After the US stock market on Wednesday May 22, chip giant Nvidia, which has been in the limelight since last year in the AI boom, announced the results for the first fiscal quarter of fiscal year 2025 up to the end of April this year.

Nvidia's total revenue and data center revenue both reached record highs in the current quarter, and increased several times over the same period last year. The revenue guidance for the next quarter also exceeded expectations. It also carried out a 10-1 stock split and a significant increase in dividends.

Nvidia rose more than 7% after the market. If the rise continues until tomorrow's opening, the stock price will break through the $1,000 mark for the first time, driving AI concept stocks such as Arm Holdings, AMD, TSMC ADR, Micron Technology, Mywell Technology, and Ultramicomputer to rise after the market.

According to some analysts, Nvidia's quarterly revenue was more than three times that of 7.192 billion US dollars in the same period last year, and was significantly higher than market expectations, indicating that AI investment in the technology industry remained strong.

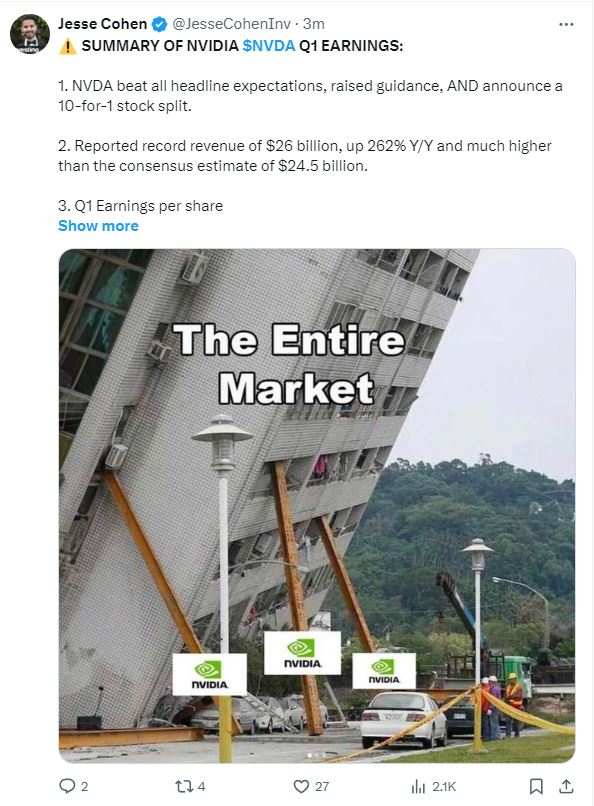

Some netizens said bluntly that the US stock market is now supported by Nvidia.

Nvidia closed down 0.5% on Wednesday, and hit a record closing high of $953.86 on Tuesday. It has climbed nearly 92% since this year, significantly outperforming the S&P 500 Index and NASDAQ's gains of more than 11%.

The company's market capitalization jumped to 2.3 trillion US dollars, ranking third in the US stock market after Microsoft and Apple. It has rebounded sharply by nearly 750% from the low price in October 2022, and surged 240% last year.

Wall Street's expectations for Nvidia's earnings are as high as ever. Forty analysts rated “buy,” 2 rated “hold,” and no one suggested “sell.” The average target price of $10,577.76 means there is still room for an increase of 11%.

Nvidia's total revenue increased by more than 200% to a new high in three quarters, profits multiplied fivefold, and split shares 10-1

According to financial reports, Nvidia's revenue for the first fiscal quarter reached a record high of 26 billion US dollars, up 18% month-on-month and 262% year-on-year. Adjusted earnings per share were $6.12, up 19% month-on-month and 461% year-over-year. Net profit increased by 620% to US$14.81 billion.

This is Nvidia's third consecutive quarter of revenue growth of more than 200% year over year, surpassing Wall Street expectations by a sharp increase of 240% to US$24.6 billion, and the company's official guidance of US$24 billion. The market originally anticipated a 540% increase in net profit to $13.1 billion.

Nvidia's gross profit margin for the quarter was 78.9%, which was significantly higher than expected. Analysts originally thought it would increase slightly to 77% from 76.7% in the previous quarter. EPS was also higher than expected earnings of $5.65 per share, surging more than fivefold from $1.09 in the same period last year.

The company expects revenue for the second quarter to be $28 billion (plus or minus 2%), which is better than the market forecast of $26.8 billion, but the non-GAAP gross margin is expected to fall to 75.5% (fluctuate 50 basis points up and down), and the gross margin for the whole year narrows to about 70%, which is also basically in line with the market outlook.

