In the face of the arrival of Rivian, how long can Tesla, Inc. sit on the throne?

With the surging world of electric cars, even the world-class overlord Tesla, Inc. can not settle down on the throne, and the new spoiler has once again entered the public eye with a strong background.

Rivian, a US electric car start-up, submitted its prospectus for listing on Nasdaq on Oct. 1, with Morgan Stanley, Goldman Sachs Group and JP Morgan as its co-sponsors.

The prospectus has not yet disclosed the amount of money raised, but according to a previous Bloomberg report, Rivian hopes to raise $8 billion, valuing the company at as much as $80 billion.

If the fundraising goes well, then the size of the financing is expected to make Rivian the largest US stock IPO of the year and the fourth largest IPO of US stocks after 2011.

According to media reports, in the past decade, only three companies in the US capital market have raised more than $8 billion in IPO, namely, BABA ($25 billion) and Facebook Inc ($16 billion) in 2014, and Uber ($8.1 billion) in 2019.

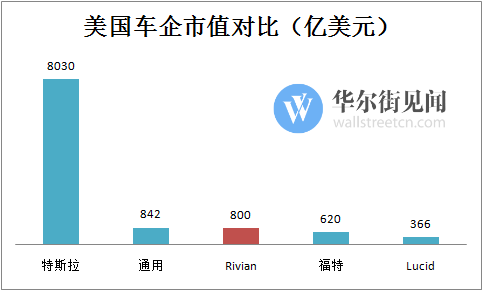

In terms of valuation, the $80 billion Rivian became the third largest auto company after Tesla, Inc. ($803 billion) and General Motors Co ($84.2 billion) as of Oct. 13, surpassing Ford's market capitalization of $62 billion. Lucid, an electric car company previously known as the "Tesla, Inc. killer", has a latest valuation of only $36.6 billion.

What is the origin of this more veritable "sworn enemy" of Tesla, Inc.?

It has been established for only 10 years and has grown rapidly.

It is no exaggeration to call Rivian Tesla, Inc. 's "nemesis".

The media quoted Morgan Stanley analysts as saying that Tesla, Inc. 's dominant position in the electric car market may be broken by Rivian.

And Tesla, Inc. himself has been paying attention to this opponent.

High valuation for RivianMusk once replied bitterly on Twitter in response to a netizen's comment on Rivian's valuation: "I don't want to be unreasonable, but before IPO, they should have delivered at least one car for every $1 billion valuation?"

In fact, even the founder of Rivian is seen as as charismatic as Musk. Although Scarlinger has only 1/1000 of Musk's followers on Twitter, Rivian lists "Rivian's services and reputation are highly dependent on Scarlinger" as one of the risk factors for the company's operation.

Scarlinger has an excellent educational background and graduated from MIT's Sloan Automotive Lab. He bravely chose to start his own business as soon as he graduated, and founded Avera, the predecessor of Rivian.

At its inception, the humble company had only about 20 people, but soon received a $2 million "grant" from the Florida government with a 2x2 hybrid sedan R1 as initial funding.

But after 2011, Scarlinger changed the company's business direction, shelving the "hybrid" option and focusing on pure electric vehicles, focusing on pickups and SUV, and officially changing the company to Rivian.

An important reason for changing the old name is that Avera was once registered as a trademark by Hyundai Motor and filed a lawsuit. But Scarlinger also said the new name also pays homage to Indian River Lagoon, where the company is located.

As a result of being shelved, the market has not been sure whether the prototype car that the company released publicly in 2011 is the original R1.

In 2015, Rivian opened R & D centers in Michigan and the San Francisco Bay area. To get closer to its core suppliers, Rivian moved its headquarters from Florida to Livonia, Michigan, the same year, starting to build a "whole ecosystem" of electric smart cars and pushing prototype cars into the shared ride and self-driving car markets.

In 2017, Rivian bought an old Mitsubishi factory in Nomer, Illinois. The move to buy rather than build the plant has also been compared to Tesla, Inc., who bought the New United Automobile Manufacturing plant in California.

At the end of 2017, Rivian announced that the prototype had been completed and would enter the testing phase. In 2018, Rivian said it would name the upcoming pickup A1T and the SUV A1C, and then renamed it, announcing that the two cars would be called R1T and R1S, respectively.

