Whales with a lot of money to spend have taken a noticeably bullish stance on Dell Technologies.

Looking at options history for Dell Technologies (NYSE:DELL) we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 63% of the investors opened trades with bullish expectations and 36% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $190,916 and 9, calls, for a total amount of $892,468.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $150.0 and $175.0 for Dell Technologies, spanning the last three months.

Volume & Open Interest Development

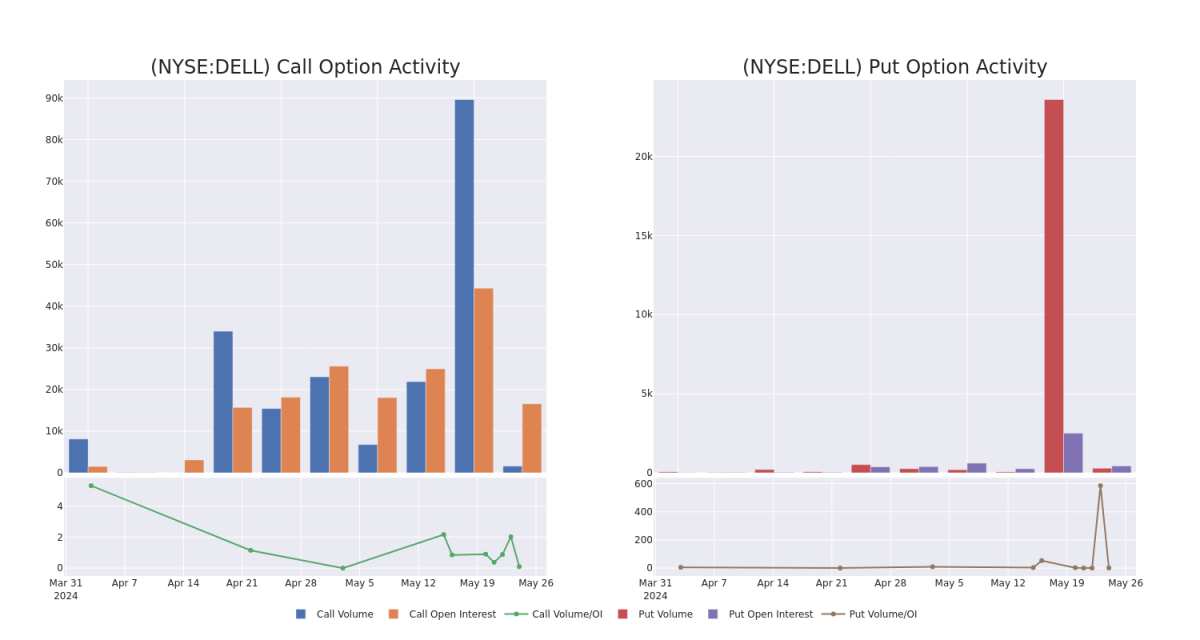

In today's trading context, the average open interest for options of Dell Technologies stands at 1544.73, with a total volume reaching 1,837.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Dell Technologies, situated within the strike price corridor from $150.0 to $175.0, throughout the last 30 days.

Dell Technologies Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DELL | CALL | TRADE | BULLISH | 10/18/24 | $24.2 | $23.9 | $24.2 | $150.00 | $484.0K | 2.1K | 205 |

| DELL | PUT | SWEEP | BEARISH | 05/31/24 | $6.8 | $6.6 | $6.8 | $152.50 | $158.4K | 271 | 234 |

| DELL | CALL | SWEEP | BULLISH | 08/16/24 | $14.0 | $13.7 | $13.85 | $160.00 | $82.3K | 1.2K | 93 |

| DELL | CALL | TRADE | BEARISH | 10/18/24 | $19.5 | $19.0 | $19.06 | $160.00 | $76.2K | 736 | 54 |

| DELL | CALL | TRADE | BEARISH | 05/24/24 | $2.0 | $1.7 | $1.8 | $157.50 | $72.0K | 1.5K | 724 |

About Dell Technologies

Dell Technologies is a broad information technology vendor, primarily supplying hardware to enterprises. It is focused on premium personal computers and enterprise on-premises data center hardware. It holds top-three shares in its core markets of personal computers, peripheral displays, mainstream servers, and external storage. Dell is vertically integrated but has a robust ecosystem of component and assembly partners, and also relies heavily on channel partners to fulfill its sales.

In light of the recent options history for Dell Technologies, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Dell Technologies

- With a volume of 1,554,633, the price of DELL is up 2.9% at $158.02.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 6 days.

What Analysts Are Saying About Dell Technologies

In the last month, 5 experts released ratings on this stock with an average target price of $145.0.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Dell Technologies, targeting a price of $165.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Dell Technologies with a target price of $155.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Dell Technologies with a target price of $152.

- Maintaining their stance, an analyst from Barclays continues to hold a Underweight rating for Dell Technologies, targeting a price of $98.

- Consistent in their evaluation, an analyst from Bernstein keeps a Outperform rating on Dell Technologies with a target price of $155.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Dell Technologies with Benzinga Pro for real-time alerts.