Norway's $1.4 trillion sovereign wealth fund made a 9.4 per cent return in the first half, with double-digit growth in its equity portfolio on investments in energy, finance and technology companies.

Norway's Oslo-based sovereign wealth fund is the largest in the world. The fund said on Wednesday that returns on equity assets were close to 14 per cent and returns on energy investments were close to 20 per cent. Investment in bonds and renewable energy infrastructure fell, while real estate returned 4.6 per cent. The total return of the fund is slightly higher than the benchmark used for comparison.

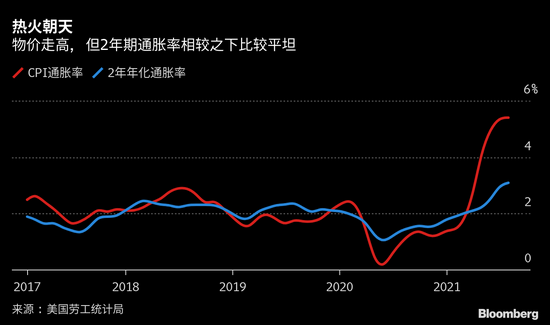

Nicolai Tangen, the fund's chief executive and former hedge fund manager, previously warned that bumper returns should not be expected to continue. Earlier this week, he said inflation is now becoming the biggest threat to returns, with both stocks and bonds at risk. At present, there is an ongoing debate over whether the rise in prices is "temporary" or lasting. In the past two months, inflation in the United States has exceeded 5%, the highest in more than a decade.

Tangen has been chief executive for nearly a year, and since he took over, the fund has more openly expressed its commitment to sustainability. The fund plans to accelerate the pace of reducing its holdings of companies that pose risks from an environmental, social and governance perspective. The company will also limit its exposure to emerging markets under the same strategy.

At the same time, the fund is shifting its focus from Europe to North America in order to achieve higher returns. On Wednesday, the fund revealed that the value of its positions in technology stocks, mainly Apple Inc, rose 16.8%.、 Microsoft Corp, Alphabet Inc. And Amazon.Com IncDonovan's stock.

Norway's sovereign wealth fund, founded in the 1990s to invest the country's oil and gas revenues overseas, made its first foray into renewable infrastructure earlier this year. The move is a landmark event that represents the expansion of the fund's asset class, which previously included only stocks, bonds and real estate.