High-rolling investors have positioned themselves bullish on Robinhood Markets (NASDAQ:HOOD), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in HOOD often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 33 options trades for Robinhood Markets. This is not a typical pattern.

The sentiment among these major traders is split, with 42% bullish and 36% bearish. Among all the options we identified, there was one put, amounting to $42,500, and 32 calls, totaling $1,240,384.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $11.5 to $35.0 for Robinhood Markets over the recent three months.

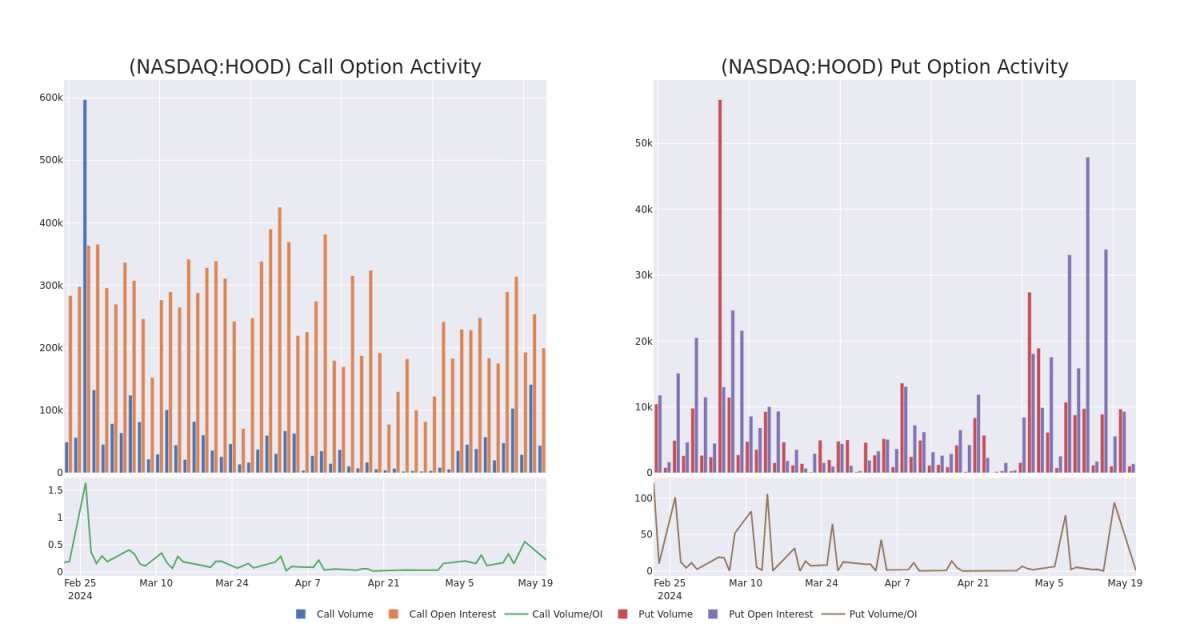

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Robinhood Markets's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Robinhood Markets's substantial trades, within a strike price spectrum from $11.5 to $35.0 over the preceding 30 days.

Robinhood Markets Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HOOD | CALL | TRADE | NEUTRAL | 01/17/25 | $5.15 | $5.05 | $5.1 | $20.00 | $61.2K | 75.6K | 8 |

| HOOD | CALL | TRADE | BULLISH | 07/19/24 | $1.17 | $1.16 | $1.17 | $25.00 | $58.5K | 2.8K | 1.2K |

| HOOD | CALL | TRADE | BEARISH | 05/31/24 | $2.93 | $2.88 | $2.88 | $18.00 | $57.6K | 2.8K | 1.2K |

| HOOD | CALL | TRADE | BULLISH | 06/21/24 | $2.79 | $2.55 | $2.76 | $19.00 | $55.2K | 7.5K | 391 |

| HOOD | CALL | TRADE | BULLISH | 05/24/24 | $1.36 | $1.32 | $1.36 | $20.00 | $54.4K | 13.9K | 1.9K |

About Robinhood Markets

Robinhood Markets Inc is creating a modern financial services platform. It designs its own products and services and delivers them through a single, app-based cloud platform supported by proprietary technology. Its vertically integrated platform has enabled the introduction of new products and services such as cryptocurrency trading, dividend reinvestment, fractional shares, recurring investments, and IPO Access. It earns transaction-based revenues from routing user orders for options, equities, and cryptocurrencies to market makers when a routed order is executed.

In light of the recent options history for Robinhood Markets, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Robinhood Markets

- With a volume of 8,884,900, the price of HOOD is down -0.62% at $20.71.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 71 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.