The company also said that GAAP and non-GAAP operating expenses are expected to be approximately US$4 billion and US$2.8 billion, respectively, and operating expenses for the whole year are expected to increase in the range of 40% to 45%.

Wall Street predicts that Nvidia's quarterly sales volume at the end of the current fiscal year in January next year will break through the 30 billion US dollar mark. Revenue for the second fiscal quarter may further increase to 26.67 billion US dollars, and revenue for the entire fiscal year may rise above the integer level of 110 billion US dollars. Last fiscal year's revenue increased 126% year over year to a record high of US$60.9 billion.

Beginning on June 10, Nvidia will complete a 10-1 stock split. Shareholders registered before the close of the market on June 6 will receive an additional 9 shares for each common share to make it easier for employees and investors to hold at a lower price. The company will also increase the dividend by 150% to 0.01 US dollars per share after the split to pay shareholders registered before June 11.

According to some analysts, Nvidia's stock price has soared 25 times in the past five years, while Alphabet, Amazon, and Tesla all split their shares in 2022.

Some netizens commented that Hwang In-hoon attended the earnings conference call and was like a superstar jumping on the concert stage to face thousands of screaming fans.

Others claim that Nvidia is like selling gold digging shovels to tech giants (the only one) in the gold mining era.

Data center revenue increased fivefold to a new high, the gaming business added an AI PC category, and the automotive business increased the robot category

By business, data center revenue has already surpassed Nvidia's gaming GPU business as a key area of rapid growth. Revenue in the first fiscal quarter reached a record high of US$22.6 billion, exceeding market expectations of US$21.1 billion, up 23% month-on-month and 427% year-on-year.

Among them, data center computing revenue was US$19.4 billion, up 29% month-on-month and 478% year-on-year, thanks to increased shipments of the Nvidia Hopper GPU computing platform for training and inference in large language models, recommendation engines, and generative AI applications.

Meanwhile, due to strong growth in InfiniBand's end-to-end solutions, network revenue increased 242% year over year to $3.2 billion. According to some analysts, Nvidia specifically emphasized strong sales of networking parts (networking parts). As companies build clusters composed of tens of thousands of interconnected chips, these components are becoming more and more important.

Company executives said that the strong growth in data center revenue over several quarters was driven by all customer types, starting with enterprises and consumer internet companies. “Large cloud providers continue to drive strong growth by deploying and upgrading Nvidia's AI infrastructure on a large scale, accounting for about 45% of our data center revenue.”

The biggest game business in the past had quarterly revenue of 2.6 billion US dollars, in line with market expectations, down 8% month-on-month and 18% year-on-year. The company said the year-on-year increase mainly reflected an increase in demand, and the month-on-month decline was due to a seasonal decline in laptop GPU sales.

It is worth noting that Nvidia has added an “AI PC” category to the traditional “gaming” business, and the future financial reporting period will surely become the focus of attention. In the first fiscal quarter, it introduced new AI performance optimization and integration for Windows systems to support chatbot functions.

The third largest business category is professional visualization. The quarterly revenue was US$427 million, which fell short of market expectations of US$480 million. The year-on-year decrease was 8% and the year-on-year increase was 45%. The year-on-year increase mainly reflected the increase in sales volume to partners after channel inventory levels were normalized.

The fourth largest business category is automotive, with quarterly revenue of US$329 million, up 17% month-on-month and 11% year-on-year, higher than market expectations, falling 1% to US$290 million. The year-on-year increase was mainly driven by autonomous driving platforms, and the month-on-month growth was driven by artificial intelligence cockpit solutions and autonomous driving platforms. Notably, a new “robot” category has been added to the “automotive” business.

Huang Renxun: Ready for the next wave of growth, Blackwell will ship in the second quarter, bringing in a lot of revenue this year

Nvidia founder and CEO Hwang In-hoon said in a statement that Blackwell's super-powerful AI chips launched in the second half of the year will bring more growth:

“The next industrial revolution has begun — businesses and countries are partnering with Nvidia to transform trillion-dollar traditional data centers into accelerated computing and build new data centers — artificial intelligence factories — to produce a new commodity: artificial intelligence.

Artificial intelligence will bring significant productivity gains to almost every industry, help companies improve cost efficiency and energy efficiency while expanding revenue opportunities.

We're ready for the next wave of growth. The Blackwell platform is fully in production, laying the foundation for generative artificial intelligence on a trillion-parameter scale.

