According to Buffett's Berkshire Hathaway's 13F position report submitted to the Securities and Exchange Commission (SEC) on Monday, the company cleared its positions in the pharmaceutical companies Biogen, Axalta Coating Systems and Liberty Global plc.An in the second quarter, and reduced its holdings in General Motors Co, according to the 13F position report submitted by Buffett's Berkshire Hathaway to the US Securities Regulatory Commission (SEC) on Monday.And so on, increased his holdings of shares such as supermarket chain Kroger, and maintained Apple Inc.The company's position remains unchanged and remains the number one heavy stock.

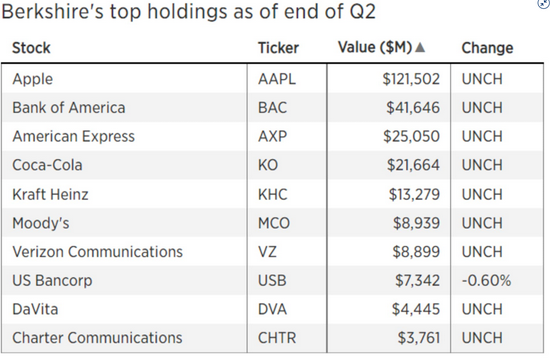

According to the 13F report, Berkshire's total market capitalization of its positions in the second quarter was about $293.023 billion, with the top ten positions accounting for 87.51 per cent. The company left Apple Inc's position unchanged in the second quarter, with a total market capitalization of $121 billion, accounting for 41.45 per cent of the position.

As of June 30, 2021, Berkshire reduced its holdings of General Motors Co (from 67 million shares to 60 million shares) and Bristol-Myers Bristol-Myers Squibb Co, Aberdeen, Liberty Global plc. Class C shares, Chevron CorpEight stocks, including Kroger (from 51.1 million shares to 61.8 million shares), RH, Aon Insurance, etc.Wait for the stock.

About 70% of Berkshire's stock portfolio is concentrated in four companies-Apple Inc and Coca-Cola Company, American Express Co and Bank of America Corporation. The company's heavy stocks include Apple Inc, Bank of America Corporation (holding 1.01 billion shares with a market capitalization of US $41.6 billion), American Express Co (maintaining 151.6 million shares), Coca-Cola Company (maintaining 400 million shares) and Kraft Heinz (maintaining 325.6 million shares).

Berkshire's top 10 stocks remained relatively unchanged last quarter:

In terms of stock portfolio adjustment, Berkshire was relatively calm in the second quarter. The company did not build any new positions in the quarter to the end of June.