Singapore opened this morning as a hot spot.

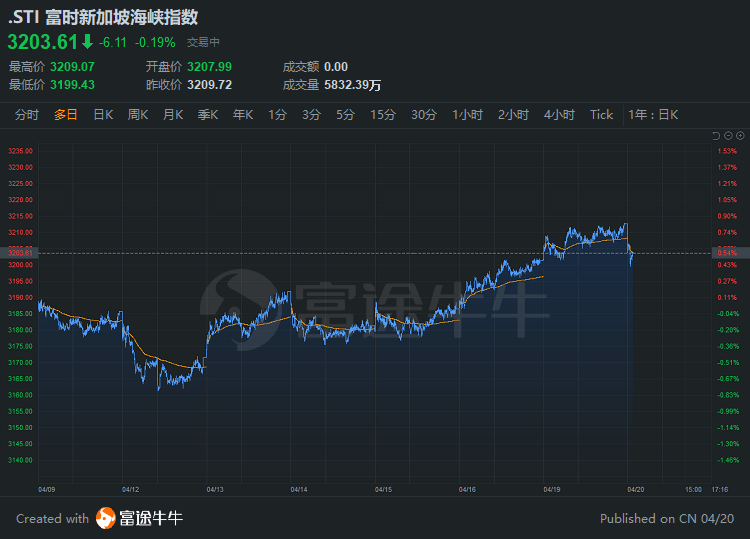

The Singapore stock market opened slightly lower on Tuesday.

GIC and ESR buy the Australian real estate portfolio of Blackstone Group for 3.9 billion yuan

Cooperation between Nafont Technology and Temasek to explore hydrogen Energy Economic opportunities

You can follow the stock:New Telecom (Singtel), Yangtze River Shipbuilding (Yangzijiang), Liangyuan Group (Neo Group), Nafeng Technology (Nanofilm), Black Gold Natural Resources (Blackgold Natural Resources), Lessat International (Lasseters International), Keppel Infrastructure Trust (Keppel Infrastructure Trust), Gebao Taiheng American Real Estate Trust (Keppel Pacific Oak US REIT), Folan International (Olam International)

-Moomoo News Team

Opening snapshot

As of 9: 06 a.m., Singapore's Straits Times Index (STI) was at 3206.69, down 3.03 points or 0.09%. The total trading volume was 35.23 million shares, with a trading volume of 131.44 million yuan, with 70 rising stocks and 83 declining stocks.

Today's hot spot

GIC and ESR buy the Australian real estate portfolio of Blackstone Group for 3.9 billion yuan

GIC (GIC) teamed up with Hong Kong-listed company ESR Cayman to buy an Australian real estate portfolio of US investment firm Blackstone Group (Blackstone) for A $3.8 billion (S $3.9 billion).

According to ESR's announcement on Sunday, GIC will contribute 80%, and ESR will contribute the rest. The portfolio is 45 assets held by Blackstone's Milestone Logistics.

The deal, by far the largest combination of logistics and ordinary real estate in Australia, will make ESR the third largest logistics real estate operator in Australia with assets under management of A $7.9 billion in Australia.

Cooperation between Nafont Technology and Temasek to explore hydrogen Energy Economic opportunities

Nafont Technology (Nanofilm Technologies), which is listed on the local motherboard, will work with Temasek (Temasek) to explore opportunities in the hydrogen energy (hydrogen energy) economy.

Nafont announced in a statement after the market closed yesterday that it had formed a joint venture with Temasek to set up a joint venture with Temasek Venezio Investments Sydrogen Energy, to apply Nafont's vacuum coating technology to major components of fuel cells and electrolysis systems.

Can pay attention to the stock

1.New Telecom (Singtel)The group is reviewing strategic options to ensure that shareholders of Intouch and AIS receive full benefits from the underlying value of the business and will make disclosures in due course in accordance with SGX listing rules, it said yesterday. It said it regards the shareholdings of Thailand's affiliate Intouch Holdings and (AIS), an information services company, as strategic investments and believes in the long-term outlook for the business.

New Telecom is in response to yesterday's announcement by (Gulf Energy Development PLC), a Gulf energy development company in Thailand. Gulf Energy offers a conditional full acquisition of Intouch, at a price of 65 baht per share and, if necessary, makes a general acquisition proposal to AIS at a price of 122.86 baht per share. The news sent Intouch's shares up as much as 9 per cent yesterday. After surging 4.94 per cent on Friday, SinoTelecom's shares continued to be spurred by the merger news, rising another 3.14 per cent at one point, bringing the intraday share price to its highest level of 2.63 yuan in more than 10 months. Singapore Telecom shares closed yesterday at 2.60 yuan, up 1.96%.

