Smart Money Is Betting Big In UNH Options

Smart Money Is Betting Big In UNH Options

Investors with a lot of money to spend have taken a bearish stance on UnitedHealth Group (NYSE:UNH).

有大量資金可以花的投資者對UnitedHealth Group(紐約證券交易所代碼:UNH)採取了看跌立場。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

今天,當我們在本辛加追蹤的公開期權歷史記錄中出現頭寸時,我們注意到了這一點。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with UNH, it often means somebody knows something is about to happen.

這些是機構還是僅僅是富人,我們都不知道。但是,當UNH發生這麼大的事情時,這通常意味着有人知道某件事即將發生。

Today, Benzinga's options scanner spotted 8 options trades for UnitedHealth Group.

今天,本辛加的期權掃描儀發現了UnitedHealth Group的8筆期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 37% bullish and 50%, bearish.

這些大資金交易者的整體情緒分爲37%的看漲和50%的看跌。

Out of all of the options we uncovered, there was 1 put, for a total amount of $28,250, and 7, calls, for a total amount of $499,210.

在我們發現的所有期權中,有1個看跌期權,總額爲28,250美元,還有7個看漲期權,總額爲499,210美元。

Projected Price Targets

預計價格目標

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $455.0 to $560.0 for UnitedHealth Group over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將UnitedHealth Group的價格定在455.0美元至560.0美元之間。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

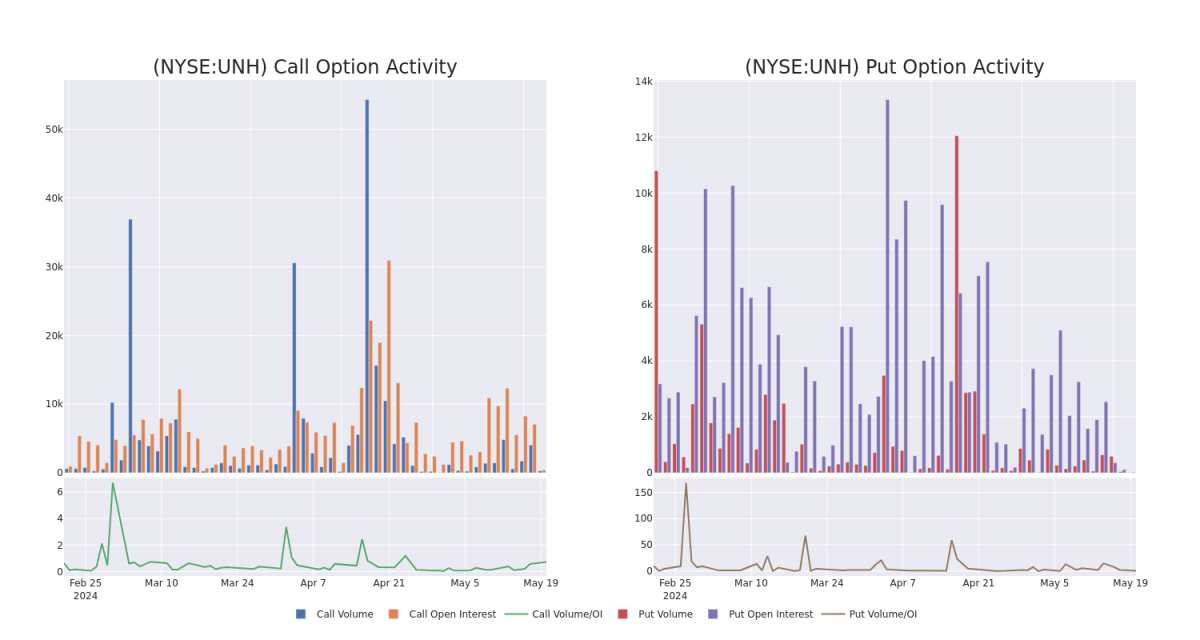

In terms of liquidity and interest, the mean open interest for UnitedHealth Group options trades today is 73.0 with a total volume of 309.00.

