May 20, 2024

SBI Global Asset Management Co., Ltd.

We would like to inform you about the initial distributions for the 3 funds established and managed by our subsidiary SBI Asset Management Co., Ltd. (US High Dividend/Dividend Increase Equity Fund (settlement type 4 times a year).

The 3 funds, which reached their settlement date today 5/20, are four-yearly settlement type funds that invest in high-dividend stocks and dividend increase stocks in the United States, and the distributions (per 10,000 units, before tax) for each fund are as shown in the table below.

| Fund name | SBI SPDR S&P 500 High dividend stocks Index funds (Settlement type 4 times a year) | SBI V US High Dividend Stocks Index funds (Settlement type 4 times a year) | SBI V US dividend increase Index funds (Settlement type 4 times a year) |

| Closing date | May 20, 2024 | May 20, 2024 | May 20, 2024 |

| Distributions*1 (Distribution ratio) | 120 yen (4.73%) | 80 yen (3.13%) | 45 yen (1.86%) |

| base price (Distribution is falling behind) | 11,150 yen | 11,272 yen | 10,681 yen |

The current distributions are basically paid from within the scope of income received from each fund, but please note that some or all of them may be special distributions*2 depending on the status of each beneficiary's base price at the time of purchase.

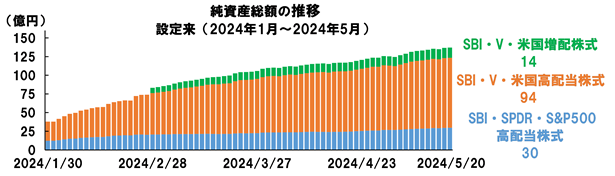

Each fund aims to pursue total return by obtaining high levels of income gains and medium- to long-term price increases in order to meet investors' needs in pursuit of “growth” and “distribution,” and are handled exclusively by SBI Securities Co., Ltd. The total net assets of each fund have shown steady growth since they were established, and we believe that we have received support from investors.

The investment results of this fund will continue to be returned to investors through dividend payments*3 in financial results four times a year, centering on dividend income.

over

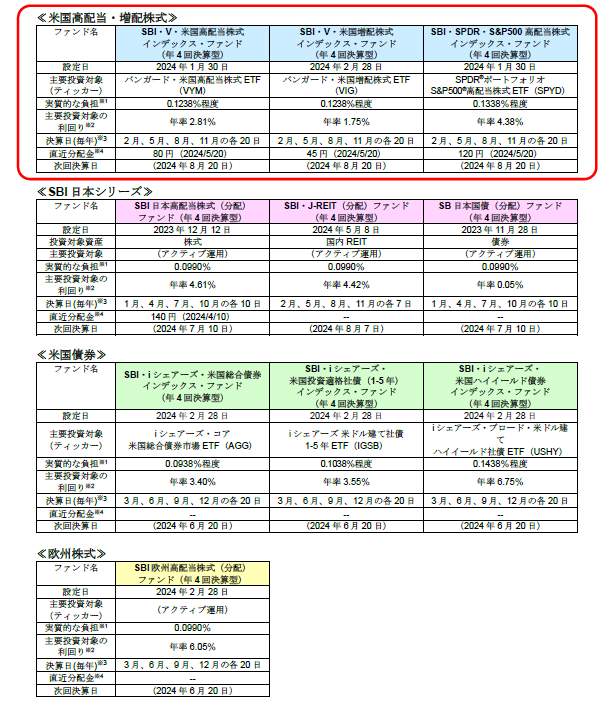

<Lineup of 4 annual settlement type funds set up and managed by SBI Asset Management>