The gold market had a large amount of important economic data and in-depth comments from the Federal Reserve that needed to be digested. The results led to the formation of one of the most dramatic trends in the precious metals market this year. Gold prices rose more than 2% last week. Analysts and traders want to know how high the price of gold can rise in the current environment.

Spot gold opened at $2361.17 per ounce last week. It stayed where it was last Monday, while eagerly awaiting the key inflation data to be released. The US PPI report released last Tuesday was mixed, but two hours later, Federal Reserve Chairman Jerome Powell told the Foreign Bankers Association that he was confident that the Federal Reserve would not need to raise interest rates again, which comforted the market. Gold prices turned positive last Wednesday morning. Traders began to push gold higher when the April Consumer Price Index (CPI) report showed a month-on-month improvement. The triple peak of the $2,400 per ounce level on Wednesday night stagnated in the short term, and spot gold declined steadily during Thursday's trading session. However, by the time the North American market opened last Friday, the bulls came back strong and never looked back.

On Friday (May 17), spot gold closed up 1.58% to close at $2414.50 per ounce. COMEX gold futures closed up 1.44% to close at $2419.8 per ounce. COMEX silver futures closed up 6.36% to close at $31.775 per ounce. On Monday (May 17), spot gold fluctuated at a high level in the Asian market and is now reported at around 2,418 US dollars/ounce.

Marc Chandler, managing director of Bannockburn Global Forex, believes there is evidence that the price of gold was a bit too high after the breakthrough. “The price of gold returned above $2,400 per ounce before the weekend and hit a record high closing price (spot market),” he said. “Momentum indicators give gold an opportunity to challenge the intraday high of around $2431.50 per ounce since April 12. Note that the Bollinger channel is two standard deviations above the 20-day moving average. Gold is trading above this level. Furthermore, I doubt that the US interest rate adjustments (as two-year Treasury yields bottomed out close to 4.70%) and the weakening dollar (the euro rose for five consecutive weeks) are over or near.”

Last week's market review

Last Monday (May 13)Before the dollar rebounded and the US Producer Price Index (PPI) and Consumer Price Index (CPI) were announced, the price of gold was still weak, prompting the price of gold to retest the $2,330 per ounce area. The spot gold price closed at 2336.01 US dollars/ounce, a decrease of 1%. COMEX gold futures closed down 1.04% to close at $2369.1 per ounce.

The price of gold fell sharply from around $2,360 per ounce last Monday, which in turn weakened the market's interest in the dollar. Traders prepare for a busy US (US) economic conference, which includes inflation data, retail sales data, and Federal Reserve Chairman Jerome Powell's May 14 speech.

Gold prices rebounded last Tuesday (May 14), driven by falling US dollar and US bond yields. Earlier data showed that US producer prices rose more than expected in April, indicating that inflation remains high.

Spot gold closed up 0.92% to close at 2358.12 US dollars/ounce. It rose to a daily high of 2359.74 US dollars/ounce in the intraday period, showing a volatile upward trend throughout the day.

Marex analyst Edward Meir said, “The dollar fell, and I think this gave some boost to the gold market.”

“Federal Reserve Chairman Jerome Powell (Jerome Powell) did not signal an interest rate hike, which is also a positive factor, which may give the price of gold an additional boost,” Meir added.

Federal Reserve Chairman Powell said on Tuesday that his confidence that inflation will continue to cool down is not as high as at the beginning of the year, and the Fed needs to be patient before cutting interest rates.

Powell said at a panel meeting in Amsterdam: “We didn't expect this to be a smooth path, but these [inflation figures] are higher than I think anyone expected.” “It tells us we need to be patient and let restrictive policies work.”

Powell said he expects the inflation rate to fall to a level close to the low level at the end of last year on a monthly basis. “[But] I'd like to say that I'm not as confident about this as the readings I saw in the first three months of this year.”

A few hours before Powell made this statement, the latest April wholesale price data was hotter than expected.

According to the newly released Producer Price Index (which measures the price of goods produced by producers), wholesale prices rose 0.5% month-on-month in April, higher than the 0.3% generally expected by the market. Excluding the volatile food and energy categories, the “core” PPI also rose 0.5% in April, higher than the expected 0.2% increase.

Notably, however, the monthly price increase in March was reduced to 0.1% from the initial 0.2% increase.

Last Wednesday (May 15)The data showed that the increase in US consumer prices in April was lower than expected, increasing the possibility that the Federal Reserve would cut interest rates. The dollar weakened, US Treasury yields declined, and gold prices climbed to a high level of nearly a month. Spot gold closed up 1.16% to close at $2385.28 per ounce. COMEX gold futures closed up 1.35% to close at $2391.8 per ounce; COMEX silver futures closed up 4.24% to close at $29.92 per ounce.

