High-rolling investors have positioned themselves bearish on Broadcom (NASDAQ:AVGO), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in AVGO often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 9 options trades for Broadcom. This is not a typical pattern.

The sentiment among these major traders is split, with 33% bullish and 44% bearish. Among all the options we identified, there was one put, amounting to $27,300, and 8 calls, totaling $492,188.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $760.0 to $1500.0 for Broadcom during the past quarter.

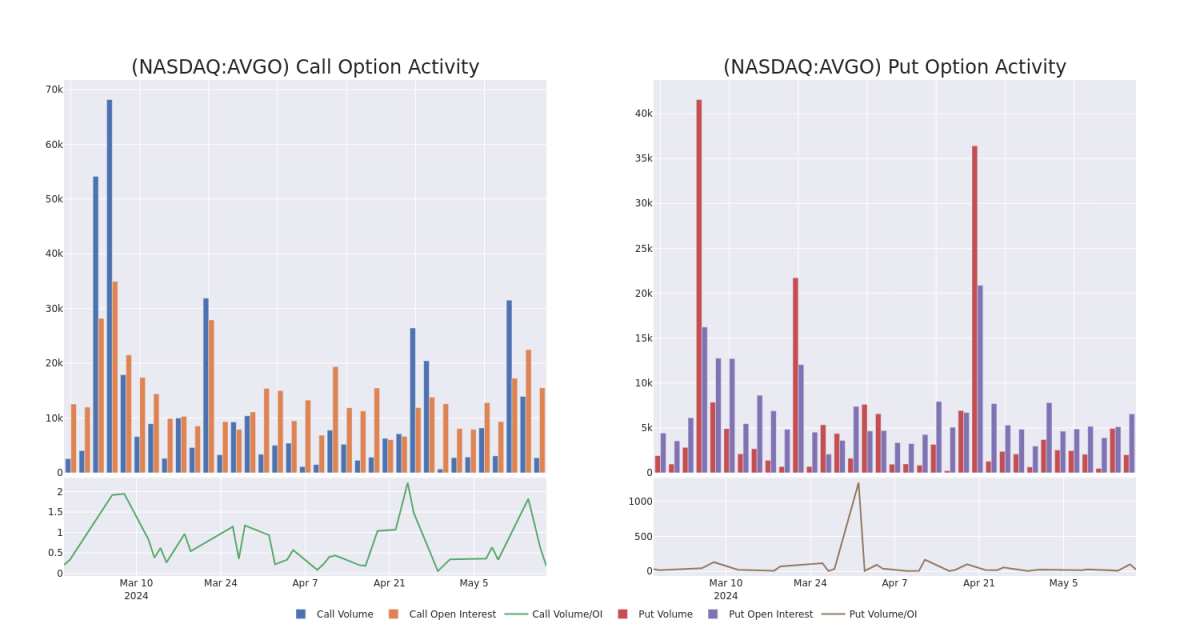

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Broadcom's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Broadcom's whale activity within a strike price range from $760.0 to $1500.0 in the last 30 days.

Broadcom Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AVGO | CALL | TRADE | BEARISH | 06/21/24 | $28.9 | $27.1 | $27.1 | $1500.00 | $205.9K | 1.7K | 89 |

| AVGO | CALL | TRADE | BEARISH | 01/17/25 | $664.1 | $659.0 | $659.0 | $760.00 | $65.9K | 664 | 1 |

| AVGO | CALL | SWEEP | BULLISH | 09/20/24 | $126.9 | $113.9 | $123.9 | $1410.00 | $61.9K | 76 | 0 |

| AVGO | CALL | SWEEP | BEARISH | 06/21/24 | $40.3 | $39.0 | $39.0 | $1460.00 | $39.0K | 802 | 10 |

| AVGO | CALL | SWEEP | BULLISH | 05/24/24 | $24.4 | $23.8 | $24.4 | $1400.00 | $34.1K | 693 | 80 |

About Broadcom

Broadcom is the sixth-largest semiconductor company globally and has expanded into various software businesses, with over $30 billion in annual revenue. It sells 17 core semiconductor product lines across wireless, networking, broadband, storage, and industrial markets. It is primarily a fabless designer but holds some manufacturing in-house, like for its best-of-breed FBAR filters that sell into the Apple iPhone. In software, it sells virtualization, infrastructure, and security software to large enterprises, financial institutions, and governments.Broadcom is the product of consolidation. Its businesses are an amalgamation of former companies like legacy Broadcom and Avago Technologies in chips, as well as Brocade, CA Technologies, and Symantec in software.

Following our analysis of the options activities associated with Broadcom, we pivot to a closer look at the company's own performance.

Present Market Standing of Broadcom

- Currently trading with a volume of 109,777, the AVGO's price is down by -1.23%, now at $1396.62.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 22 days.

What Analysts Are Saying About Broadcom

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $1550.0.

- In a cautious move, an analyst from Jefferies downgraded its rating to Buy, setting a price target of $1550.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Broadcom options trades with real-time alerts from Benzinga Pro.