Source: Wall Street

Japan remained the largest overseas holder of US Treasuries in June, increasing its holdings by $11.1 billion to $1.277 trillion, the third increase in 11 months. Chinese mainland remains the second largest overseas holder of US debt, reducing its holdings by 16.5 billion and falling for four months to a total of $1.062 trillion, the lowest in eight months.

Japan continued to be the largest overseas holder of US Treasuries in June, with its holdings rising by $11.1 billion month-on-month to $1.277 trillion, according to the US Treasury Department's International Capital flows report (TIC) on Monday, Aug. 16. However, the country has reduced its holdings of US debt more frequently since the beginning of the year, increasing its holdings only for the third time in 11 months in June.

Chinese mainland remains the second largest overseas holdings of US debt, with its holdings falling by $16.5 billion in June for four consecutive months to $1.062 trillion, the lowest level since October last year.

China has sold more than $34 billion of US debt in the past two months, the biggest sell-off since 2016, according to financial blog Zerohedge. In February, Chinese mainland's holdings of Treasuries hit a 19-month high, and they increased their holdings for the fourth month in a row, the longest straight increase since 2017.

Historical data show that since June 2019, Japan has surpassed China in terms of US debt holdings for the first time since May 2017. In July last year, Japan's total holdings of US debt reached an all-time high of $1.29 trillion. Since then, Japan began to reduce its holdings of US debt one after another, and the proportion of US debt held by the US government has been hovering at an all-time low.

Overall, Japan and China still hold more US debt than the third to fifth "creditors" of the UK, Ireland and Luxembourg combined.

In June, the top ten "creditors" also had three major creditors to reduce their holdings of US debt. Among them, the Cayman Islands, which represents hedge fund interest, increased its holdings by nearly $16 billion for three months in a row, bringing the total to the highest level in at least one year. Belgium reduced its holdings by $7.9 billion, the lowest since September last year. Total U.S. government debt held abroad rose by $66.8 billion to $7.202 trillion, the highest level since February 2020.

In addition, the net international capital inflow of the United States in June was 31.5 billion US dollars, which was only 1/3 of that of the previous month. Before May, the net inflow was revised down from 105.3 billion US dollars to 98.2 billion US dollars. The United States had a net long-term capital inflow of $110.9 billion in June, compared with a net outflow of $30.2 billion.

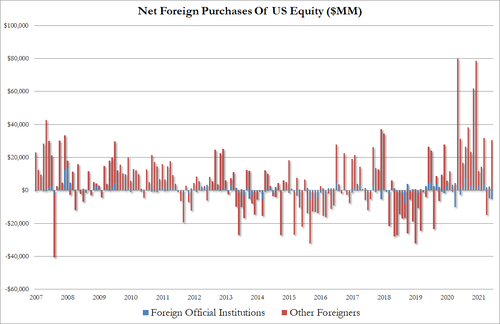

In that month, foreigners bought a net $10.9 billion of long-term US Treasuries, $22.7 billion of US agency debt, $13.8 billion of US corporate debt and $26.2 billion of US stocks, which reversed the trend of net selling of US stocks for at least two months. and the biggest wave of stock purchases since March, and the main force is unofficial foreign individuals and institutions.

The US TIC report is the monthly data on international capital flows published by the US Treasury, including the purchase and sale of US Treasuries, government bonds, corporate bonds and corporate stocks by foreign countries, which are used to measure foreign demand for US debt and assets.

According to the Bloomberg dollar spot index, the dollar rose about 2.3% in June, reversing the decline in May; 10-year Treasury yields fell about 13 basis points to 1.47%, compared with 1.27% on Monday.