The US CPI rose 0.3% last month after rising 0.4% in March and February, indicating that inflation resumed its downward trend in the early second quarter, boosting financial market expectations that the Federal Reserve will cut interest rates in September. Economists surveyed by Reuters had predicted a 0.4% increase in CPI, up 3.4% year over year.

This indicator, which measures America's basic inflation, cooled down for the first time in six months in April. For US Federal Reserve officials seeking to cut interest rates starting this year, this is certainly a small step in the right direction. Previously, the indicator had exceeded expectations three times in a row, raising concerns that inflation had become entrenched. Data from the US Bureau of Labor Statistics also showed that the year-on-year increase fell to its lowest level in three years. The Federal Reserve is trying to break up price pressure by weakening demand across the economy. Another report released on Wednesday showed that retail sales stagnated in April, as high borrowing costs and rising residents' debt prompted consumers to be more cautious.

Phillip Streible, chief market strategist at Blue Line Futures, said the consumer price index data “may be an early sign that inflation will cool down over time and the Federal Reserve will cut interest rates for the first time.”

Last Thursday (May 16)Although signs of cooling US inflation have strengthened hopes that the Federal Reserve will cut interest rates this year, leading to a rebound in the US dollar. The two-year US bond yield has risen by more than 7 basis points, rebounding from a low point since the beginning of April, and the 10-year real yield once fell below 2%. The price of gold declined slightly, but remained near a one-month high. Spot gold closed down 0.36% to close at $2376.76 per ounce, hitting its highest level since early April 19. COMEX gold futures closed down 0.59% to close at $2380.8 per ounce. COMEX silver futures closed up 0.27% to close at $29.81 per ounce.

Jim Wyckoff, senior analyst at Kitco Metals, said: “After the recent rise in the gold market, short-term futures traders faced some routine pressure to take back profits, and the strengthening of the US dollar index today has also intensified this pressure.”

The data showed that consumer prices in the US rose less than expected in April. The index rose 0.2% versus competitors after hitting a multi-month low on the previous trading day.

Meanwhile, New York Federal Reserve President John Williams said that the positive news of cooling inflation is not enough to require the Federal Reserve to cut interest rates as soon as possible. Lower interest rates lower the opportunity cost of holding unprofitable gold. Federal Reserve Bostic said that there is still a lot of pricing pressure in the economy. Businesses are unable to fully transfer prices (increases), and the economy is slowing down. It might be appropriate to cut interest rates before the end of the year, but we don't have any firm plans.

According to CME's Fed Watch tool, market participants expect the possibility that the Fed will cut interest rates in September to be about 68%.