Strong and growing demand for generative AI training and inference on the Hopper platform is driving our data center revenue growth. In addition to cloud service providers, generative AI has expanded to consumer internet companies as well as enterprise, sovereign AI, automotive, and healthcare customers, creating multi-billion dollar vertical markets.”

Huang Renxun said during the earnings call that Blackwell's next generation of superpower chips is being “produced at full capacity,” and this year we will see “a large amount of Blackwell chip revenue”. Blackwell chip products will be shipped in the second quarter of this year, increased production in the third quarter, and launched in data centers in the fourth quarter.

He also claims that the reasoning workload is growing “significantly”. Electronic computing (computers) is switching from information retrieval to production skills. “Over a longer period of time, we will complete the redesign of how computers work. The computers of the future will generate answers, not just search (information).”

The financial report also said that in the first fiscal quarter, non-GAAP operating expenses increased 43% year over year and 13% month over month, mainly reflecting the increase in the number of employees and salary benefits. Cash and equivalents at the end of the quarter were $31.4 billion, up from $15.3 billion a year ago and $26 billion last quarter. Stock repurchases of $7.7 billion and cash dividends of $98 million were paid during the quarter.

Why is it important

Nvidia is the undisputed leader in AI chip production and the most obvious beneficiary of the AI trend. In addition, the increase in its stock price already accounts for a quarter of the increase in the S&P 500 index this year. No wonder some analysts say that this is the most important financial report for this quarter or the whole year. It will not only provide the latest insight in the field of artificial intelligence, but also influence the performance of AI concept stocks and even the stock market.

Nvidia's earnings report will also be a key test indicator of whether investment in and demand for artificial intelligence in the technology industry can continue. According to estimates by brokerage firm Bernstein, hyperscale companies such as Google, Amazon, Microsoft, Meta, and Apple are expected to have a total capital expenditure of 200 billion US dollars this year, a large portion of which will be used to purchase dedicated infrastructure such as AI chips, while Nvidia accounts for about 80% of the AI chip market.

Investment bank Stifel pointed out that investors' attention is likely to remain focused on the medium-term sustainability of the accelerated investment in AI infrastructure. Bernstein said that it is currently unknown how long this investment cycle will last and how much excess production capacity will be generated during this period to prevent AI from developing as fast as expected.

What do you think of Wall Street?

Wall Street is focusing first on Nvidia's revenue guidance and AI outlook. On the one hand, for a huge company like Nvidia, its profit growth rate is almost unprecedented, and it is rare for it to be able to maintain high profit margins.

Nvidia's next most powerful chip, the Blackwell GB200, will be officially launched in the second half of this year, which is bound to continue to increase profits. KeyBanc Capital Markets believes that the strongest chip may bring more than 200 billion US dollars in revenue to data centers in 2025.

CFRA analysts believe Nvidia still has plenty of room to grow, driven by a continued shift to artificial intelligence servers, early stages of CPU expansion, and potential target market space such as new software applications and a greater focus on energy efficiency.

However, many people also pointed out that given AMD and Arm's stock price response in this earnings season, if Nvidia's performance only “meets expectations,” it may cause the stock price to fall, or require close to 26 billion US dollars in quarterly revenue and similar high growth guidelines to meet the high expectations of the market.

The second concern is whether profit margins have hit recent peaks and capital expenses. There are concerns that Nvidia's profit margins will narrow in the second half of the year as capital expenses behind new product launches accelerate. Operating expenses for the last quarter increased 25% year over year to US$2.21 billion, and the expenditure for the first fiscal quarter is expected to be close to US$3 billion.

The third concern is whether the company's management will evaluate the sales replacement effect of Blackwell's super-powerful chips on existing H100 Hopper chips, as well as competitive risks from large-scale technology companies such as Microsoft, Google, and Amazon to develop their own AI chips.

Analysts such as Gene Munster, the co-founder of asset management agency Deepwater, and Bank of America are worried that the official launch of Blackwell in the second half of the year will curb Nvidia's recent chip sales. “A major product was officially warmed up six months before launch, which may have some consequences. That is, revenue for the next two quarters will be disappointing, with a quarter-on-quarter increase or less than 10% for the first time.”

In terms of concerns that Nvidia customers are developing their own chips, analyst Piper Sandler said bluntly that even if Google and other companies build their own customized chips, Nvidia will maintain at least 75% of the AI accelerator market share. Raymond James also said that given the upcoming launch of Blackwell chips, even any Nvidia stock price pullback will be short lived.