May 24, 2024

SBI Securities Co., Ltd.

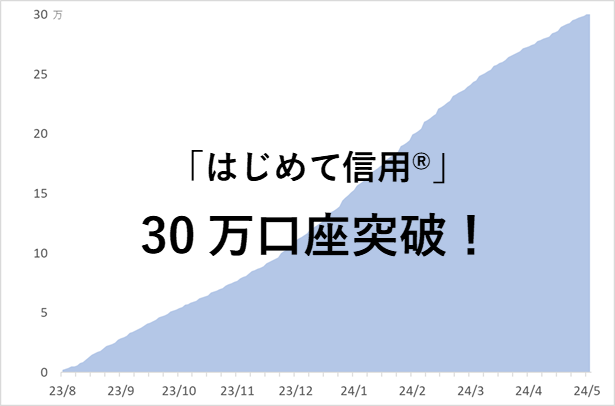

SBI Securities Co., Ltd. (Headquarters: Minato-ku, Tokyo; President and CEO: Masato Takamura; hereinafter “the Company”) is announcing that the “First Credit” account has exceeded 300,000 accounts as of 2024/5/20 (Monday).

Aiming to provide individual investors with a variety of options for asset formation, we launched a “first credit” service in 2023/8 where even those without stock trading experience, which is the first major internet securities*1, can reduce risk and perform margin transactions (including sales).

With leverage of 1 times and a margin limit of 5 million yen, compared to general margin trading, credit transactions can be performed with reduced risk, and a service that is easy to use even for beginners in stock trading has been realized. After gaining trading experience with “first credit,” it is also possible to step up to general margin trading.

In 2024/9, we implemented the “Zero Revolution” *2, which makes online domestic stock trading fees (in kind and credit) free, and in 2024/5, we began a domestic credit trading debut program that can reduce the cost of interest rates and stock loan fees and begin margin trading.

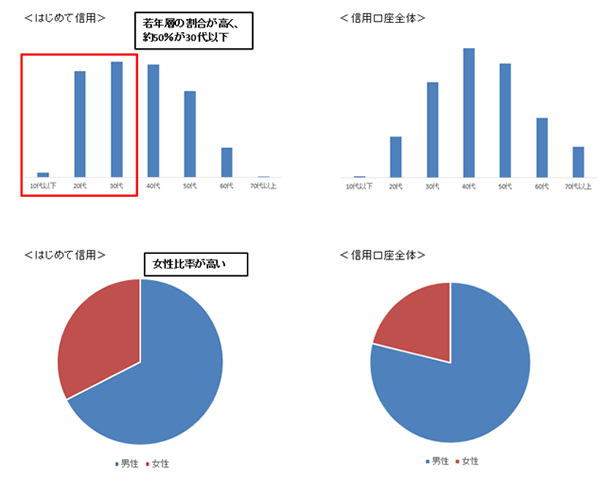

These efforts have made it possible to provide customers of a wide range of ages who have not used margin trading until now with the opportunity to start margin trading, such as loop trade where the same stocks can be traded many times a day with the same funds, and credit sales services that can raise profits even in falling markets, which is an investment method that cannot be done with spot trading.

About half of our customers using margin trading for the first time started with “first credit,” and as a result of receiving support from many customers, “first credit” accounts surpassed 300,000 as of 2024/5/20 (Monday).

We will continue to strive to provide “the highest level of service in the industry with the lowest fees in the industry” based on the “customer-centric” management philosophy.

(URL:https://go.sbisec.co.jp/lp/domestic_margin_first_230814.html)

(URL:https://search.sbisec.co.jp/v3/ex/RT_campaign_240501domestic_margin_debut.html)

| Trade name, etc. | SBI Securities Co., Ltd. Financial Instruments Brokers, Commodity Futures Traders |

| registration number | Kanto Finance Bureau Director (Gold Trading) No. 44 |

| Join an association | Japan Securities Dealers Association, Financial Futures Dealers Association, General Incorporated Association Type 2 Financial Instruments Dealers Association, Japan STO Association, Japan Commodity Futures Trading Association |

<Fees, etc. and risk information>

There are no account opening fees and management fees for SBI Securities' comprehensive securities account.

When investing in products, etc. handled by SBI Securities, you may be charged prescribed fees and necessary expenses for each product. Also, there is a risk that losses will occur due to price fluctuations, etc. for each product (there is a risk that losses will exceed the secured deposit/margin (principal) pledged in margin transactions, commodity futures transactions, foreign exchange margin transactions, and exchange CFDs (Kurikku Stock 365)). Fees, etc. and risks to be borne when investing in each product, etc. vary from product to product, so for details, please check the relevant product page on the SBI Securities website, signs relating to the Financial Instruments and Exchange Act, etc., or documents issued before signing a contract.