Source: the road to value

Authors: Yan Xiang, Xu Ruchun, Zhu Chengcheng, Jin Han

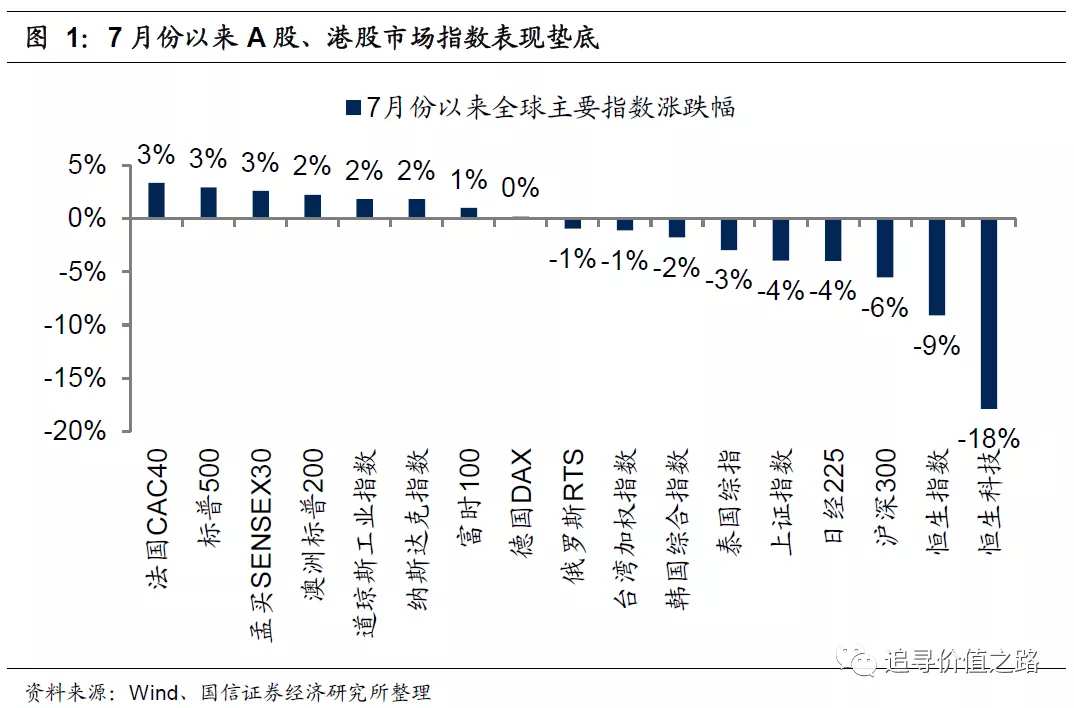

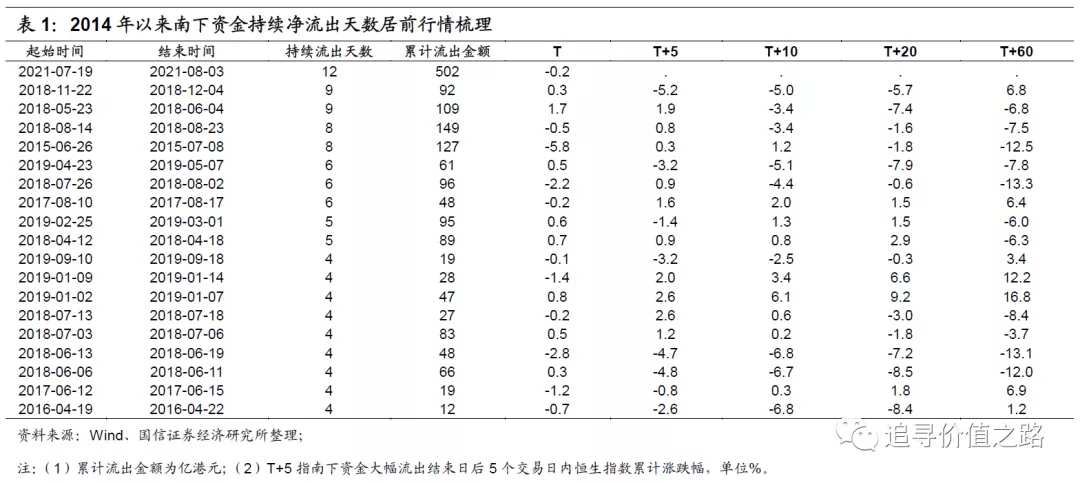

Since July 2021, the A-share and Hong Kong stock market indexes have ranked substantially at the bottom of the world's major market indexes, and the recent volatility in the Hong Kong stock market has also led to a sustained net outflow of southward capital. As of August 3, southward capital has continued to net outflow from the Hong Kong stock market for 12 consecutive trading days, with a cumulative net outflow of HK $50.2 billion, the longest southward net outflow since data were available in 2014.

This paper combs in detail the situation that the time of continuous net outflow of southward funds is relatively high in history. From the statistical results, both the number of days and the scale of outflow of southward funds are in a very front position in history, which reflects that the current market sentiment has been extremely pessimistic. In the future, we think that as the impact of short-term events gradually fades, the market situation will improve.Since July 2021, the A-share and Hong Kong stock market indexes have ranked significantly at the bottom of the world's major market indexes.

Specifically, since the beginning of July, the French CAC40 index, the S & P 500 index and the Mumbai SENSEX30 index have risen 3.3%, 2.9% and 2.6% respectively, ranking first among the major global indices we have counted. The Shanghai Composite Index and the CSI 300 Index fell 4.0% and 5.5% respectively, while the Hang Seng Index and the Hang Seng Technology Index fell as much as 9% and 18% respectively, ranking substantially at the bottom of our major indices.

The recent increase in volatility in the Hong Kong stock market has also led to a sustained net outflow of southward capital. As of August 3, southward capital has continued to net outflow from the Hong Kong stock market for 12 consecutive trading days, making it the longest southward net outflow in history.

Specifically, there was a net outflow of HK $1.78 billion a day from southward on July 19, and continued to have a net outflow of HK $50.24 billion in the 12 trading days since then, with a cumulative net outflow of HK $50.24 billion over the 12 trading days.

Judging from the allocation of Hong Kong stock market holdings, as of August 3, the market value of Hong Kong stock market holdings in finance, information technology, optional consumption, health care and other industries was significantly higher, while the market value of foreign positions in public utilities, materials, energy and daily consumption industries was relatively low.

Judging from the proportion of the market value of Hong Kong shares in the total market value, as of August 3, the market capitalization of Hong Kong stocks such as first Control Group, people's Financial Technology, China Holdings, Dongyue Group, Carnival International, via Biology, Minhua Holdings, Cofco Jiakang, Poly Xiexin Energy and Hagia Medical Services accounted for a relatively high proportion of their total market capitalization.

Judging from the total market value of Hong Kong shares, as of August 3, the total market capitalization of Tencent, China Construction Bank Corporation, Industrial and Commercial Bank of China, HSBC Holdings plc, Xiaomi Group, China Mobile Limited, Meituan, ANTA Sports Products, Great Wall Motor and Wuxi Biologics was relatively high.

All the above-mentioned stocks are only a statistical summary of public data and do not constitute any profit forecasts and investment ratings.

Risk hints: macroeconomic is less than expected, overseas markets fluctuate sharply, and historical experience does not represent the future.

Edit / lydia