Inspur Digital Enterprise Technology Limited (HKG:596) shares have continued their recent momentum with a 33% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 41%.

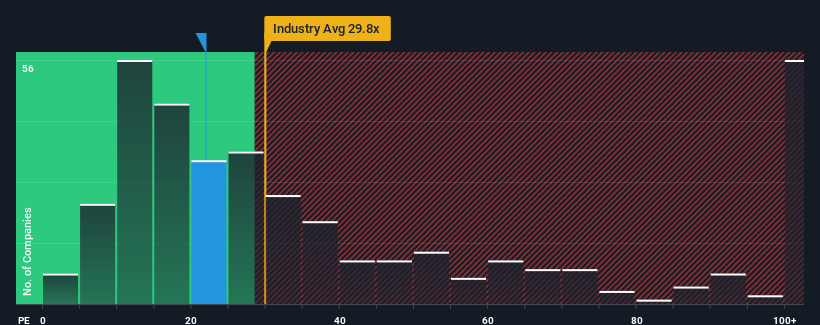

After such a large jump in price, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may consider Inspur Digital Enterprise Technology as a stock to avoid entirely with its 21.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, Inspur Digital Enterprise Technology has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Is There Enough Growth For Inspur Digital Enterprise Technology?

In order to justify its P/E ratio, Inspur Digital Enterprise Technology would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 70% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 49% per year during the coming three years according to the only analyst following the company. With the market only predicted to deliver 16% per year, the company is positioned for a stronger earnings result.

With this information, we can see why Inspur Digital Enterprise Technology is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shares in Inspur Digital Enterprise Technology have built up some good momentum lately, which has really inflated its P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Inspur Digital Enterprise Technology's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Inspur Digital Enterprise Technology with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than Inspur Digital Enterprise Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.