This week's outlook

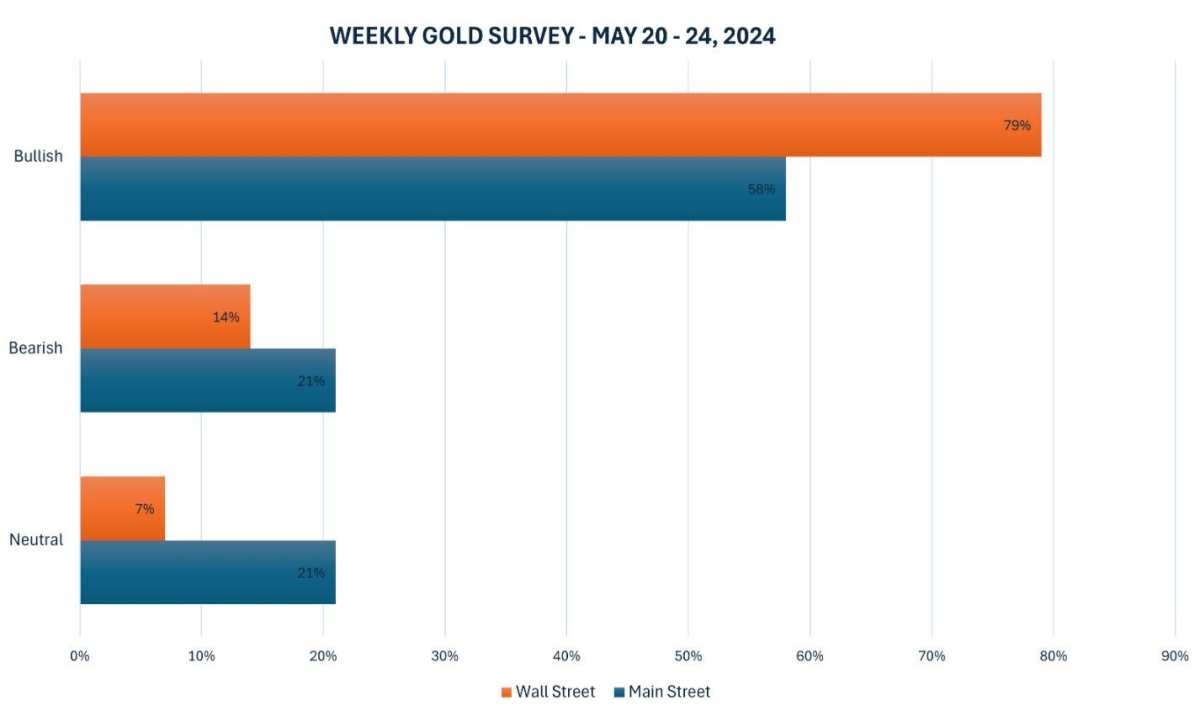

Fourteen Wall Street analysts participated in the Kitco News gold survey last week, and after Friday's breakthrough, the bullish sentiment was as strong as this year. Eleven experts (79%) expect the price of gold to continue to rise in the coming week, while only 2 analysts (14%) expect the price of gold to fall. A lone expert, accounting for 7% of the total, believes that gold prices will trend sideways in the coming week.

Meanwhile, 144 votes were cast in Kitco's online poll, and mainstream investors were positive, but to varying degrees. Eighty-three retail traders, or 58%, expect gold prices to rise in the coming week. Another 30 respondents (21%) expect gold prices to fall, while 31 respondents (21%) expect precious metals to remain range-bound in the coming week.

After last week's inflation data drama, the market will take a short break this week. On Wednesday, the US existing home sales data for April and the minutes of the FOMC April/May monetary policy meeting will be released. On Thursday, the market will receive S&P Manufacturing and Services Purchasing Managers' Index (PMI) preview data, the number of jobless claims at the beginning of the week, and new home sales data for April. The April Durable Goods Report will be released on Friday.

Marc Chandler, managing director of Bannockburn Globa LForex, believes there is evidence that the price of gold was a bit too high after breaking through this week.

“The price of gold returned to the level of 2,400 US dollars/ounce before the weekend, and is expected to reach a record high closing price (spot market),” he said. “The momentum indicator gives gold an opportunity to challenge the intraday high of around $2431.50 per ounce since April 12. Note that the Bollinger channel is two standard deviations above the 20-day moving average. Gold is trading above this level. Furthermore, I doubt that the US interest rate adjustments (as two-year Treasury yields bottomed out close to 4.70%) and the weakening dollar (the euro rose for five consecutive weeks) are over or near.”

Darin Newsom, senior market analyst at Barchart, believes that gold may take back some of its recent gains.

“This is a purely technical interpretation, as June seems to be close to the potential top of its 5 short-term uptrends,” he said. “The daily stochastic indicator indicates that the contract is seriously overbought. As of early Friday morning, I had a reversal pattern which told me the trend was about to change, but there's still a long time left today. We'll see what happens when the market closes on Friday or early Monday morning.”

Sean Lusk, co-head of commercial hedging at Walsh Trading, witnessed a boom in the entire commodities market on Friday, with precious metals leading the way.

“Our price is $2,410 per ounce, and we're back at a high level,” he said. “Silver is on fire here, and copper is also burning as an industrial metal platinum. It's been a hell of a trip.”

“You could say crude oil is underperforming and is still a little over 10 percent higher than this year. That's not crazy,” he added, “but if this continues, everything else will follow. We'll probably spend a really hot summer here.”

Lusk told Kitco News that high inflation, large-scale debt issuance, and uncontrolled central bank printing are driving market participants to precious metals and other commodities.

“We just printed too much money, and now you're seeing the results,” he said. “Where are they spending all that money? In addition to buying stocks on dips, large sums of money also went into metals to hedge against inflation. Not only us, but even economies around the world are doing the same thing. They're increasing their holdings, but no one knows where to go.”

Lusk said he couldn't imagine a better situation than the current one to push the price of gold higher.

“It's a perfect bullish storm,” he said. “You have geopolitical concerns. You've experienced a pandemic. What will our government do after that? Print more content for all of these funding projects that haven't really started yet. We're in the campaign year now, so all of this gold-related stuff will only create more uncertainty in the back end, which is why you're continuing to run here.”

“This goes back to the old adage that every time we create more, it becomes less valuable.”

Michael Moor, founder of Moor Analytics, said, “The price of gold is rising and may reach $2448.8 per ounce in the next few days.” “We held the low of $2285.2 per ounce at the lowest price of $2288.5 per ounce, then rebounded to $138.5 per ounce. Breaking through $2302 per ounce (up $1.6 per hour) brought strength of $121.7 per ounce. We ended up running out of money at $2385.3 per ounce.”

Kitco senior analyst Jiwyckoff expects the price of gold to rise further in the coming week “because the chart is firmly bullish.”

At 06:35 Beijing time, spot gold is now reported at 2418.30 US dollars/ounce.