Visa's Options: A Look at What the Big Money Is Thinking

Visa's Options: A Look at What the Big Money Is Thinking

Financial giants have made a conspicuous bearish move on Visa. Our analysis of options history for Visa (NYSE:V) revealed 10 unusual trades.

金融巨頭對Visa採取了明顯的看跌舉動。我們對Visa(紐約證券交易所代碼:V)期權歷史的分析顯示了10筆不尋常的交易。

Delving into the details, we found 30% of traders were bullish, while 60% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $384,872, and 5 were calls, valued at $194,735.

深入研究細節,我們發現30%的交易者看漲,而60%的交易者表現出看跌趨勢。在我們發現的所有交易中,有5筆是看跌期權,價值爲384,872美元,5筆是看漲期權,價值194,735美元。

Expected Price Movements

預期的價格走勢

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $240.0 to $365.0 for Visa during the past quarter.

分析這些合約的交易量和未平倉合約,看來大型企業一直在關注Visa在過去一個季度的價格範圍從240.0美元到365.0美元不等。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

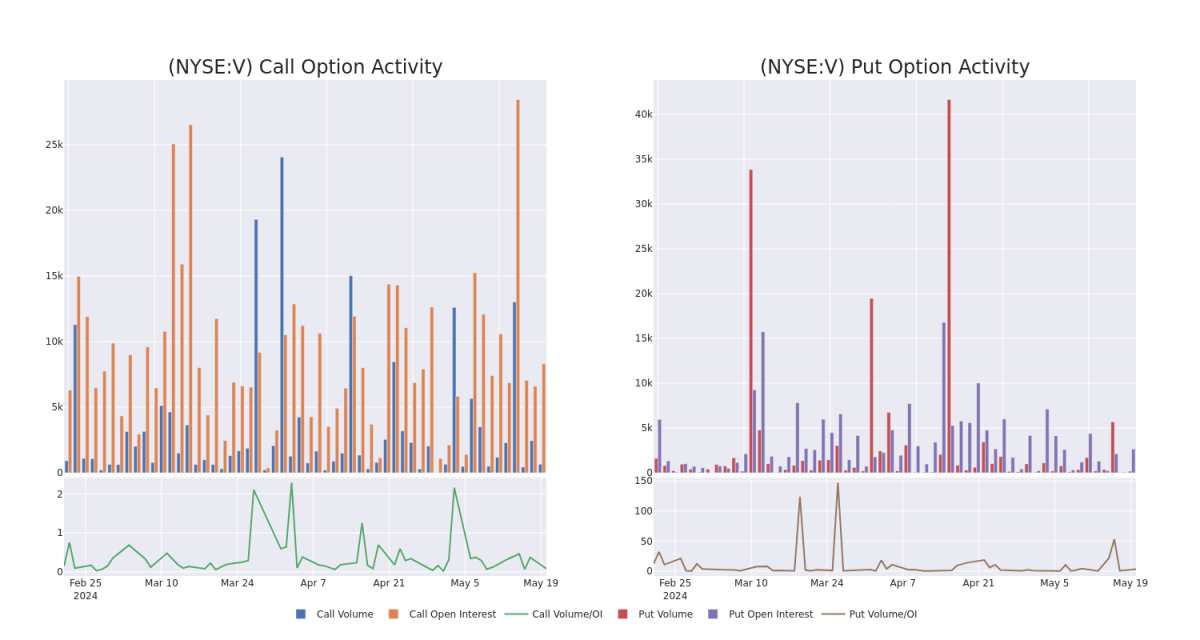

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平倉合約是一種對股票進行盡職調查的有見地的方法。

This data can help you track the liquidity and interest for Visa's options for a given strike price.

這些數據可以幫助您跟蹤給定行使價下Visa期權的流動性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Visa's whale activity within a strike price range from $240.0 to $365.0 in the last 30 days.

