As Pinduoduo's new growth engine, while boosting performance, Temu's ability to break through the ceiling and hand over long-term profit responses is still a major focus of this quarter's earnings report.

In the context of Temu and the main station blossoming more, Pinduoduo's quarterly report is expected to continue its high growth trend, but it is also facing the test of whether the growth momentum can continue.

Pinduoduo will release financial results for the first quarter of 2024 on May 22. After the financial report is released, the company will hold a performance conference call at 19:30 p.m. Beijing time on the 22nd.

Wall Street's current consensus forecast is that Pinduoduo's revenue for the first quarter was 76.86 billion yuan, up 104.2% year on year, adjusted net profit increased 53.4% year on year to 15.53 billion yuan, and adjusted earnings per share were 10.5 yuan, up 52.2% year on year. The overall growth rate has slowed significantly from the previous quarter, but remains strong.

As Pinduoduo's new growth engine, while boosting performance, Temu's ability to break through the ceiling and hand over long-term profit responses is still a major focus of this quarter's earnings report.

Online marketing services may double year over year, advertising demand is strong

By business, Wall Street expects Pinduoduo's online marketing services and other revenue to be 37.65 billion yuan in the first quarter, up 104% year on year; revenue from transaction services will be 38.07 billion yuan, up 38% year on year.

Some analysts pointed out that Pinduoduo's initiatives in promoting product and service innovation, supporting agricultural and grocery businesses, strengthening cooperation with various parties, and meeting the diverse needs of consumers are expected to make a positive contribution to first-quarter revenue.

The increase in advertising demand and the strong momentum of online marketing and trading services are also expected to drive Pinduoduo's revenue growth in the first quarter.

However, factors such as reduced consumer spending, increased advertising and promotion expenses, and rising payment processing costs and cloud service costs may slow down Pinduoduo's performance in the first quarter.

How was Temu doing in the first quarter?

In this financial report, the most notable one is Temu, a cross-border e-commerce platform owned by Pinduoduo. According to previous estimates by Dolphin Investment Research, Temu achieved an impressive revenue of 26 billion yuan in the fourth quarter of 2023. Pinduoduo's management revealed during the fourth quarter conference call that since Temu was launched in September 2022, it has entered more than 50 countries and regions around the world.

Many agencies are optimistic about Temu's market potential.

UBS believes that the market may have underestimated Temu's market expansion potential for low-income consumers and the higher profit margins that its managed e-commerce model may bring. However, UBS also mentioned that Temu has certain geopolitical risks.

HSBC believes that with an all-line low price strategy and active marketing methods for products from clothing to children's toys, Temu is expected to grow the fastest among overseas e-commerce businesses in China, and is expected to reach 140 billion US dollars in GMV by 2027.

Some analysts have previously pointed out that although Temu is making great strides in the short term, the limitations of its business model and rising costs brought about by expanding into new markets may limit its room for value improvement. Temu's upper value limit is thought to be less than a few tens of billion US dollars, and there is still a gap compared to the value of Pinduoduo's main site of nearly 200 billion US dollars. Meanwhile, in the process of expanding into new markets outside of the US, Temu's gross profit growth rate fell short of revenue due to increased difficulty in fulfilling contracts and declining scale effects, and gross margin was likely to face downward pressure.

How is the market responding?

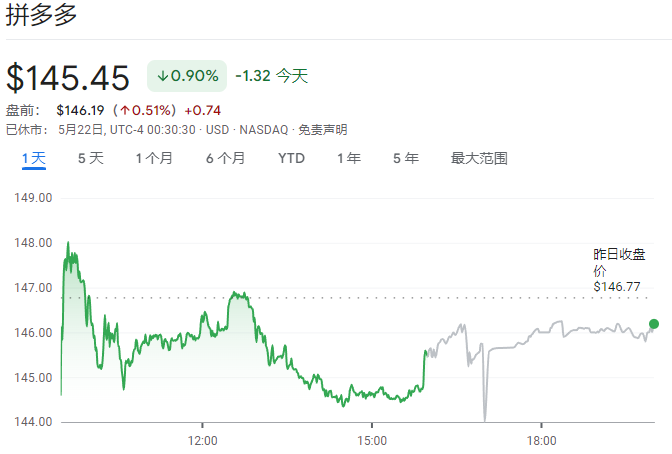

By the close of the US stock market on Tuesday, Pinduoduo had fallen 0.9% to $146.19. Over the past year, Pinduoduo's stock price has soared by more than 130%, but since 2024, capital profits have been settled, and Pinduoduo's stock price has declined all the way down.

Will the quarterly report be a catalyst for Pinduoduo's stock price rebound? Some investment institutions had already made choices before the financial report was released.

Appaloosa Management (Appaloosa Asset Management), a subsidiary of David Tepper, a famous billionaire hedge fund manager in the US, increased its holdings of Pinduoduo shares sharply in the first quarter of 2024 and purchased 1.325 million shares. Currently, Pinduoduo shares account for 3.61% of its investment portfolio.

Furthermore, Pinduoduo has become the largest stock of 100 billion private equity Gaoyu and Gao Yi Asset International, especially the former.

Gao Lin added 1.68 million shares of Pinduoduo in the first quarter, with an increase of 16.62%. The latest number of shares held rose to 11.7815 million shares, and the market value of shares held at the end of the period reached 1.37 billion US dollars (approximately RMB 9.891 billion), that is, the single ticket position was close to 10 billion yuan, which shows the popularity of Pinduoduo.

UBS raised the target price of Pinduoduo shares from $217 to $248, maintaining the buy rating.