May 21, 2024

SBI Holdings Co., Ltd.

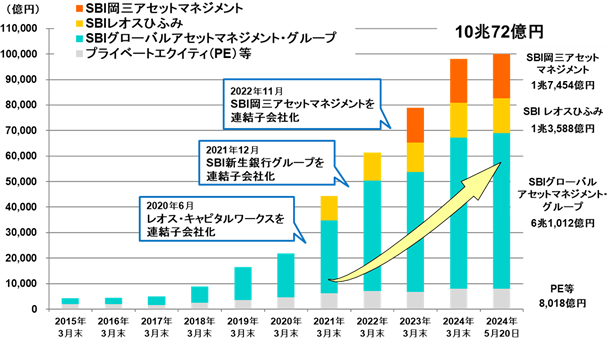

SBI Holdings Co., Ltd. (Headquarters: Minato-ku, Tokyo; Chairman and President: Yoshitaka Kitao; hereinafter “the Company”) is an asset management company under the umbrella of the Group: SBI Global Asset Management Co., Ltd. (Headquarters: Minato-ku, Tokyo; President and CEO: Tomoya Asakura; hereinafter “SBI Global Asset Management”), SBI Leo Hifumi Co., Ltd. (Headquarters: Chiyoda-ku, Tokyo; Chairman and CEO: Fujino Hideto We are pleased to inform you that the total balance of assets managed by SBI Okasan Asset Management Co., Ltd. (Headquarters: Chuo-ku, Tokyo, President and CEO Katsushi Shiokawa, hereinafter “SBI Okasan Asset Management”), and our private equity, etc. (hereinafter “Group Asset Management Balance”) exceeded 10 trillion yen on 2024/5/20.

In SBI Global Asset Management, the “SBI · V · S&P 500 Index Fund,” which is a public offering index fund set up and managed by SBI Asset Management, which is under the umbrella of SBI Asset Management, has surpassed the net asset balance of 1.6 trillion yen in 4 and a half years from establishment, and as a public offering active fund, the “SBI Japan High Dividend Equity (Distribution) Fund (settlement type 4 times a year)” which began setting up and operation on 2023/12/12 has a net asset balance in just 5 months 70 billion yen, the “SBI European High Dividend Equity (Distribution) Fund (annual settlement type),” which was set up and operated on 2024/2/28, surpassed the net asset balance of 10 billion yen in just 40 business days, respectively, and asset balances under management have increased rapidly.

Also, at SBI Leo Hifumi, the public offering active funds “Hifumi Asset Management,” “Hifumi Plus,” “Hifumi World,” and “Hifumi World +” updated the highest base price, and on 2024/2/26, the total asset balance of the mutual fund “Hifumi” series and domestic and international pension fund management etc. exceeded 1.3 trillion yen. Also, the YouTube channel “Money Manabiba!” boasts one of the largest number of subscribers in the financial industry We have gained the support of many customers by providing various information on money, investments, and the economy.

Furthermore, at SBI Okasan Asset Management, asset balances under management are steadily expanding, centering on the “Japan Good Dividend Rebalance Open” (net asset balance 193.6 billion yen), which has a management record of close to 20 years, and the “World Semiconductor-related Focus Fund” (net asset balance 131.2 billion yen) established on 2023/9/20. (Net asset balance as of 2024/5/20)

(*1) The exchange rate for the last day of each month is applied.

(*2) Anything less than 100 million yen is rounded off.

(*3) Private equity (PE, etc.) does not include cash deposits and unpaid amounts. Until the end of 2017/3, among investments made by investment business associations, etc., unlisted stocks, etc. without a market price were evaluated based on acquisition costs (amounts after impairment processing those that have undergone impairment treatment), but after 2018/3, they were evaluated at fair value. The balance shown as 2024/5/20 is as of the end of 2024/3.

(*4) SBI Okasan Asset Management, SBI Leo Hifumi, and SBI Global Asset Management Group companies (hereinafter “asset management companies”) are recorded as mutual funds and investment advisors, respectively, and there is some overlap.

(*5) Figures for each asset management company include public investment trusts, public bond investments, and private equity trusts.

Until now, each of the Group's asset management companies has implemented various product developments to meet the diverse needs of investors based on the basic view of “customer-centric” business construction, but as a result of such initiatives being accepted by many investors, we believe that we have now been able to break through the 10 trillion yen milestone. Going forward, in addition to diversifying the products offered and reducing costs, we will contribute to optimal asset formation for investors by providing new products such as alternative investments, and at the same time aim to achieve the Group's target balance of 20 trillion yen of assets under management during fiscal 2027.

over