下面,我們可以分別觀察過去30天在行使價從240.0美元到365.0美元範圍內Visa所有鯨魚活動的看漲和看跌期權交易量和未平倉合約的變化。

Visa Option Activity Analysis: Last 30 Days

簽證期權活動分析:過去 30 天

Significant Options Trades Detected:

檢測到的重要期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| V | PUT | TRADE | BEARISH | 09/20/24 | $8.9 | $8.85 | $8.9 | $280.00 | $107.6K | 1.0K | 3 |

| V | PUT | SWEEP | BEARISH | 01/16/26 | $24.15 | $23.95 | $24.15 | $285.00 | $96.6K | 23 | 40 |

| V | PUT | SWEEP | BULLISH | 09/20/24 | $18.45 | $17.85 | $17.85 | $295.00 | $71.4K | 107 | 40 |

| V | PUT | SWEEP | BEARISH | 01/16/26 | $86.8 | $84.85 | $86.24 | $365.00 | $68.9K | 7 | 8 |

| V | CALL | TRADE | BEARISH | 01/16/26 | $67.5 | $65.15 | $65.9 | $240.00 | $52.7K | 141 | 12 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| V | 放 | 貿易 | 粗魯的 | 09/20/24 | 8.9 美元 | 8.85 美元 | 8.9 美元 | 280.00 美元 | 107.6 萬美元 | 1.0K | 3 |

| V | 放 | 掃 | 粗魯的 | 01/16/26 | 24.15 美元 | 23.95 美元 | 24.15 美元 | 285.00 美元 | 96.6 萬美元 | 23 | 40 |

| V | 放 | 掃 | 看漲 | 09/20/24 | 18.45 美元 | 17.85 美元 | 17.85 美元 | 295.00 美元 | 71.4 萬美元 | 107 | 40 |

| V | 放 | 掃 | 粗魯的 | 01/16/26 | 86.8 美元 | 84.85 美元 | 86.24 美元 | 365.00 美元 | 68.9 萬美元 | 7 | 8 |

| V | 打電話 | 貿易 | 粗魯的 | 01/16/26 | 67.5 美元 | 65.15 美元 | 65.9 美元 | 240.00 美元 | 52.7 萬美元 | 141 | 12 |

About Visa

關於簽證

Visa is the largest payment processor in the world. In fiscal 2022, it processed over $14 trillion in total volume. Visa operates in over 200 countries and processes transactions in over 160 currencies. Its systems are capable of processing over 65,000 transactions per second.

Visa是世界上最大的支付處理商。在2022財年,它處理的總交易量超過14萬億美元。Visa在全球200多個國家開展業務,處理超過160種貨幣的交易。它的系統每秒能夠處理超過65,000筆交易。

Visa's Current Market Status

Visa的當前市場狀況

- Currently trading with a volume of 2,448,928, the V's price is down by -0.39%, now at $279.0.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 64 days.

- 該V目前的交易量爲2448,928美元,價格下跌了-0.39%,目前爲279.0美元。

- RSI讀數表明,該股目前可能接近超買。

- 預計業績將在64天后發佈。

Expert Opinions on Visa

關於簽證的專家意見

5 market experts have recently issued ratings for this stock, with a consensus target price of $299.8.

5位市場專家最近發佈了該股的評級,共識目標價爲299.8美元。

- Maintaining their stance, an analyst from Wedbush continues to hold a Outperform rating for Visa, targeting a price of $300.

- An analyst from Macquarie persists with their Outperform rating on Visa, maintaining a target price of $300.

- Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Visa with a target price of $299.

- Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Visa with a target price of $325.

- An analyst from Mizuho persists with their Neutral rating on Visa, maintaining a target price of $275.

- Wedbush的一位分析師堅持其立場,繼續對Visa維持跑贏大盤的評級,目標股價爲300美元。

- 麥格理的一位分析師堅持對Visa的跑贏大盤評級,將目標價維持在300美元。

- 奧本海默的一位分析師在評估中保持了對Visa跑贏大盤的評級,目標價爲299美元。

- 瑞銀的一位分析師在評估中保持了對Visa的買入評級,目標價爲325美元。

- 瑞穗的一位分析師堅持對Visa的中性評級,維持275美元的目標價。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。