Financial giants have made a conspicuous bearish move on American Airlines Gr. Our analysis of options history for American Airlines Gr (NASDAQ:AAL) revealed 9 unusual trades.

Delving into the details, we found 22% of traders were bullish, while 77% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $661,274, and 4 were calls, valued at $128,031.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $14.5 and $25.0 for American Airlines Gr, spanning the last three months.

Insights into Volume & Open Interest

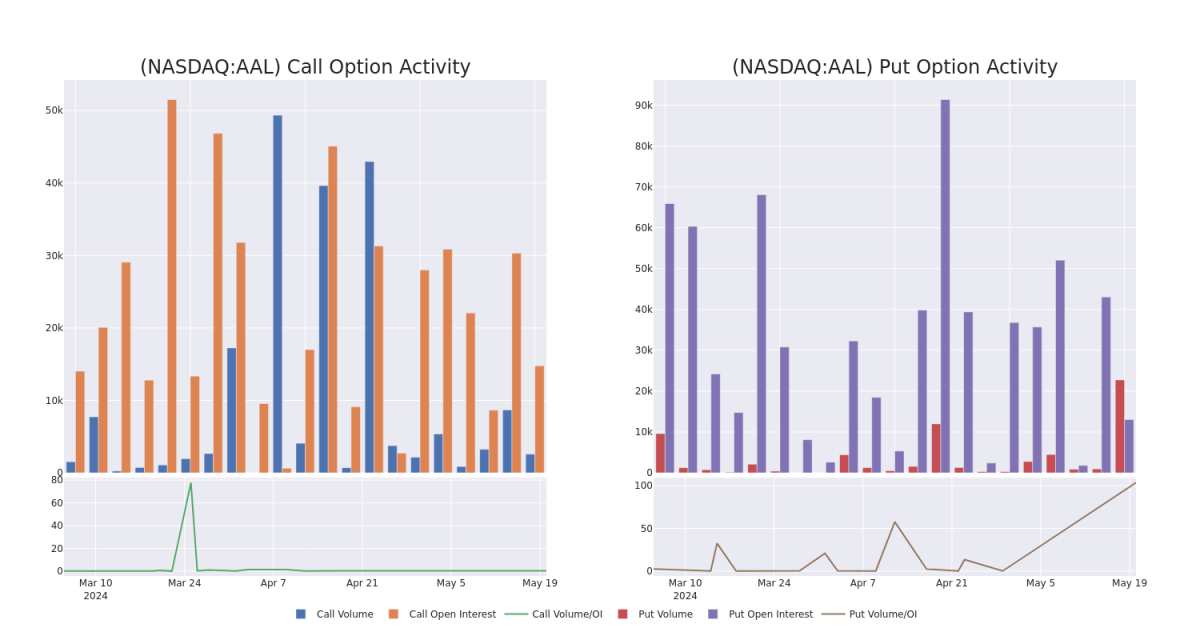

In terms of liquidity and interest, the mean open interest for American Airlines Gr options trades today is 3475.38 with a total volume of 25,321.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for American Airlines Gr's big money trades within a strike price range of $14.5 to $25.0 over the last 30 days.

American Airlines Gr Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AAL | PUT | TRADE | BEARISH | 01/16/26 | $10.3 | $10.15 | $10.3 | $25.00 | $305.9K | 3 | 297 |

| AAL | PUT | TRADE | BEARISH | 06/07/24 | $0.82 | $0.79 | $0.81 | $15.00 | $202.5K | 5.2K | 2.5K |

| AAL | PUT | SWEEP | BEARISH | 05/24/24 | $0.54 | $0.5 | $0.53 | $15.00 | $73.8K | 6.0K | 7.3K |

| AAL | PUT | SWEEP | BEARISH | 05/24/24 | $0.53 | $0.51 | $0.53 | $15.00 | $53.1K | 6.0K | 11.0K |

| AAL | CALL | SWEEP | BULLISH | 12/18/26 | $3.95 | $3.8 | $3.95 | $15.00 | $39.5K | 587 | 116 |

About American Airlines Gr

American Airlines is the world's largest airline by aircraft, capacity, and scheduled revenue passenger miles. Its major US hubs are Charlotte, Chicago, Dallas/Fort Worth, Los Angeles, Miami, New York, Philadelphia, Phoenix, and Washington, D.C. It generates over 30% of US airline revenue connecting Latin America with destinations in the United States. After completing a major fleet renewal, the company has the youngest fleet of US legacy carriers.

Current Position of American Airlines Gr

- Currently trading with a volume of 15,042,432, the AAL's price is down by -2.04%, now at $14.43.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 59 days.

What Analysts Are Saying About American Airlines Gr

In the last month, 2 experts released ratings on this stock with an average target price of $19.95.

- Maintaining their stance, an analyst from Bernstein continues to hold a Outperform rating for American Airlines Gr, targeting a price of $22.

- An analyst from HSBC downgraded its action to Buy with a price target of $17.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest American Airlines Gr options trades with real-time alerts from Benzinga Pro.