2.Yangtze River Shipbuilding (Yangzijiang)After the market closed yesterday, it revealed that in addition to the new contract announced on March 5, it had won contracts for the construction of 15 other ships with a total value of US $970 million (S $1.29 billion). The 15 vessels include six container carriers with a carrying capacity of 10 5000 TEUs (TEU), two 2400TEU container carriers, two medium haul tankers (MR tanker), with a deadweight tonnage of 50 000 tonnes, three bulk carriers with a deadweight tonnage of 82 300 tonnes and two large lake bulk carriers with a deadweight tonnage of 31 800 tonnes.

It noted that these vessels were mainly scheduled for delivery in 2022-23 and therefore did not have any significant impact on the Group's profitability for the current fiscal year. The Group has obtained new orders of US $4010 million this year.

Shares of Yangzijiang Shipbuilding rose 5.39% yesterday, closing at 1.37 yuan.

3. The acquirer has controlled more than 90%.(Neo Group) of Liangyuan GroupEquity, the group is bound to be privatized. The offer put forward by the acquirer has now been turned into an unconditional offer, and because it controls more than 90% of the shares, the acquirer has the right and intends to forcibly acquire the rest of the shares at a purchase price of 0.60 yuan per share after the offer closes.

Liangyuan Group, a catering service provider, revealed after the market closed yesterday that as of 6pm yesterday, the acquirer Forestt Investment had taken a 91.16 per cent stake in the group. The deadline for acquisition offers has now been extended from May 11 to May 25 and will not be extended any longer.

Forestt Investment is the private company of Liang Yuan Group founder, Chairman and President Liang Jiaji and his wife Liu Aiping (Executive Director of Liang Yuan Group). At the end of March this year, Liangyuan Group announced that Forestt Investment had put forward a takeover proposal to it, with the aim of delisting and privatizing the company. The share price of Liangyuan Group was unchanged yesterday, closing at 0.605 yuan.

4.(Nanofilm) of Nafeng TechnologyAfter the market closed yesterday, it was revealed that the company and Temasek Holdings's Venezio Investments reached a non-binding terms and conditions and will invest together in Sydrogen Energy to explore hydrogen energy economic opportunities using Nafont's unique vacuum coating technology. Nafont Technology pointed out that Sydrogen will be responsible for all the business related to hydrogen energy in the group. Nafont will take a majority stake in the joint venture Sydrogen Energy.

Nafeng Technology shares rose 0.58% yesterday to close at 5.20 yuan.

5. Kelly board co., Ltd.Black gold natural resources (Blackgold Natural Resources)Yesterday, it was approved by the Accounting and Enterprise Regulatory Bureau ((ACRA)) to postpone the holding of the annual shareholders' meeting and the submission of the annual report. It also applied to the SGX on Friday to postpone the holding of the annual shareholders' meeting on May 21 at the latest, which has yet to be approved by the SGX. It also revealed on Friday that it had signed a non-legally binding agreement with Mongolian-registered company Tengri Coal and Energy to conduct a 1 billion yuan reverse merger to facilitate the Mongolian company's backdoor listing.

Black Gold Natural Resources shares were flat yesterday, closing at 1.7 points.

6.Lessat International (Lasseters International)It was revealed that its Australian Golden Nugget Hotel and Casino business, health club business and permanent deed land and buildings were yesterday signed for a total price of A $105m (S $108.6m), subject to a number of conditions, including shareholder approval. The buyer is a company of Iris Capital, an Australian integrated project and hotel group. Shares of Lessat International fell 2.50 per cent yesterday to close at 3.9 cents.

7.Keppel Infrastructure Trust (Keppel Infrastructure Trust)According to the business report for the first quarter of this year, the group's earnings before interest, tax, depreciation and amortisation decreased by 0.2% to 97.9 million yuan compared with the same period last year, while the operating cash flow increased by 15.6% to 66.5 million yuan. Keppel Infrastructure Trust fell 1.82% yesterday to close at 0.54 yuan.

8.Kebao Taiheng American Real Estate Trust (Keppel Pacific Oak US REIT)The first-quarter business report revealed that distributable revenue in the first quarter rose 3.6 per cent year-on-year to $14.9 million, net real estate revenue fell 2.8 per cent to $20.4 million and revenue fell 2.1 per cent to $34.6 million. The trust debt ratio is 37.5%, and there is no need for long-term refinancing until November 2022, with cash and unspent facilities reaching $93.5 million at the end of March.

Keppel Taiheng American real estate trust fell 0.68% yesterday to close at $0.735.

9.Folan International (Olam International)It plans to issue 100 million yuan of permanent securities, and it will issue 250 million yuan of permanent securities on January 18 this year. The two tranches of securities will be combined into a series with an issue price of 100.013% and a distribution rate of 5.375% in the first five years. Yolan International shares were flat yesterday, closing at 1.73 yuan.

Source: Lianhe Zaobao