Vincent Medical Holdings Limited (HKG:1612) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 5.6% isn't as impressive.

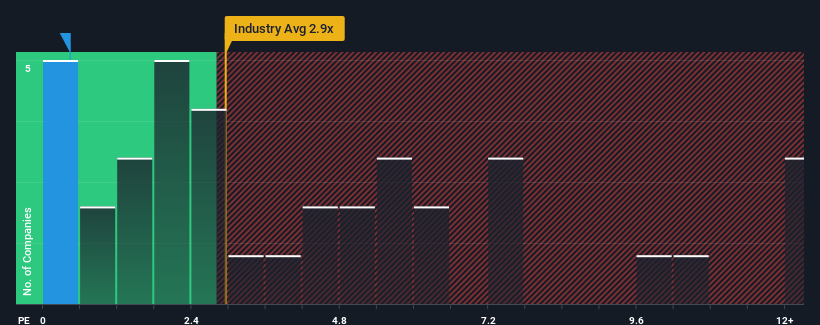

Although its price has surged higher, Vincent Medical Holdings' price-to-sales (or "P/S") ratio of 0.4x might still make it look like a strong buy right now compared to the wider Medical Equipment industry in Hong Kong, where around half of the companies have P/S ratios above 2.9x and even P/S above 7x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

How Has Vincent Medical Holdings Performed Recently?

Recent times haven't been great for Vincent Medical Holdings as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Vincent Medical Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Vincent Medical Holdings' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 38% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 18% per year during the coming three years according to the lone analyst following the company. With the industry predicted to deliver 49% growth per annum, the company is positioned for a weaker revenue result.

With this information, we can see why Vincent Medical Holdings is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Vincent Medical Holdings' P/S?

Vincent Medical Holdings' recent share price jump still sees fails to bring its P/S alongside the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Vincent Medical Holdings' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you take the next step, you should know about the 2 warning signs for Vincent Medical Holdings that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.