After the Hong Kong stock market on May 23, Bilibili (NASDAQ: BILI, HKEX: 9626; “Station B” for short) announced its first-quarter results for this year. Fluctuations in US stock prices at Station B clearly intensified that night.

In fact, Station B's earnings report for the current period is actually not bad---Commercialization is progressing steadily, and operating efficiency continues to improve, and the pace of loss reduction has even surpassed market expectations.

According to financial reports, Station B's total revenue for the quarter was 5.66 billion yuan (RMB, same unit), up 12% year on year; gross profit increased 45% year on year to 1,605 billion yuan during the same period, and gross margin rose 28.3%, achieving seven consecutive quarters of month-on-month increase; adjusted net loss narrowed 56% year over year to 456 million yuan, slightly better than market expectations of 498 million yuan.

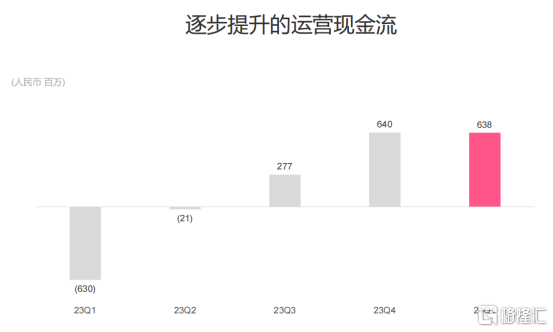

Also, it is worth mentioning that Station B's net operating cash flow for the current period was 638 million yuan.Positive operating cash flow has been achieved for 3 consecutive quarters. Cash flow, as a source of real profit, also sent a favorable signal for Station B's self-certification.You need to know that the reason why Amazon has not lost money for a long time is a continuous positive cash flow.

It looks like,Station B started quite well this year, with remarkable results in reducing losses.However, if we want to reach our profit target in the third quarter, we may have to run a little faster.

On the one hand,Stand B has to keep looking for increments and “adding” in business.

Among Station B's four major businesses, value-added services require a high investment in homemade content. For Station B, which is desperate to prove its ability to make money to the market, it's a bit unrealistic to take the lead; the e-commerce business is currently too small to carry the flag. Therefore, if Station B wants to be profitable in the short term, it is likely that it will still have to rely on high-margin advertising and game businesses.

The reason why the commercial performance of Station B this season was slightly better than expectedMainly due to the acceleration of monetization in advertising and value-added businesses, games have not picked up yet, but there are clear signs of growth.

As Station B's “number one hero” in recent years, the advertising business is still the biggest highlight.

Although Q1 was a low season for the advertising industry, Station B's advertising revenue still achieved a high growth of 31%, reaching 1.67 billion yuan, further accelerating from month to month. Among them, performance advertising revenue increased by more than 50%. This is mainly due to increased traffic, improved efficiency of advertising tools, and increased advertising inventory due to rich scenarios.

According to Li Ni, Vice Chairman and COO of Station B, Q1 advertising business revenue mainly comes from the three major fields of games, 3C digital appliances, and boutique e-commerce, and Q2 will further expand into the automotive, network services, medical care, and education industries. This means that there is still plenty of room for future market growth for Station B's advertising business.

Also,Another major support point for Station B's advertising revenue is its increasingly prosperous trading ecosystem.

On the one hand,Users are becoming more and more aware of the trading scenario.According to the data, the number of users watching transactional content in Q1 reached 37.2 million, doubling from the previous year.

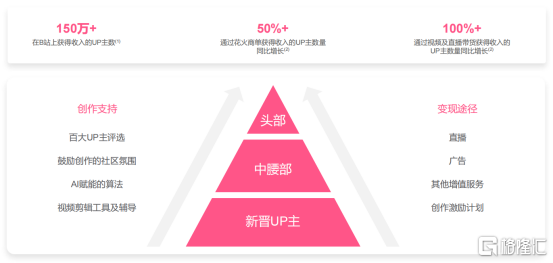

On the other hand,There are also more and more UP owners who make money by bringing goods.The number of UP owners earning revenue by bringing goods doubled year over year. As far as the industry is concerned, 3C appliances currently have the largest trading volume in the home improvement, food and beverage, apparel and beauty categories. Among them, the 3C digital category and women's apparel category saw outstanding growth this season. According to public data, the volume of 3C digital delivery transactions on the Q1 website increased by more than 230% over the same period last year; the volume of goods delivery in the women's apparel category has already exceeded that of last year.

Station B, which has a “fertile ground” for trading, is naturally regarded by major e-commerce platforms as “guests.”

Considering that Station B will continue to adhere to the “big open loop” strategy, deepen cooperation with platforms such as Ali, JD, Pinduoduo, and Vipshop, and use more intelligent marketing analysis tools, it is expected to accelerate the rise in advertising and transaction volume in Q2. According to Li Ni's disclosure, during the “618” period this year, the overall platform budget of Station B increased by more than 30%, and the merchant budget increased by more than 250%.

Of course, as more UP owners taste the sweetness of delivery, it will also drive more UP owners to “try it out”, thereby driving the commercialization process of Station B, which in turn will drive up the revenue of UP owners. Only when the commercialization of the platform develops can UP owners earn more money. Of course, Station B also provides a more diversified revenue model for UP owners.

In addition, the value-added service business is still Station B's “guiding principle”. Q1 revenue was 2.53 billion yuan, an increase of 17% over the previous year, which also exceeded market expectations. In terms of the conference membership business, the total number of conference members reached 21.9 million in the first quarter, of which over 80% were annual subscriptions or automatic renewal members, and the growth was steady and steady.

Currently, there is no sign of recovery of station B games, but in Q2, two exclusive and intermodal mobile games will be launched. Among them, the number of pre-orders for “Three Kingdoms: Seek the World” is currently reported to have exceeded 2 million.

(Source: Public Information)

Looking at it from a long-term perspective, as the largest game content community in China, Station B has unique game community content and player concentration. The double-digit growth rate of Q1 game advertising is proof of its unique commercial value in the gaming sector.

In addition to putting effort into the business and intensive farming, Station B must continue to reduce costs and increase efficiency.

Station B's gross margin continued to rise, indicating continued results in cost control. In addition to this, Station B drastically reduced losses this season, also benefiting from a reduction in R&D expenses. Also, sales rates for this season have all been reduced year over month.

It should be pointed out that the cost of content, as the largest part of the cost, is relatively rigid. At the same time, since the bandwidth cost of the video platform itself is not much reduced, there is still relatively limited room for cost reduction, and subsequent increases in gross margin may have to be achieved even more by improving monetization efficiency.

If you want to run fast, the chassis must be stable.In this regard, the ambition of Station B is obvious to all.

First, in terms of the number of users, whether DAU or MAU, Q1 hit record highs, reaching 102 million and 342 million respectively.

(Source: BOC International)

Second, maintain high viscosity, and maintain DAU/MAU at 29.9%. The average daily time is 105 minutes, which is also a record high.

In addition, the featured section is booming, and the number of broadcasts in categories such as knowledge, games, and entertainment on the Q1 site all increased by more than 20% over the same period last year. The AI category also increased by more than 80% year over year, and related UP Sunday activities increased by more than 60% year over year. Station B has become one of the communities with the strongest AI content mentality, and is also the core discussion area for new energy vehicles. At the same time, new categories are constantly emerging, such as home improvement, travel, fitness, fashion, parent-child, etc.

In short, the commercial value and internal resilience of Station B are still prominent. The current trend is still good, and it is worth a little more patience. Looking at the capital market, the short-term market is more of a financial and emotional game, but in the long run, once it is determined to be a high-quality stock, a pullback is an opportunity.