The two cars were originally scheduled to be launched in June 2021However, due to the global lack of core, the delivery of R1T has been delayed until September 2021. The seven-seat SUV R1S and the commercial logistics vehicle EDV are scheduled to be delivered in December this year.

Back to Amazon.Com Inc and Ford two big trees

The strategy has been moving so fast until 2011 that it is inseparable from the financiers behind founder Scarlinger. As of August 2021, the company has raised about $11 billion, which is directly close to Tesla, Inc. 's post-IPO financing.

In the early days, Rivian's funding mainly came from "gifts." Scarlinger's father was the founder of a military-related thermal control company, and on the one hand, he was rich enough to support Rivian; on the other hand, because of his relationship with the government and the military, it also brought convenience for Scarlinger's follow-up development.

The main sources of early payments include donations and tax loans from Florida and strategic investments from Sumitomo.

Larger financing began in 2018, with historical investors including Amazon.Com Inc, Standard Chartered Bank, Ford, Blackrock and other financial institutions.

Among them, Amazon.Com Inc, who is known as "hates Tesla, Inc. most", has played an important role in the financing history of Rivian, and Ford has also occupied an important position.

The current prospectus does not disclose the specific proportion of shareholders' shareholdings. the only thing that can be determined is that Amazon.Com Inc and Ford both own more than 5% of the shares, and Amazon.Com Inc ranks first among shareholders.However, it has been reported by foreign media that Amazon.Com Inc's current shareholding has reached 1/4 of the company.

Based on the current total financing and the $2.5 billion invested by Amazon.Com Inc, Amazon.Com Inc's equity share before the IPO is at least close to 25 per cent.

At the same time, Peter Kravets (Peter Krawiec), Amazon.Com Inc's senior vice president of global enterprise and business development, serves on the board of directors of Rivian.

The relationship between Rivian and Amazon.Com Inc is too important to be ignored. in addition to the equity relationship, most of its income also comes from Amazon.Com Inc.

In September 2019, Rivian signed an agreement with Amazon.Com Inc to provide Amazon.Com Inc with EDV trucks for its last mile of logistics delivery. Rivian plans to deliver 10, 000 EDV for Amazon.Com Inc in 2022 and 100000 vehicles by 2030.

The specific order rhythm in the future will depend on the progress of Amazon.Com Inc's own logistics business and the layout of charging facilities. But at least Rivian has Amazon.Com Inc's exclusive delivery truck order for the next four years and still has the priority to supply for the next two years.

Another major shareholder, Ford, in addition to providing funding, also helped develop the prototype car.According to the prospectus, Ford's role in Rivian is mainly played by its wholly-owned subsidiary Troy Design and Manufacturing Co. Provide prototype design and development services for Rivian.From 2019 to the end of 2020, Rivian paid a total of $74 million in service fees to the Ford subsidiary.

Create the first electric pickup truck

So what is the charm of Rivian, which is highly relied on by Amazon.Com Inc and Bezos?

Unlike Tesla, Inc., Rivian chose a track that is extremely popular in the United States from the very beginning-pickup electric cars.

For Americans who lack high-speed public transportation, self-driving is a more convenient way to travel. At the same time, most people have their own villas, garages, lawns and courtyards, and need to buy a lot of tools, materials and daily necessities in order to take care of the yard, while labor costs are so high in the United States that most people choose to do it themselves.

As a result, pick-up trucks that can fit anything have become the favorite model for Americans, followed by the SUV.

In the ranking of US car sales in 2020, the top three Ford F-Series, Chevrolet Solod and Dodge RAM were all pickups, followed by the fourth SUV.

On the other hand, in the face of the trend of automobile electrification and increasingly stringent global emission standards, the United States, as the world's largest consumer market for pick-up trucks, the electric replacement of fuel pick-up trucks has been put on the agenda.Traditional pick-up trucks with large displacement, high fuel consumption and many other "disadvantages" that are not conducive to environmental protection will no longer exist in pure electric pickup models.With the continuous promotion of the US government's zero-emission policy in 2035, there is no doubt that the electric pick-up truck in the future has a very broad potential for development.

Rivian, who is well versed in the American market, chose to specialize in electric pickups to cater to the tastes of American fans, and it was naturally half the success.Now, it has also successfully launched its first electric pickup truck.

Even looking back a few years ago, Rivian was the first car company to launch an electric pickup truck.

