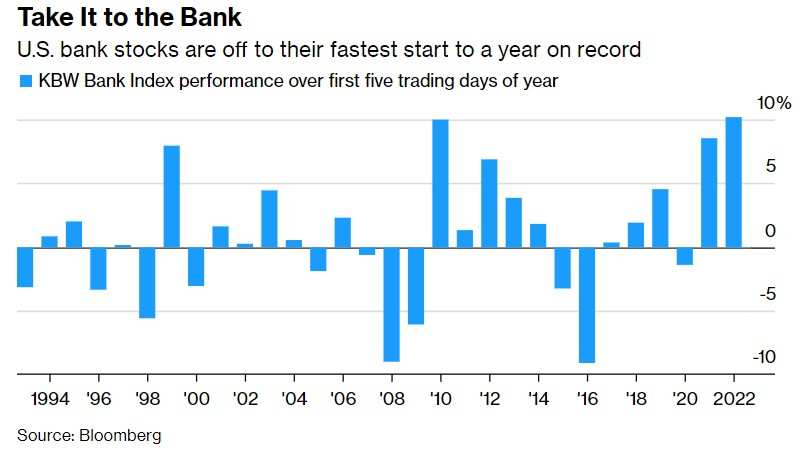

Us bank stocks opened the new year with their best start to the year in more than a decade, with bank stocks performing very strongly at a time when the three major indexes of US stocks were weakening one after another. The "hawkish" minutes of the Fed's meeting helped to extend the rally in bank stocks, which posted their best annual gain since 2013 in 2021.

On Wednesday, the Fed released the minutes of its December 2021 policy meeting, which showed that Fed policy makers planned to speed up monthly bond purchases and said they would raise interest rates three times this year. They also say the reduction in the balance sheet is likely to begin at some point after the Fed starts raising interest rates. Spurred by this factor, the KBW bank index hit a record this week, with the index rising nearly 5 per cent on Thursday and Friday.

According to the media, the KBW bank index, which tracks the 24 largest banks in the United states, rose more than 10% this week, the biggest weekly increase in the new year since statistical records began. This week, some Fed policy makers sent a hawkish signal that they could start raising interest rates as early as March. Us bond yields have risen steadily, with 10-year Treasury yields soaring to 1.767% as of Friday, breaking through 2021 highs and intraday highs of 1.801%. During this period, bank stocks became a safe haven for investors, and investors began to buy bank stocks on a large scale.

"higher interest rates and accelerated loan growth are two important catalysts for investors to be more bullish on bank stocks," Raymond James analysts Wally Wallace and David Long wrote in a report. "

However, not everyone believes that strong bank stocks will continue to rise this year. David George, an analyst at Baird, said: "investors are scrambling to allocate bank stocks that have benefited from higher interest rates, making them outperform this week. However, it is hard to see that they have further upward space. He added: "the risk / return balance of banking groups is becoming a bit unattractive. "

The current rally in bank stocks will soon face a major test, that is, performance. Wells Fargo & Co (WFC.US), JPMorgan Chase & Co (JPM.US) and Citigroup Inc (C.US) will kick off the fourth-quarter earnings season for US stocks next Friday, US Eastern time. Expectations of continued weak loan growth still exist, but some analysts believe that these large commercial banks are still expected to make further progress on the basis of basically good results in the third quarter.

While most analysts agree that banks will meet expectations of accelerated loan growth, the sharp spread of the Omicron mutant virus in the US will test the level of demand from consumers and investors.

David Chiaverini, an analyst at Wedbush, said: "loan growth is likely to slow in the first quarter of this year due to the Omicron mutation, but we expect loan growth to return to an upward trajectory for the rest of 2022. "

Edit / somer