IBM Unusual Options Activity For May 23

IBM Unusual Options Activity For May 23

Financial giants have made a conspicuous bearish move on IBM. Our analysis of options history for IBM (NYSE:IBM) revealed 8 unusual trades.

金融巨頭對IBM採取了明顯的看跌舉動。我們對IBM(紐約證券交易所代碼:IBM)期權歷史的分析顯示了8筆不尋常的交易。

Delving into the details, we found 25% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $189,283, and 2 were calls, valued at $83,475.

深入研究細節後,我們發現25%的交易者看漲,而50%的交易者表現出看跌趨勢。在我們發現的所有交易中,有6筆是看跌期權,價值爲189,283美元,2筆是看漲期權,價值83,475美元。

Predicted Price Range

預測的價格區間

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $150.0 to $225.0 for IBM during the past quarter.

分析這些合約的交易量和未平倉合約,大型企業似乎一直在關注IBM在過去一個季度的價格範圍從150.0美元到225.0美元不等。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

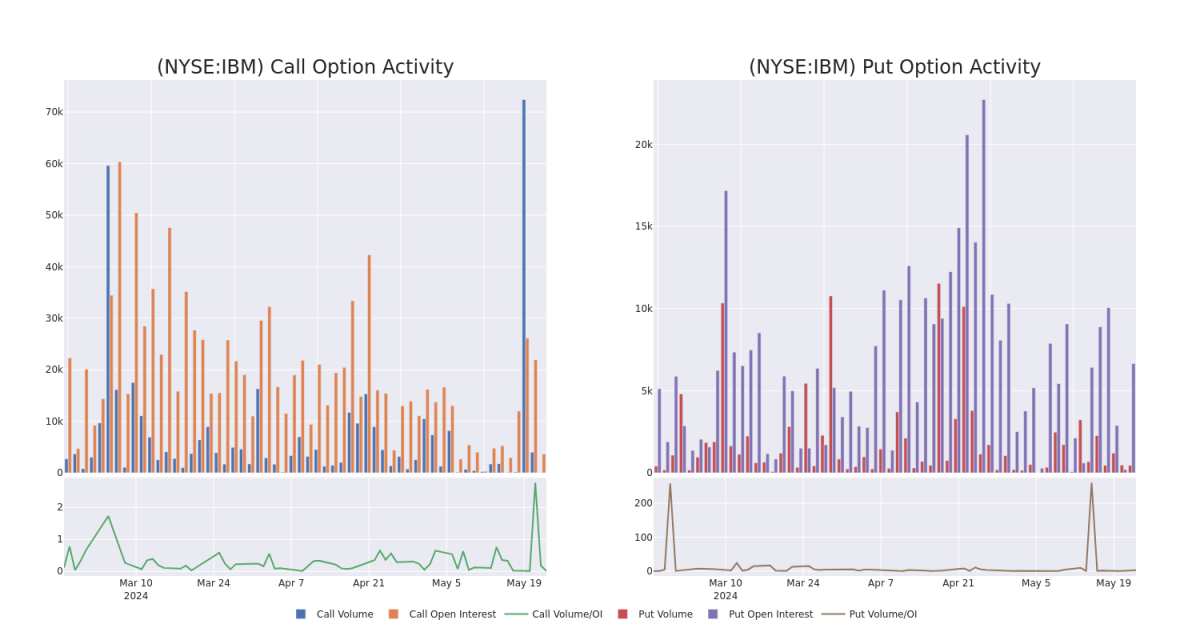

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for IBM's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across IBM's significant trades, within a strike price range of $150.0 to $225.0, over the past month.

檢查交易量和未平倉合約爲股票研究提供了至關重要的見解。這些信息是衡量特定行使價下IBM期權的流動性和利息水平的關鍵。下面,我們簡要介紹了過去一個月IBM重大交易的看漲期權和未平倉合約的趨勢,行使價區間爲150.0美元至225.0美元。

