Deep-pocketed investors have adopted a bullish approach towards Moderna (NASDAQ:MRNA), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MRNA usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 32 extraordinary options activities for Moderna. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 43% leaning bullish and 37% bearish. Among these notable options, 7 are puts, totaling $556,704, and 25 are calls, amounting to $2,114,502.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $90.0 to $180.0 for Moderna over the recent three months.

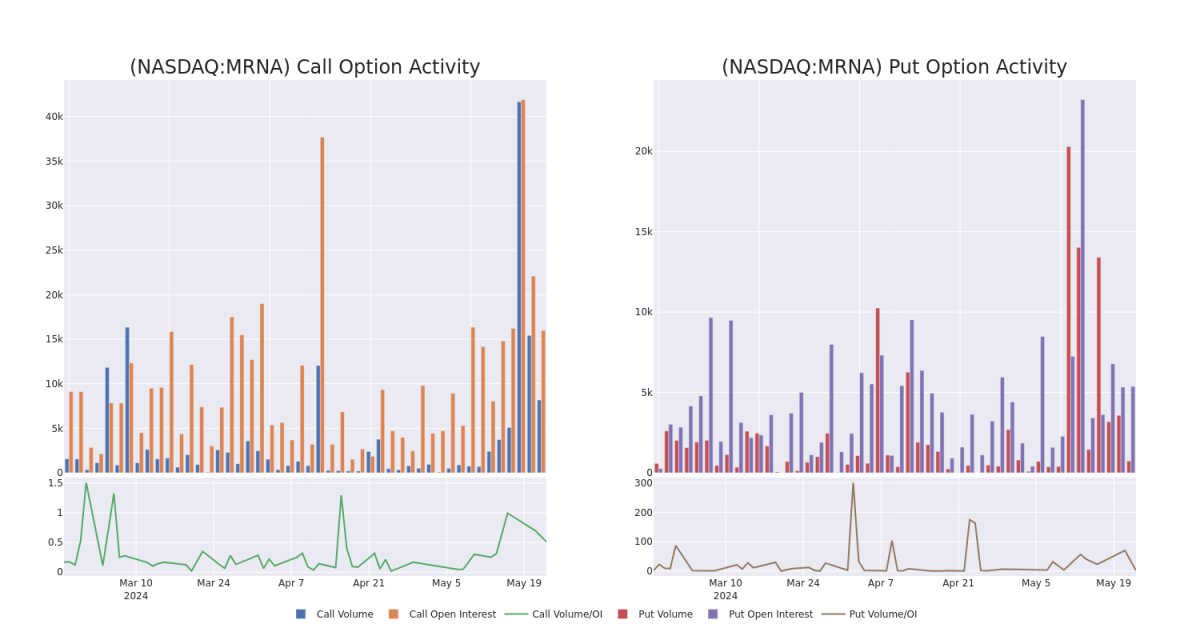

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Moderna's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Moderna's whale trades within a strike price range from $90.0 to $180.0 in the last 30 days.

Moderna Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRNA | CALL | TRADE | NEUTRAL | 01/17/25 | $46.95 | $42.7 | $44.85 | $130.00 | $358.8K | 1.3K | 80 |

| MRNA | PUT | TRADE | BEARISH | 01/17/25 | $14.7 | $14.4 | $14.7 | $140.00 | $294.0K | 428 | 1 |

| MRNA | CALL | SWEEP | BULLISH | 01/16/26 | $75.3 | $68.2 | $72.73 | $110.00 | $290.8K | 168 | 40 |

| MRNA | CALL | SWEEP | NEUTRAL | 05/31/24 | $21.7 | $20.45 | $21.05 | $140.00 | $210.5K | 693 | 101 |

| MRNA | CALL | TRADE | NEUTRAL | 01/16/26 | $49.9 | $43.75 | $47.37 | $160.00 | $189.4K | 455 | 0 |

About Moderna

Moderna is a commercial-stage biotech that was founded in 2010 and had its initial public offering in December 2018. The firm's mRNA technology was rapidly validated with its COVID-19 vaccine, which was authorized in the United States in December 2020. Moderna had 39 mRNA development candidates in clinical trials as of mid-2023. Programs span a wide range of therapeutic areas, including infectious disease, oncology, cardiovascular disease, and rare genetic diseases.

In light of the recent options history for Moderna, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Moderna's Current Market Status

- With a volume of 1,393,780, the price of MRNA is down -2.28% at $159.61.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 70 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.