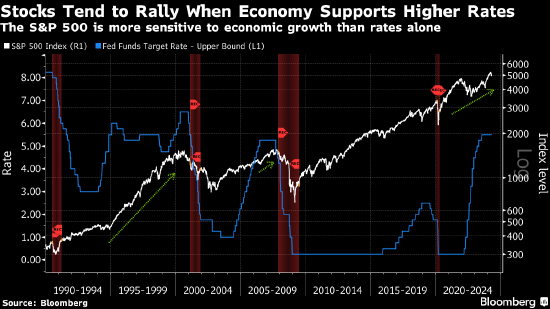

Deutsche Bank believes that even if the Federal Reserve does not cut interest rates this year, the S&P 500 index can continue to soar and reach another record high.

Binky Chadha, the bank's chief US stock and global strategist, said in an interview that as long as the economy and corporate profits grow, the stock market can remain strong even in the face of prolonged high interest rates. Chadha raised the S&P 500 point year-end forecast to 5,500 points last week, about 4% higher than Thursday's closing level.

This is a reassuring message for investors. The US stock market fell on Thursday as data showed an acceleration in US corporate activity, causing traders to postpone the expected US Federal Reserve interest rate cut until the end of the year. Although the rise in Nvidia's stock price mitigated the general market decline, the S&P 500 index fell below the 5,300 mark, marking the worst day since the end of April.

However, Chadha said that the situation where investors have always been frightened by the prospect of high interest rates is only fleeting, and there is no reason to think this trend will change. He said that historically, there will be a 3% to 5% pullback every two to three months.

“The experience of the past two years is that when interest rates rise suddenly, the stock market is sold off, and then if interest rates stabilize, the stock market immediately rebounds,” he said.

As inflation remains stubborn and officials have hinted that they are not in a hurry to cut interest rates, traders have readjusted their expectations about the extent to which the Fed's policy will be relaxed. Currently, the market has only fully absorbed the 25 basis point interest rate cut once this year, and in December of last year, it was predicted that interest rates would be cut up to seven times in 2024.

Even so, the S&P 500 is still up about 10% this year, and has closed for 24 trading days at a record high, meaning that about a quarter of the trading day has reached a new high.

The strategist pointed out that the strong profit cycle, economic expansion, and easing price pressure made him optimistic. Although the consensus on predicting the US recession has changed, he pointed out that forecasters have underestimated economic growth for seven consecutive quarters. At the same time, he said that inflation mainly reflects factors such as seasonality and the stickiness of rent measures.

Chadha said that although the valuation looked “quite full,” it was not too high when measured by historical indicators.

“Is market pricing too high? We don't think so,” he said. “What I want to say is that in terms of economic growth compared to macroeconomic consensus, we think there is an upward risk, and we think the risk facing inflation is basically downward.”