The current trading market capitalization exceeds $2.5 trillion for the first time in history

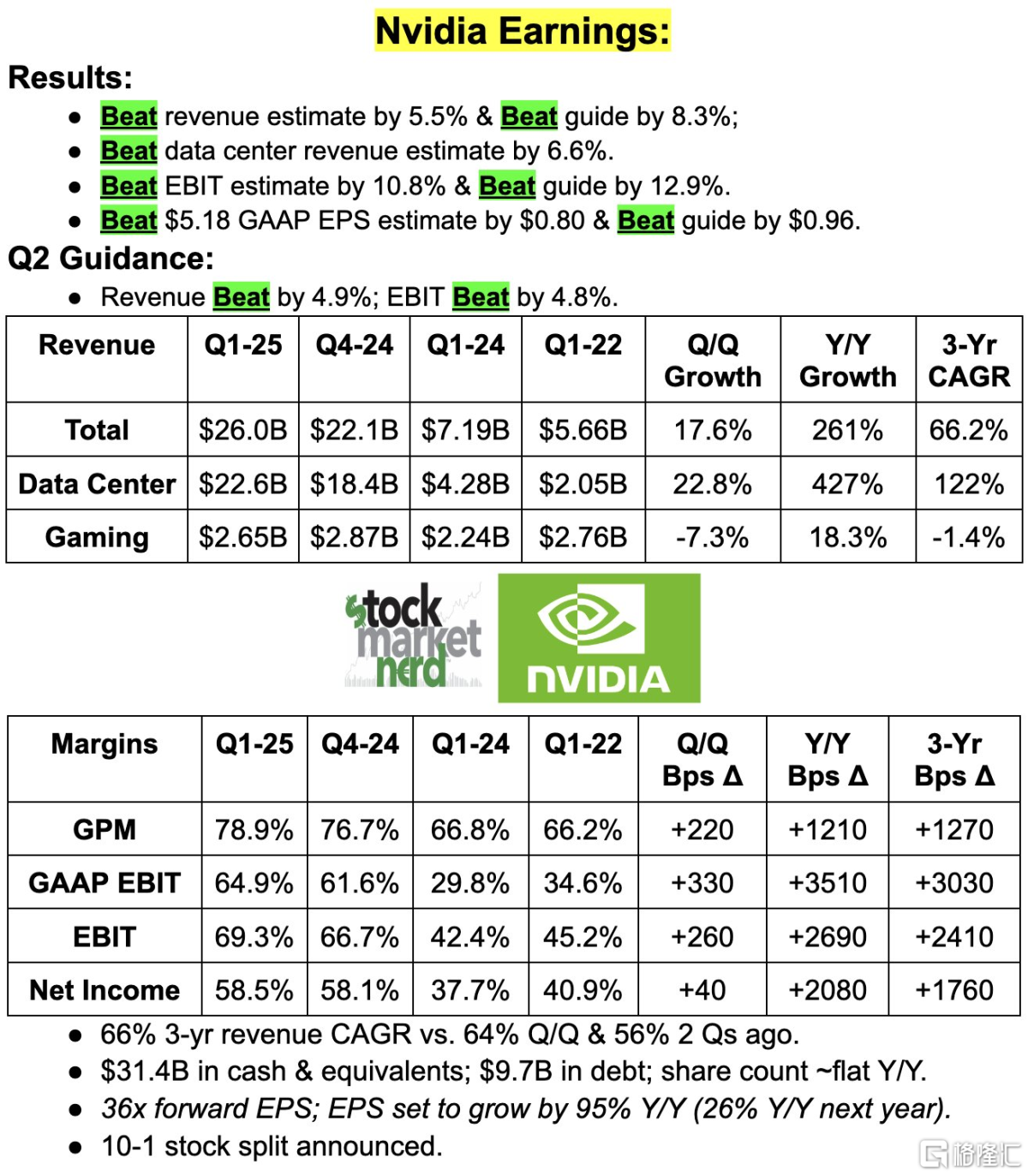

In the newly announced financial quarter results, Nvidia's performance completely crushed expectations, and the company's stock price broke through the key mark of 1,000 US dollars in post-market trading.

Before the US stock market, Nvidia's stock price rose 6.75% to reach 1013.59 US dollars/share, breaking through the key mark of 1,000 US dollars in one fell swoop.

By Wednesday's close, Nvidia had accumulated a 92% increase this year.

