The Hang Seng Technology Index closed down 2.48%, down 7.61% weekly.

Today, Hong Kong stocks continued to recover, and market sentiment continued to be sluggish. At one point, the Hang Seng Technology Index plummeted by 3% and eventually closed down 2.48%. The weekly decline was 7.61%. The Hang Seng Index and the National Index fell 1.38% and 1.44% respectively, and emerged from four consecutive declines.

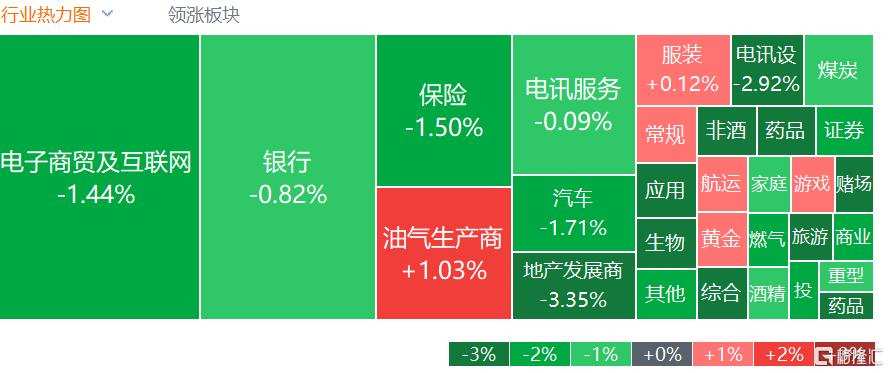

On the market, weights such as large technology stocks, big financial stocks, and Chinese head stocks dragged down the market. Kuaishou fell more than 4%, fell more than 11% after Bilibili's results, and China Life Insurance, China Finance Corporation, China Merchants Bank, etc. fell one after another, and all recorded continuous declines; institutions said the impact of real estate policies on new home sales still needed to be observed, and domestic housing stocks declined significantly; biotech stocks continued to fall sharply throughout the day, denying that clinical data fell short of expectations; Kang Fang Biotech closed down nearly 23%; Auto Gaming, PV stocks, etc., restaurant stocks, mobile game stocks, etc. generally declined.

On the other hand, favorable electricity reform policies have been implemented one after another. Electricity stocks bucked the trend. Huadian International Electric Power surged 6%, while petroleum stocks and shipping stocks rose partially.

Let's take a look specifically:

Biotech declined across the board, dragged down by “rumours that clinical data fell short of expectations”. Kangfang Biotech plummeted more than 22%, Lepu Biotech and Shengnuo Pharmaceuticals fell more than 8%, Rongchang Biotech fell more than 7%, and Zaiding Pharmaceuticals, BeiGene Shenzhou, and Jiahe Biotech fell more than 6%.

According to the news, Kang Fang Biotech responded to the sharp drop, saying that the HR for AK112's progression-free survival period disclosed by ASCO reached 0.46. This is the core data for evaluating clinical study results. The data results are excellent, and there are no claims that it falls short of expectations. Currently, with excellent results, the AK112-301 data has been accepted as an oral report at the 2024 ASCO Conference and will be published globally on June 1 according to the organizer's plan. In addition, Kang Fang Biotech announced that the marketing application for lung cancer drugs has been approved.

Domestic housing stocks and property management stocks fell. Jinhui Holdings fell more than 19%, R&F Real Estate fell more than 9%, Vanke, Agile Group, Ocean Group, and Country Garden Services fell more than 8%, Xuhui Holding Group and Sunac Services fell more than 7%, and China Jinmao and Sunac China fell more than 6%.

Travel stocks declined, with Ctrip Group, China Express, Hong Kong China Travel Service falling more than 2%, and Tongcheng Travel falling more than 1%.

Gaming stocks fell collectively, with Wynn Macau, Melco International Development, Sands China, Aobo Holdings, Galaxy Entertainment, and MGM China falling more than 2%.

Power stocks fluctuated upward. Huadian Electric Power rose more than 6%, Longyuan Electric Power rose more than 5%, Dongfang Electric rose more than 4%, Datang Power, China Electric Power, and Huaneng International Power shares rose more than 3%, and China Resources Electric Power rose more than 2%.

Petroleum stocks rose; CNOOC rose more than 2%, and China Oil and Gas Holdings rose more than 1%.

Pork stocks surged higher and fell, with Yurun Foods rising more than 1% and COFCO Jiajiakang rising 0.5%.

Game stocks have rebounded. China Mobile Games and Wangchen Technology Holdings rose more than 2%, while Xindong and Dream World rose more than 1%.

Today,Southbound capitalNet purchases of HK$2,516 million include net purchases of HK$1,612 million from Hong Kong Stock Connect (Shanghai) and HK$905 million from Hong Kong Stock Connect (Shenzhen).

Looking to the future,Zheshang International believes that from a fundamental point of view, the April economic data still did not perform well, and continued to show a state of external heat and internal cold. On the financial side, expectations of interest rate cuts in the market were clearly repeated due to PPI exceeding expectations and CPI cooling last week. Subsequent interest rate hikes are unlikely, but interest rate cut expectations will still be repeated based on subsequent data, and there is great uncertainty.

In terms of configuration, with macroeconomic data still weak, it is recommended to maintain the allocation for dividend-related sectors such as energy, banking, telecommunications, and utilities, and booming sectors such as construction machinery, auto parts, home appliances, electronics, and the Internet of Technology.