就流動性和利息而言,今天UnitedHealth Group期權交易的平均未平倉合約爲73.0,總交易量爲309.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for UnitedHealth Group's big money trades within a strike price range of $455.0 to $560.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天UnitedHealth Group在455.0美元至560.0美元行使價區間內的大額資金交易的看漲和看跌期權交易量和未平倉合約的變化。

UnitedHealth Group 30-Day Option Volume & Interest Snapshot

UnitedHealth 集團 30 天期權交易量和利息快照

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UNH | CALL | SWEEP | BEARISH | 05/24/24 | $69.2 | $67.4 | $68.08 | $455.00 | $142.8K | 272 | 7 |

| UNH | CALL | TRADE | BULLISH | 03/21/25 | $31.0 | $28.35 | $30.5 | $560.00 | $122.0K | 59 | 41 |

| UNH | CALL | SWEEP | NEUTRAL | 05/24/24 | $68.35 | $67.55 | $67.95 | $455.00 | $108.5K | 272 | 124 |

| UNH | CALL | TRADE | BULLISH | 06/14/24 | $11.65 | $9.85 | $11.4 | $520.00 | $37.6K | 62 | 35 |

| UNH | CALL | TRADE | BULLISH | 06/14/24 | $8.8 | $8.6 | $8.8 | $525.00 | $30.8K | 22 | 36 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UNH | 打電話 | 掃 | 粗魯的 | 05/24/24 | 69.2 美元 | 67.4 美元 | 68.08 美元 | 455.00 美元 | 142.8 萬美元 | 272 | 7 |

| UNH | 打電話 | 貿易 | 看漲 | 03/21/25 | 31.0 美元 | 28.35 美元 | 30.5 美元 | 560.00 美元 | 122.0 萬美元 | 59 | 41 |

| UNH | 打電話 | 掃 | 中立 | 05/24/24 | 68.35 美元 | 67.55 美元 | 67.95 美元 | 455.00 美元 | 108.5 萬美元 | 272 | 124 |

| UNH | 打電話 | 貿易 | 看漲 | 06/14/24 | 11.65 美元 | 9.85 美元 | 11.4 美元 | 520.00 美元 | 37.6 萬美元 | 62 | 35 |

| UNH | 打電話 | 貿易 | 看漲 | 06/14/24 | 8.8 美元 | 8.6 美元 | 8.8 美元 | 525.00 美元 | 30.8 萬美元 | 22 | 36 |

About UnitedHealth Group

關於聯合健康集團

UnitedHealth Group is one of the largest private health insurers, providing medical benefits to about 53 million members globally, including 5 million outside the U.S. as of mid-2023. As a leader in employer-sponsored, self-directed, and government-backed insurance plans, UnitedHealth has obtained massive scale in managed care. Along with its insurance assets, UnitedHealth's continued investments in its Optum franchises have created a healthcare services colossus that spans everything from medical and pharmaceutical benefits to providing outpatient care and analytics to both affiliated and third-party customers.

UnitedHealth Group是最大的私人健康保險公司之一,截至2023年年中,爲全球約5300萬會員提供醫療福利,其中包括美國以外的500萬會員。作爲僱主贊助、自管和政府支持的保險計劃的領導者,UnitedHealth在管理式醫療領域取得了巨大的規模。除了其保險資產外,UnitedHealth對其Optum特許經營權的持續投資還創造了一個醫療保健服務巨頭,涵蓋了從醫療和藥品福利到爲關聯和第三方客戶提供門診護理和分析的所有領域。

In light of the recent options history for UnitedHealth Group, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於UnitedHealth Group最近的期權歷史,現在應該將重點放在公司本身上。我們的目標是探索其目前的表現。

Present Market Standing of UnitedHealth Group

聯合健康集團目前的市場地位

- With a trading volume of 588,710, the price of UNH is down by -0.7%, reaching $520.94.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 53 days from now.

- UNH的交易量爲588,710美元,價格下跌了-0.7%,至520.94美元。

- 當前的RSI值表明該股可能已被超買。

- 下一份收益報告定於53天后發佈。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for UnitedHealth Group with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解UnitedHealth Group的最新期權交易,以獲取實時警報。