through the common triggers of liquidity crises in history, namely, capital withdrawal and siphon, shrinking collateral and pessimistic contagion, the King Macro Research team believes thatIn the short term, even if some commodity prices soar "empty", but the volume of capital withdrawal and siphon scale will be far less than the stock and debt housing market.

If subsequent commodity prices plummet, physical commodity collateral may face a sharp contraction, which in turn triggers a "deleveraging" chain reaction, adding pessimism to further contagion, and liquidity risk may increase.

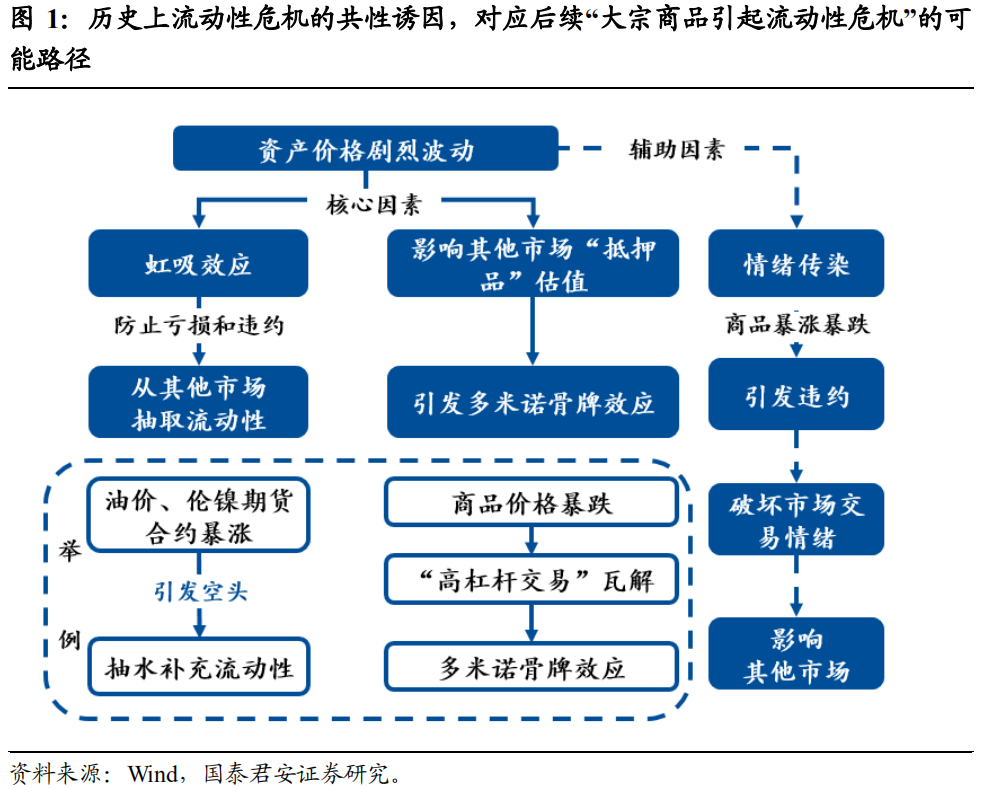

1. The common triggers of liquidity crisis in history and the possible paths of liquidity crisis induced by commodity price fluctuations:

1) Core factor 1:

The withdrawal and siphon effect of funds. The price of an asset fluctuates sharply, causing a siphon effect, and traders in that market extract liquidity from other markets to prevent losses and defaults. For commodity markets, oil prices and nickel futures contracts are soaring, triggering short sellers to pump water from other markets to replenish flows.

2) the collateral shrinks:

This asset involves the valuation of "collateral" in other markets. For commodities, it is mainly the collapse of "highly leveraged trading" in other markets after the collapse in prices, which leads to a domino effect.

3) the auxiliary factor is fear contagion.After the sharp rise and fall of commodity prices, it triggers default, undermines market trading sentiment, and then affects other markets.

2. Soaring commodities have little short-term liquidity risk.

1) siphon effect:

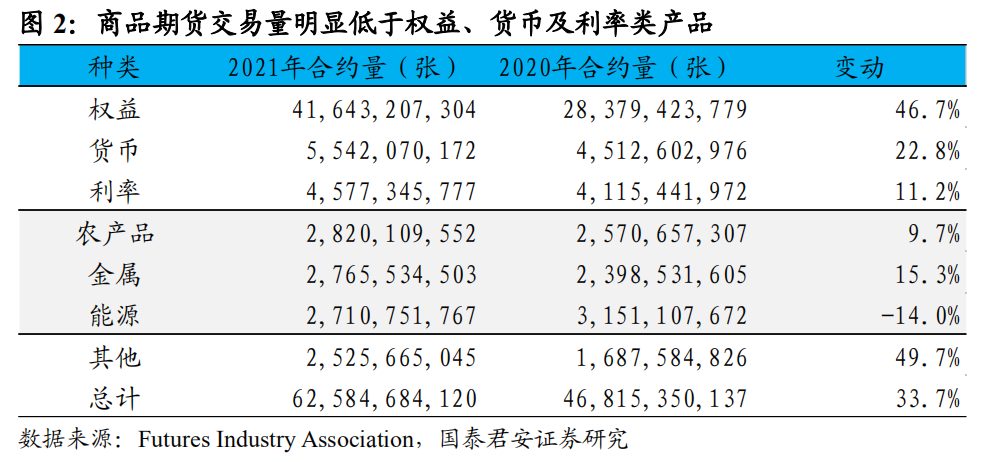

The siphon effect of capital is relatively limited because of the scale and trading mechanism of commodities. Commodities implement a margin trading mechanism, which theoretically results in losses within the limit of margin size. As far as the margin scale is concerned, the margin size of the global market is about 6.2 trillion RMB. This is not on a par with the global stock market of more than 100 trillion US dollars and the US Treasury bond market of more than 20 trillion US dollars.

therefore,The liquidity risk caused by the surge of commodities is mainly the risk of short positions, is the liquidity risk in the futures market, the absorption effect on the overall financial system is relatively limited, will not cause a systematic liquidity crisis.

2) in terms of collateral:

It is rare to use futures contracts directly as collateral. If commodities are used as collateral, the current Russian-related commodity prices are discounted, but the volume involved is small, and the impact on other leveraged transactions can also be controlled.

3) emotional contagion:

Default of commodity contract can indeed infect pessimism, but the futures market is limited in scale and has the attributes of high game and high leverage, which makes other markets have a greater tolerance for its volatility. During the 2014 oil price collapse, crude oil ETF volatility rose sharply, while the VIX index remained stable, and crude oil ETF volatility has been higher than stocks for a long time.

3. In the longer term, the risk may increase if the subsequent market slump.

Referring to the history of US sanctions against United, aluminum prices rose nearly 30 per cent in half a month and then began to fall sharply. We believe that if the conflict between Russia and Ukraine is gradually eased, there is a risk of a collapse in commodities.

主If the collateral effectNot only will there be discounts on Russian-related commodities, but if other commodities plummet, highly leveraged trading in other markets using these commodities as collateral will also be deleveraged on a large scale, creating a domino effect.The second is the infection of pessimism.As there is something wrong with the collateral, the risk of the futures market will be transmitted to other markets, which will make the mood of the futures market contagious and bring panic.

Edit / phoebe