Rivian first released its first electric pickup truck, R1T, in November 2018, and Tesla, Inc. released its first electric pickup truck, called Cybertruck, on November 22nd, 2019. According to Tesla, Inc., so far, the number of orders for Cybertruck has exceeded 1 million. It was followed by two established US automakers, General Motors Co and Ford, which released all-electric versions of Hummer and Fmure 150 in November 2020 and May 2021, respectively.

Although the time has been delayed many timesBut on Sept. 15, founder Scarlinger announced on Twitter that the first car of the company's first electric pickup, the R1T, had been completed and gone offline.As a result, Rivian became the first carmaker to bring electric pickups to market. This time is well ahead of GM, Ford and other competitors. Tesla, Inc. 's Cybertruck was originally scheduled to be delivered by the end of this year, but it has also been delayed and is expected to be offline in 2022 and begin mass delivery in 2023.

So there's a reason Musk is so tit-for-tat with Rivian.Who gave Rivian a year's lead and then went offline for the first car?

In addition, Rivian poached frequently, including Tesla, Inc., Ford, FF and McLaren, including a number of company employees and executives were included by Scarlinger. Despite being sued by the mad Tesla, Inc., Rivian continued to hire Kalayjian, a former executive of Tesla, Inc., as senior vice president of engineering and products at Rivian.

The mileage of the standard pickup is about 500 km.

On the official website, the current pickup truck model R1T and SUV model R1S are in pre-sale, you can choose your own configuration plan. According to the prospectus, as of the end of September, it had nearly50,000 copies(48390) pre-orders for R1T and R1S (a refundable deposit of 1000 yuan per order).

Whether it is R1T, R1S or the EDV,Rivian delivered to Amazon.Com Inc, the "skateboard" pure electric drive platform is adopted.

This "skateboard" platform willElectrical Machinery、Battery management system、Cooling system、Suspension system、Hydraulic control systemAll integrated into a complete module, located in the middle of the chassis. The four-motor version of R1T can be realized.Tank steeringTurn in place.

From the outside, the appearance of the R1T is not as radical as the Cybertruck, and the whole body retains the main frame of the traditional pickup truck. Through the thick light belt through the front of the car, as well as two long oval headlights to create a technological sense of the front face.

The R1S chose a fully enclosed body with two seats in the third row, but at the same time, the equipment channel function was sacrificed.

In terms of price, the R1T's first release of the standard model is priced at about $73000, while the standard version of the R1s, which is scheduled to be released in December, costs slightly more than $2200 and is priced at $75500.

Due to different positioning, the two cars are different in size, weight, volume, payload and range.

Pick-up trucks often pull goods in daily life, which requires large torque and strong heat dissipation, which is very demanding for the battery; in addition, the high and low temperature of the outdoor environment also puts forward higher requirements for the battery.

The EPA rated mileage of the R1T is about 314 miles and the corresponding mileage is about 505.On the other hand, its endurance capacity on the highway is 471.3km, which is 7% lower than the comprehensive value, and its endurance capacity in the city is 533.9km, which is 5% higher than the comprehensive value.

The R1s is a little more than 316 miles, with a corresponding mileage of about 509.Its endurance capacity is 476.9km on the highway, which is 6% lower than the comprehensive value, and its endurance capacity in the city is 533.2km, which is about 5% higher than the comprehensive value. According to the US Environmental Protection Agency, the comprehensive energy consumption of this pure electric SUV is 304Wh/km.

Rivian also said it plans to launch a version of the R1s with a longer battery life than the 640km in January 2022, followed by an entry-level version with a contract extension of 402km.

At the level of smart driving:

The R1T pickup truck of Rivian not only has the function of "tank steering" and can realize the 180-degree in-situ steering of the vehicle, but also its automatic driving ability is not inferior to that of Tesla, Inc.. The R1T is equipped with an L3-level out-of-hand driving assistance system and equipped with hardware above Tesla, Inc..

Amazon.Com Inc's 100000 EDV series has much smaller mileage because it focuses on solving the problem of short-distance logistics. But the EDV series is excellent in terms of capacity, with the three versions having a capacity of 500,700 and 900 cubic feet, respectively.

Accelerate overall layout

According to the prospectus, the company did not achieve revenue because the first car was just off the line in September. In terms of expenses, the company mainly spent on research and development, with losses of US $426 million and US $1.018 billion respectively from 2019 to 2020, and a loss of US $994 million in the first half of this year.

Among them, the R & D investment is about 766 million US dollars in 2020 and 683 million US dollars in the first half of 2021.

