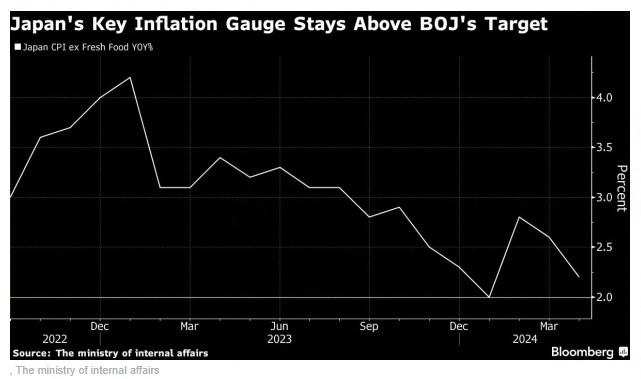

At a time when the recent depreciation of the Japanese yen heightens concerns that cost-driven inflationary pressure may continue,Japan's inflation has cooled for the second month in a row, but it is still above the Bank of Japan's target.

Japan's Ministry of the Interior said on Friday thatConsumer prices excluding fresh food rose 2.2% year over year in April, which is in line with analysts' estimates. The indicator remained at or above the Bank of Japan's 2% target for the 25th consecutive month.

The biggest factor dragging down the index is the slowdown in the price increase of processed food (to 3.5%), partly due to the base effect of the increase in processed food prices a year ago, which indicates that companies are more willing to pass on the rising costs to consumers. The increase in accommodation costs was also small, which dragged down the overall indicators.

The deeper inflation index, which excludes fresh food and energy prices, fell to 2.4%, which is also in line with market consensus.

Figure: Japan's key inflation indicators are still above central bank targets

These results alone are unlikely to divert the Bank of Japan from seeking opportunities to further reduce its easing policy settings. Bank of Japan observers are increasingly pointing out the risk that the Bank of Japan will raise interest rates early when the yen remains near a 34-year low, even though the Japanese government has twice been suspected of market intervention to support the yen.

The Bank of Japan emphasized that service prices are a key factor in its policy review. The year-on-year increase was 1.7%, which is a decrease from 2.1% last month. Economists are paying more attention to this month's data, as April marks the beginning of the fiscal year, at a time when many companies are considering implementing price changes.

This trend is likely to reverse in the next few months as many companies begin implementing salary increases.Previously, Japan's largest trade union umbrella organization won promises of over 5% salary increases from large companies, which is the biggest increase in more than 30 years. The Bank of Japan hopes these salary increases will stimulate spending and prices.

Kohei Okazaki, a senior economist at Nomura Securities, said, “I think starting now, salary increases will steadily put pressure on price increases in terms of both demand and supply. Our main scenario is that this will happen to some extent.”

Tokyo's inflation is the main measure of national data. After the local government began providing education subsidies, inflation in Tokyo unexpectedly plummeted in April. Analysts, including Nissei Institute of Fundamental Research (NLI), estimate that these measures have had a much smaller impact on national indicators, reducing price increases by about 0.1% or less.

Utility subsidies are deducted 0.48% from the overall CPI indicator. The government will begin phasing out these spending in May, which could push the country's key inflation indicator to 3% during the summer.

Bloomberg Economics said:”The Bank of Japan seems to believe that a healthy wage price cycle will boost future inflation. The expected rise in utility costs will also boost inflation data for the next few months, providing good prospects for the Bank of Japan to raise interest rates.”