Inflationary pressure is expected to ease in the second half of the year

On the morning of May 23, local time, the Bank of Korea held a financial and monetary committee meeting. The central bank announced that it will continue to keep the 3.5% benchmark interest rate unchanged, while raising the economic growth forecast for this year to 2.5%.

Although inflation continues to slow, the risk of upward inflation has increased due to improved economic growth and increased exchange rate fluctuations. In addition to this, geopolitical risks also persist. Accordingly, the Commission notes that it is appropriate to assess domestic and foreign policy conditions while maintaining current restrictive policy positions.

Prior to issuing the interest rate decision, Bank of Korea Governor Lee Chang-yong said that as market expectations that the Federal Reserve may maintain monetary tightening policies for a longer period of time continue to heat up, the Bank of Korea may delay cutting interest rates.

The policy survey also reflects the idea of postponing interest rate cuts: analysts currently believe that the target interest rate will remain unchanged until the third quarter, then cut interest rates by 50 basis points in the fourth quarter, and some analysts have postponed the time to cut interest rates.

The global economy is recovering moderately

Judging from the external environment, global economic growth is better than expected, but the growth rate is moderate, inflation is declining, and there is a difference between the economic conditions of major countries and the rate at which inflation is slowing down. Among them,

The US is expected to maintain a good growth trend supported by continued growth in consumption and investment;

The Eurozone is expected to gradually ease the decline in growth, but at a slower pace;

At the same time, inflation is slowing at different rates in major developed countries, and the time it takes for inflation to converge to target levels may vary greatly among countries.

In the US, for example, both consumer price inflation and core inflation have declined. Among them, CPI rose 0.3% month-on-month and 3.4% year-on-year in April; after excluding highly volatile food and energy prices, core CPI rose 0.3% month-on-month and 3.6% year-on-year in April. Meanwhile, the Eurozone inflation rate in April was 2.4%, the same as in March, and 7.0% for the same period last year.

In terms of global financial markets, major countries' long-term treasury bond yields and the US dollar index first rose sharply and then fell, in line with changes in expectations for the timing and magnitude of the Federal Reserve's interest rate cuts. Looking ahead, the committee believes that global economic growth and global financial markets may be affected by slowing inflation, the fragmentation of monetary policy operations in major countries, and the development of geopolitical risks.

The committee said that in the future, it will continue to implement monetary policy while monitoring economic growth, so as to stabilize consumer price inflation at the target level for the medium term, while focusing on financial stability. Although economic growth is currently better than expected and inflation is expected to continue to slow, it is still too early to judge that inflation will move towards the target level.

In the future, the Commission will maintain a restrictive monetary policy position for a long enough period until such confidence is established. In this process, the central bank will thoroughly evaluate trends such as slowing inflation, improving economic growth, financial stability risks, household debt growth, the fragmentation of monetary policy operations in major countries, and geopolitical risk dynamics.

A drag on economic growth

Looking at domestic conditions, in the first quarter of this year, South Korea's exports continued to rise, consumption and construction investment slowed down somewhat, and the economic growth rate greatly exceeded expectations. Meanwhile, labour market conditions are generally good, and the number of employed persons continues to grow strongly.

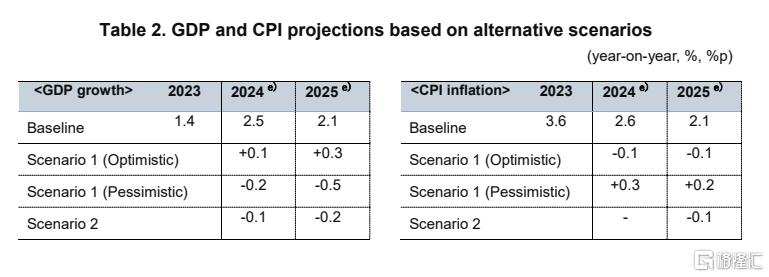

However, starting in the second quarter, with exports continuing to grow, domestic demand showed a correction, and consumption will continue to recover moderately in the second half of the year. As a result, the annual GDP growth rate is expected to be 2.5%, far exceeding the 2.1% forecast in February. The future direction of economic growth may be affected by the rate of IT industry expansion, consumption recovery trends, and the monetary policies of major countries.

In terms of domestic finance and foreign exchange markets, South Korea's long-term treasury bond yields first rose and then fell, in line with changes in domestic and foreign monetary policy expectations. The high exchange rate of the Korean won against the US dollar fluctuated greatly due to the trend of surrounding currencies such as the US dollar and yen, as well as geopolitical risks.

Looking at household debt and the housing market, household loans in the financial sector increased as the growth rate of housing-related loans expanded, while other loans that had previously declined also increased. Housing prices in Seoul have risen, but prices in other regions have continued to fall. Although risks associated with real estate project financing, such as rising delinquency rates, still exist, it is expected that the restructuring will proceed in an orderly manner with the announcement of the government's soft landing measures. Just last month, Bank of Korea Governor Lee Chang-yong said that this month's reassessment of the economy is essential for formulating policies for the rest of the year.

Meanwhile, the committee re-examined its assessment of future growth and inflation paths.

Among them, GDP is expected to grow by 2.5% this year, far exceeding the 2.1% forecast in February. The future economic growth path may be affected by the rate of IT industry expansion, consumption recovery trends, and the monetary policies of major countries.

The annual consumer price inflation rate and core inflation rate are expected to be 2.6% and 2.2%, respectively, in line with the February forecast. However, the upward pressure on inflation due to improved economic growth was insufficient to adjust the annual forecast.

Looking ahead, as the upward risk of the inflation outlook increases since April, the Commission will need more time to be confident that the inflation target will converge, and there is more uncertainty about the timing of interest rate cuts.