IBM Call and Put Volume: 30-Day Overview

IBM 看漲和看跌交易量:30 天概述

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IBM | CALL | TRADE | BEARISH | 01/16/26 | $37.0 | $35.25 | $35.25 | $150.00 | $52.8K | 250 | 15 |

| IBM | PUT | TRADE | BULLISH | 05/31/24 | $2.16 | $2.1 | $2.12 | $172.50 | $41.9K | 451 | 327 |

| IBM | PUT | TRADE | BEARISH | 10/18/24 | $12.05 | $11.9 | $12.05 | $180.00 | $33.7K | 1.0K | 43 |

| IBM | PUT | SWEEP | NEUTRAL | 01/17/25 | $54.4 | $51.35 | $53.16 | $225.00 | $31.8K | 20 | 6 |

| IBM | CALL | SWEEP | BULLISH | 01/17/25 | $15.55 | $15.3 | $15.3 | $170.00 | $30.6K | 3.3K | 20 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IBM 公司 | 打電話 | 貿易 | 粗魯的 | 01/16/26 | 37.0 美元 | 35.25 美元 | 35.25 美元 | 150.00 美元 | 52.8 萬美元 | 250 | 15 |

| IBM 公司 | 放 | 貿易 | 看漲 | 05/31/24 | 2.16 美元 | 2.1 美元 | 2.12 美元 | 172.50 美元 | 41.9 萬美元 | 451 | 327 |

| IBM 公司 | 放 | 貿易 | 粗魯的 | 10/18/24 | 12.05 美元 | 11.9 美元 | 12.05 美元 | 180.00 美元 | 33.7 萬美元 | 1.0K | 43 |

| IBM 公司 | 放 | 掃 | 中立 | 01/17/25 | 54.4 美元 | 51.35 美元 | 53.16 美元 | 225.00 美元 | 31.8 萬美元 | 20 | 6 |

| IBM 公司 | 打電話 | 掃 | 看漲 | 01/17/25 | 15.55 美元 | 15.3 美元 | 15.3 美元 | 170.00 美元 | 30.6K | 3.3K | 20 |

About IBM

關於 IBM

IBM looks to be a part of every aspect of an enterprise's IT needs. The company primarily sells software, IT services, consulting, and hardware. IBM operates in 175 countries and employs approximately 350,000 people. The company has a robust roster of 80,000 business partners to service 5,200 clients—which includes 95% of all Fortune 500. While IBM is a B2B company, IBM's outward impact is substantial. For example, IBM manages 90% of all credit card transactions globally and is responsible for 50% of all wireless connections in the world.

IBM 希望成爲企業 IT 需求方方面面的一部分。該公司主要銷售軟件、IT 服務、諮詢和硬件。IBM 在 175 個國家開展業務,擁有大約 35 萬名員工。該公司擁有龐大的80,000名業務合作伙伴,爲5,200名客戶提供服務,其中包括所有財富500強的95%。儘管IBM是一家B2B公司,但IBM的對外影響是巨大的。例如,IBM 管理着全球90%的信用卡交易,並負責全球所有無線連接的50%。

In light of the recent options history for IBM, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於IBM最近的期權歷史,現在應該將重點放在公司本身上。我們的目標是探索其目前的表現。

Present Market Standing of IBM

IBM 目前的市場地位

- Currently trading with a volume of 1,843,325, the IBM's price is down by -1.68%, now at $170.78.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 55 days.

- IBM目前的交易量爲1,843,325美元,其價格下跌了-1.68%,目前爲170.78美元。

- RSI讀數表明,該股目前可能接近超買。

- 預計收益將在55天后發佈。

Expert Opinions on IBM

關於 IBM 的專家觀點

5 market experts have recently issued ratings for this stock, with a consensus target price of $177.8.

5位市場專家最近發佈了該股的評級,共識目標價爲177.8美元。

- Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on IBM with a target price of $190.

- Maintaining their stance, an analyst from BMO Capital continues to hold a Market Perform rating for IBM, targeting a price of $190.

- An analyst from Exane BNP Paribas has revised its rating downward to Underperform, adjusting the price target to $145.

- An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on IBM, which currently sits at a price target of $179.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Neutral rating for IBM, targeting a price of $185.

- Stifel的一位分析師在評估中保持了對IBM的買入評級,目標價爲190美元。

- BMO Capital的一位分析師堅持自己的立場,繼續維持IBM的市場表現評級,目標價格爲190美元。

- Exane BNP Paribas的一位分析師已將其評級下調至表現不佳,將目標股價調整爲145美元。

- 摩根士丹利的一位分析師決定維持對IBM的等權評級,目前的目標股價爲179美元。

- 摩根大通的一位分析師保持立場,繼續對IBM維持中性評級,目標股價爲185美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest IBM options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。藉助Benzinga Pro的實時警報,隨時了解最新的IBM期權交易。