Singapore opened this morning as a hot spot.

The Singapore stock market opened down 2.35 points this morning.

DPU of Huisheng International Trust fell 45.5% year on year in the first half of the year.

DBS Group's first-quarter net profit rose 72% to 2.01 billion yuan compared with the same period last year.

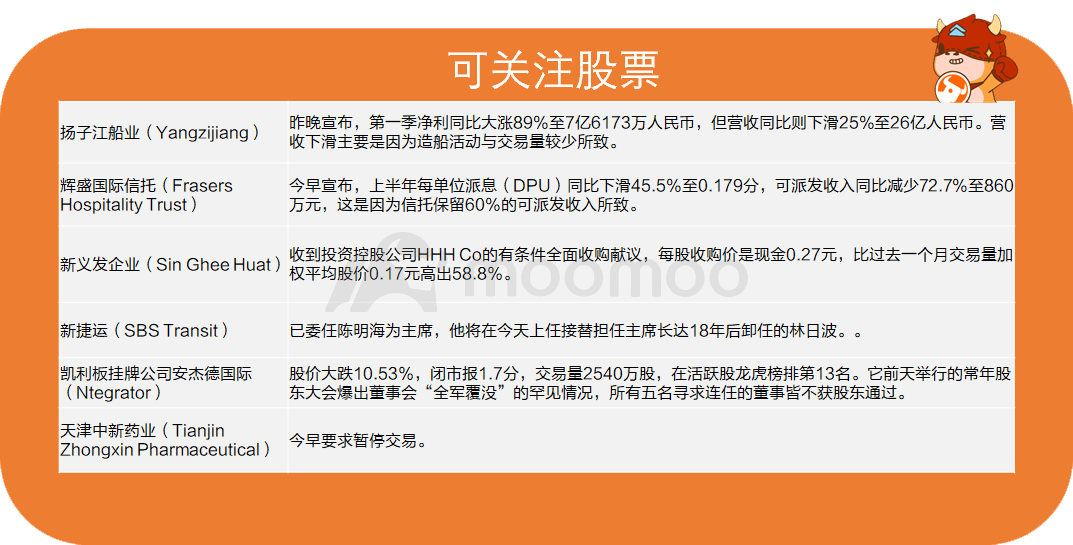

You can follow the stock:Yangzijiang Shipbuilding, Huisheng International Trust, Tianjin Zhongxin Pharmaceutical Co., Ltd., Xinyifa Enterprise, New MRT, Kelly Board listed company Anjade International

-Moomoo News Team

Opening snapshot

The Singapore stock market opened slightly lower this morning.$FTSE Singapore Straits Time Index (.STI.SG) $It fell 2.35 points, or 0.07%, to 3219.23. The total turnover was 1 36.94 million shares, totaling 344.17 million yuan.

Today's hot spot

DPU of Huisheng International Trust fell 45.5% year on year in the first half of the year.

Frasers Hospitality Trust's dividend per unit (DPU) fell 45.5 per cent to 0.179 points in the first half from a year earlier, while distributable income fell 72.7 per cent to 8.6 million yuan from a year earlier, as the trust retained 60 per cent of its distributable income.

Total revenue of the trust in the first quarter fell 36.2 per cent year-on-year to 39.9 million yuan, while net real estate income (NPI) fell 40.9 per cent to 26.7 million yuan. This is because in the first half of last year, the first quarter before the outbreak of crown disease performed well.

You Jingfen, president of Star Lion Hotel Trust Management Company, said that in recent months, due to the tightening of travel restrictions in many countries, a new global outbreak of crown disease and concerns about the variant virus have affected the performance of the trust portfolio.

DBS Group's first-quarter net profit rose 72% to 2.01 billion yuan compared with the same period last year.

DBS Group's first-quarter net profit rose 72% year-on-year to 2,010 million yuan, surpassing 2 billion yuan for the first time.

Compared with the fourth quarter of last year, the group's first-quarter net profit almost doubled by 99%.

In line with the requirements of the Monetary Authority of Singapore to exercise restraint in paying dividends, the Group paid a dividend of 18 cents per share in the first quarter, with the option of substituting dividends on shares (scrip dividend). The dividend payment date is June 25.

Due to the good quality of assets, the newly formed non-performing assets and special reserves were maintained at the level before the Crown Disease outbreak, and the Group reinjected 190 million yuan of general reserves.

Fengyi International's first-quarter net profit doubled to US $450 million

Wilmar International's first-quarter net profit doubled to US $450.2 million (S $597.7 million) in the first quarter from a year earlier, the best first-quarter performance since going public.

The Group released its business briefing for the first quarter up to the end of March this year after the market closed today. The Group noted strong performance in all its core businesses, with revenue and profits growing. In addition, the losses suffered by safe-haven derivatives at mark-to-market prices in the fourth quarter of last year have been reversed, which further pushed up the group's net profit.

The group's core net profit rose 38.3% to $423.7 million in the first quarter.

Can pay attention to the stock

Source: Lianhe Zaobao