Over time, the company's stock price has soared 25 times over the past 5 years. At the beginning of January 2020, Nvidia's market capitalization just surpassed 150 billion US dollars. Currently, the market capitalization of transactions exceeds 2.5 trillion US dollars for the first time in history, forcing Microsoft and Apple.

Nvidia's $2.5 trillion market capitalization is more than the combined market capitalization of Tesla and Amazon, which is greater than the combined market capitalization of the entire German stock market and the Italy+Australian stock market.

Some netizens joked that Nvidia's role in the market is like:

Some hot topics about Nvidia

After the announcement of the results, which completely crushed expectations, Huang Renxun and company executives all explained current market concerns during telephone financial reporting meetings and media interviews.

Regarding the stock split, Nvidia announced that it will carry out a 10-to-1 stock split, and the adjustment will be carried out when the market opens on June 10.

For investors who held Nvidia prior to the stock split, they will receive 9 additional shares of common stock, which will be distributed after the market closes on June 7 (Friday).

Nvidia also said that after the stock split, it will increase its first-quarter dividend by 150% to 0.1 US dollars per share, compared to 0.04 US dollars per share before.

Regarding customer concerns about delays in procurement, Hwang In-hoon said in an interview: “People want to deploy data centers now. They want to put our GPUs to work now and start making money and saving money, so demand is very strong.”

Hwang In-hoon said that by next year, demand for both Hopper and Blackwell will exceed supply, and the complexity of chips poses a challenge for Nvidia to keep up with growing demand.

He also emphasized that Blackwell is “backwards compatible” with Hopper's architectural system. This seems to mean that customers don't have to wait for a higher-performance BlackWell, buy Hopper early and enjoy it early, and can upgrade smoothly after Blackwell comes out.

Regarding the customer's desire to go to Nvidiarization, Hwang In-hoon believes that Nvidia's products are just as powerful for reasoning and training.

“We're leading the way in reasoning because reasoning is a very complex problem.”

“The software stack is complex, and so are the types of models people use, and the vast majority of today's reasoning is done on Nvidia. So we expect this to continue.”

Nvidia CFO Colette Kress also said that cloud service providers have seen an “immediate and strong return on investment.” If the cloud provider spends $1 on Nvidia's hardware, they can rent it out for $5 over the next four years.

In addition to cloud service vendors, Hwang In-hoon revealed that more and more companies and industries, from Meta and Tesla to pharmaceutical companies, are using Nvidia products. Countries are also developing their own systems, and this trend is known as sovereign artificial intelligence. These opportunities are creating multiple multi-billion dollar markets beyond cloud service providers.

In fact, apart from cloud services, the industry that uses Nvidia chips the most is automotive.

Hwang In-hoon said, “Tesla is far ahead when it comes to autonomous cars, but one day, every one of our cars will have to be capable of autonomous driving.”

However, most of Nvidia's current revenue still comes from a small number of customers. Amazon, Meta, Microsoft, and Google are the biggest buyers of its chips, accounting for about 40% of its sales.

Regarding the chip supply process, Hwang In-hoon said that Blackwell architecture GPUs will be shipped in the second quarter and production will increase in the third quarter. It is expected that they can be deployed in customer data centers in the fourth quarter, and Blackwell is expected to bring a significant increase in revenue this year. This delivery schedule was aggressive and surprised analysts.

He revealed that Blackwell's first customers included Amazon, Google, Meta, Microsoft, OpenAI, Oracle, Tesla, and xAI.

He also said that Nvidia has entered the rhythm of launching new products every year, and that after the Blackwell chip, another chip will be launched to achieve “one generation per year.”

What do you think of Wall Street?

Nvidia's strong performance shows that the AI boom continues, and the related investment of enterprises is still huge.

Ryan Detrick, chief market strategist at Carson Group, said: “Even in the face of huge expectations, Nvidia once again stepped forward and delivered results. “The data center's revenue, which is always important, is strong, and future revenue guidance is impressive.”

Edward Jones analyst Logan Purk said, “Demand for Nvidia GPU chips is still heating up, and these results may be sufficient to satisfy investors' appetites and prove to the market that investment in artificial intelligence has not slowed down.”

Michael Schulman, chief investment officer at Running Point Capital, said: “I'm sure the whole of Wall Street was relieved because many investors and analysts were nervous about Nvidia and the entire data center before this announcement.”

Editor/Jeffrey