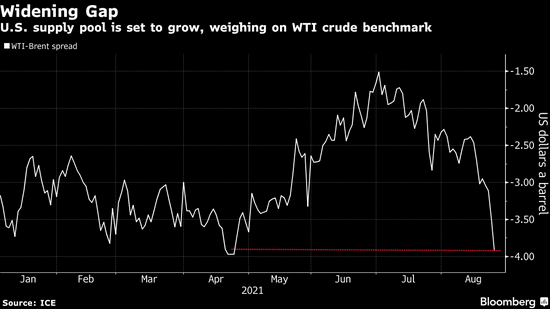

The spread between the closely watched US benchmark and global benchmark crude oil futures widened to its largest in four months as traders expected a surge in US crude oil supplies.

At a time when domestic refineries are preparing for seasonal shutdowns and oil demand tends to fall, the US government plans to sell its largest strategic oil reserve in seven years.The price of West Texas Intermediate has been dragged down. At the same time, the gap was further exacerbated by an improved outlook for overseas demand, which kept Brent prices higher.

At present, as the Delta virus variant begins to affect domestic demand, US refineries have scaled back their operations earlier than in previous years. The weakness of the WTI- Brent spread is in stark contrast to that of a few months ago, when the US market was tight and refineries were running at full capacity to meet strong summer demand.

The widening spread is likely to reignite overseas interest in WTI-linked US crude. Exports have fallen over the past few weeks as many regions have adopted various restrictions to deal with the rapidly spreading Delta variant.

While Asian buyers, the biggest customer of US oil, may buy US strategic oil reserves, there is still some competition. China and India have also been selling their strategic stocks to domestic refineries.

The discount from WTI-Brent at 2: 00 p.m. New York time is $3.86 per barrel.