And it is expected that for some time in the future, Rivian will continue to invest in the self-built factory-charging network, while generating revenue through a comprehensive ecological business model.

1. Speed up the construction of self-built factories

The plant that is currently producing R1T and R1S at the same time is Normal.

As mentioned earlier, the factory is an old Mitsubishi factory bought by Rivian in 2017. The factory, which currently has a planned production capacity of 150000 units, came from the factory when the first car came off the line on Sept. 15.

At the same time, there is a production line specializing in the production of electric delivery truck EDV ordered by Amazon.Com Inc.

But Rivian is not only satisfied with this factory, it is also planning to build its own plants in the United States and the United Kingdom.

According to Auto Heart, a document from the Department of Economic Development of Fort Worth, Texas, USA in August 2021 showsRivian plans to invest $5 billion to build a second plant in the United States, including car manufacturing, auto parts assembly and a research and development center.

The plant is planned to cover an area of about 2000 acres and has a planned annual production capacity of 200000 cars, 50, 000 more than Nomer.

In addition, Rivian plans to invest 1 billion pounds to build its first overseas production line near Bristol, but the project is still in its infancy, according to local media reports. At the same time, Germany and the Netherlands are in similar negotiations with Rivian.

The Chinese market is also part of Rivian's plan.

According to the plan, after the launch of the R1S seven-seat SUV in January 2022,Rivian will also launch a compact SUV in China in 2022, and Mr Scarlinger has said: "We can't really build a car company without thinking about China and Europe as important long-term markets."

And it has been revealed that these products may eventually be produced directly locally.

2. Construction of super / fast charging network

At present, with the imminent delivery of vehicles, Rivian is also building DC fast charging network and AC fast charging network. Officials call their own fast charging networkAdventure Network。

Rivian will provide a variety of ways to fast charge, destination charge and home charge. The initial charging rate of its fast charge is 200kW, and then it will be upgraded to 300kW.

Among them, Rivian plans to build more than 600 sites by 2023.3500个DC quick filling pile.

In addition to 3500 quick-filling piles, Rivian synchronization is planned to be built by the end of 202310000个Destination charging piles (called Rivian Waypoints) support the maximum charging power of 11.5kW. Destination charging piles will be mainly distributed in Shangchao, hotels, restaurants, parks and other places.

3. Construct business ecology.

In addition, the ecology of Rivian also includes six parts: vehicle technology, cloud, product development and operation, service and data analysis.

With the product delivery date approaching, Rivian has more and more service centers, and it is expected to open 10 experience centers in the United States this year alone and launch more stores in 2022. The services that Rivian can provide, in addition to regular after-sales maintenance and customized upgrades, also include vehicle insurance business and credit business, so Rivian, which is a direct business model, does not give up the cake of the financial module, but wants to master the benefits of customer insurance, credit business and customer experience.

Among them, it is expected that (1) through resale and replacement, it will make a profit of US $34500 per civilian vehicle (about US $19800 for commercial vehicles); (II) the insurance and credit business will earn about US $8700 (US $7400 for commercial vehicles); and (III) after-sales services will make a profit of US $3500 (US $6100 for commercial vehicles).

In software services, Rivian plans to generate about $15500 in revenue over the life cycle of each car, including fees for driving aids of about 10, 000 yuan. This coincides with Tesla, Inc. 's FSD price.

Through the construction of full ecology, coupled with charging and other services, then excluding the purchase of cars, each civilian consumer model of Rivian has an expected income of US $67900 in the whole life cycle!

Amazon.Com Inc's cash flow of 100000 EDV in the next four years will also be close to this, with a bicycle of about $64600. This also means that Rivian will have strong cash flow.

The end

As a latecomer, Rivian's first electric pickup truck has stunned the market and opened competitors, including Tesla, Inc., for at least a year.

Although the short-term Rivian is still in a huge investment cycle and may continue to lose money, the company has shown an unstoppable posture.

Given that Tesla, Inc. was also at a loss in the first few years of his listing and did not make an annual profit until 2020, the market still has a lot of time for Rivian.

At the beginning of the IPO document, Scarlinger briefly introduced Rivian's entrepreneurial history with a letter: from a blank piece of paper to the present, Rivian is full of imagination because there are no limits.

Faced with a charming but potentially thorny road ahead, a market capitalization of $80 billion may be just the beginning for the startup.

Edit / Charlotte