Traders cut bets on interest rate cuts in June

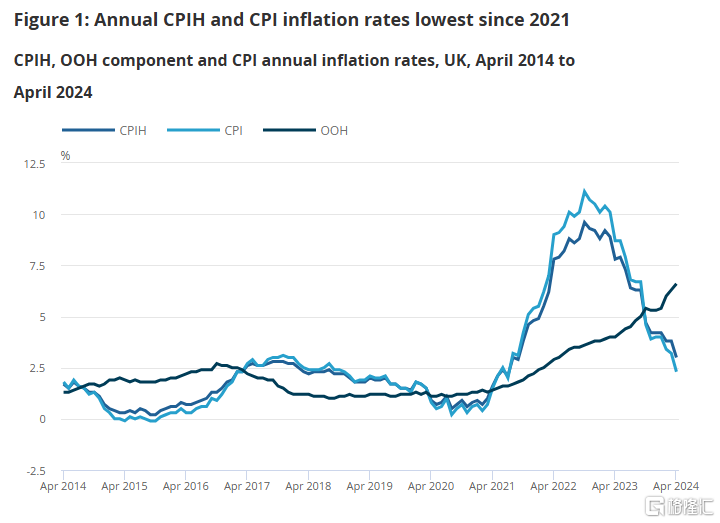

On Wednesday, the UK Office for National Statistics released data showing that the UK's CPI rose 2.3% year on year in April, down from 3.2% in March, the lowest level since July 2021, but higher than the 2.1% expected by economists; the core CPI, which excludes fluctuations in energy and food prices, rose 3.9% year on year, down from 4.2% in March, higher than the 3.6% forecast.

The service sector inflation rate declined slightly, from 6.0% to 5.9%, higher than the forecast of 5.5%.

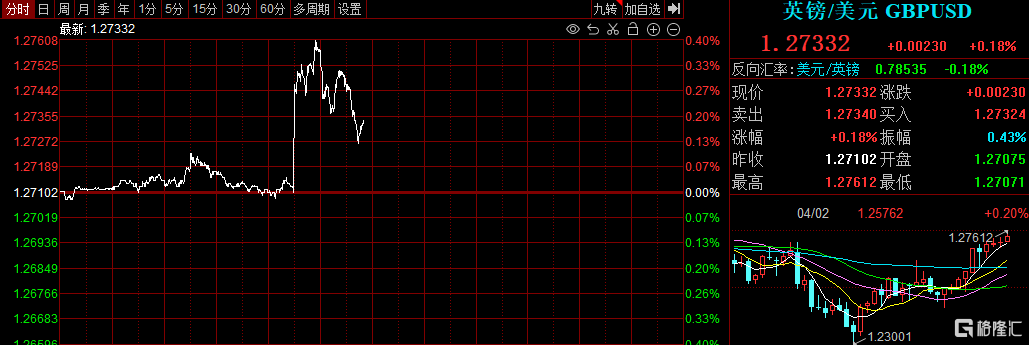

After the data was released, the pound rose in the short term. Investors expected the possibility that the Bank of England would cut interest rates in June was only 18%, down from 50% on Tuesday.

CPI fell to 2.3% in April

Service sector inflation remains high

According to data released by the UK Office for National Statistics, due to further cooling of energy prices, the UK's inflation rate fell to 2.3% in April, significantly lower than 3.2% in March, the lowest level since July 2021, and is very close to the 2% inflation control target set by the Bank of England. Although this figure is higher than the market's 2.1% forecast, it clearly shows that inflationary pressure in the UK continues to decline.

The core inflation rate fell to 3.9% from 4.2% in March, higher than the forecast of 3.6%; the service sector inflation rate declined slightly, from 6.0% to 5.9%, higher than the forecast of 5.5%.

According to the UK Office for National Statistics, falling gas and electricity prices contributed the most to the decline in CPI.

Looking specifically at it,

In terms of housing and household services, prices for housing and household services fell 0.1% between March and April, compared with a monthly increase of 1.0% in the same period last year.

The fall in rates between March and April reflects a significant downward impact on gas and electricity. In the year ending April, the prices of electricity, gas, and other fuels fell 27.1%, the biggest drop on record, with data dating back to 1989. Natural gas prices fell 37.5% year over year and fell 26.5% in the year ending March; electricity prices fell 21% year over year compared to 13% in March.

In terms of food and non-alcoholic beverages, prices rose 0.3% between March and April, compared to a monthly increase of 1.4% a year ago. Prices have been relatively high but stable since early summer 2023, rising about 2% between May 2023 and April 2024. In contrast, the sharp increase between March 2022 and May 2023 was around 22%.

The annual rate declined in 8 of the 11 food and non-alcoholic beverage categories, with the exception of fats, oils, fish, and hot drinks.

Hopes of interest rate cuts in June dashed?

Although the data shows that the UK's overall inflation rate is within easy reach of the Bank of England's 2% target, UK service sector inflation remains high.

Tomasz Wieladek, chief European economist at asset management firm Pryce, said that service sector inflation may not only prevent the Bank of England from cutting interest rates in June, but may even force policymakers to raise interest rates again in unpredictable circumstances.

Wieladek said that the extent of relief in service prices in the UK last month was lower than the overall inflation rate. Considering the early arrival of Easter, the increase in May is likely to be even greater. Due to the Bank of England's policy committee's firm focus on the service sector, continued stickiness may cause the Bank of England to raise interest rates again at some point. Today's data clearly shows that the market is too optimistic about the interest rate cut in June, and is still too optimistic about the Bank of England's interest rate cut this year.

Yael Selfin, the UK's chief economist at KPMG, said that the decline in inflation is close to the Bank of England's target, but it may not be enough to persuade the central bank to cut interest rates in June.

Institutional market analyst Divyang Shah said that last month's UK inflation data did not move in the right direction of cutting interest rates early. Although it is still possible to cut interest rates in August, the risk now is that interest rate cuts will be postponed until after summer.

Wednesday's data means the UK's inflation rate is lower than the US, Canada, France, and Germany. Japan has yet to release inflation data for April. Italy's inflation rate is 0.9%.

Despite this, the UK's inflation record since 2020 did not rank well among Western European countries. Consumer prices rose by more than 22% during this period, and only the Netherlands, Austria, and Germany performed just as bad.

The International Monetary Fund warned on Tuesday that cutting interest rates in the UK too soon may face the risk of rising inflation, but delaying easing could “stagnate or even reverse” economic recovery.