JD issues convertible bonds, and Ali will follow suit. Who might be next?

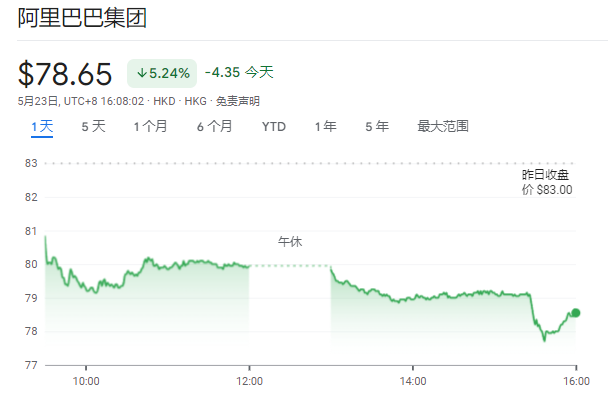

On Wednesday, Alibaba's Hong Kong stock fell by more than 5%. According to the news, people familiar with the matter said that Ali is considering issuing convertible bonds and plans to raise about 5 billion US dollars in capital.

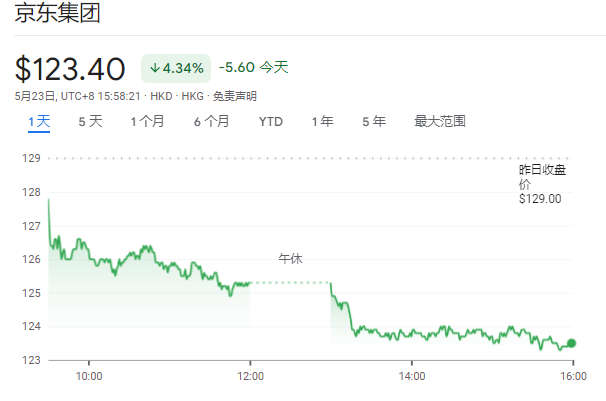

Earlier, on May 21, JD announced that it plans to issue convertible bonds with a total scale of 1.75 billion US dollars. After three days of continuous decline, JD Hong Kong stocks fell by more than 4% today.

JD said that the issuance of this convertible bond will enable it to use low financing costs (0.25% coupon rate) to speed up the share repurchase process at the current stock price. The conversion price is 45.7%, and the market price premium is about 35%.

In response, HSBC stated:

It is no surprise that Internet companies use the bond market to enhance shareholder returns. In the current high interest rate environment, convertible bonds provide a better financing option compared to ordinary bonds.

JD's decline was no surprise. Historically, after Internet companies issued convertible bonds, stock prices often fell in the short term. Over the past three years, the stock price dropped an average of 8% on the first day after the announcement, and fell 23% on the 30th day.

Who will likely continue to follow up? HSBC believes that:

I prefer Meituan, Tencent, NetEase, and Pinduoduo. We estimate that Meituan and Tencent are the companies most likely to issue convertible bonds, while NetEase is likely to be more defensive.

Investors should pay attention to four major indicators when analyzing who will follow up: 1) Stock price performance: Station B, JD, and Tencent Music performed the best in the past month; 2) Offshore liquidity: Tencent, iQiyi, Station B, Baidu, and Meituan have net US dollar debt; 3) Shareholder returns and cash positions: Tencent's stock repurchases and dividends this year are expected to account for 140% or more of net cash positions, followed by JD 42% and Weibo 35%; 4) Historical convertible bond issuance: iQiyi has issued four times in the past five years, Pinduoduo twice.