Zero Run's next goal is to achieve self-hematopoiesis in a stable manner

On the evening of May 17, Zero Sports Auto was the first to announce financial results for the first quarter of this year. As a leader among the new domestic second-tier car builders, Zero Sports maintained sales growth in the first quarter, and net losses subsided under the fierce price war.

However, the negative impact still exists, leading the gross margin level back to negative in the first quarter.

Specifically, Zero Run Q1 achieved revenue of 3.486 billion yuan, up 141.7% year on year and 33.9% month on month; gross margin level fell back to negative level of -1.4%, up 6.4 percentage points year on year, down 8.1 percentage points from month to month; net loss converged to 1.01 billion yuan, down 10.6% year on year and 6% month on month.

1. Overseas markets will provide increments this year to help Zero Sports achieve annual sales targets

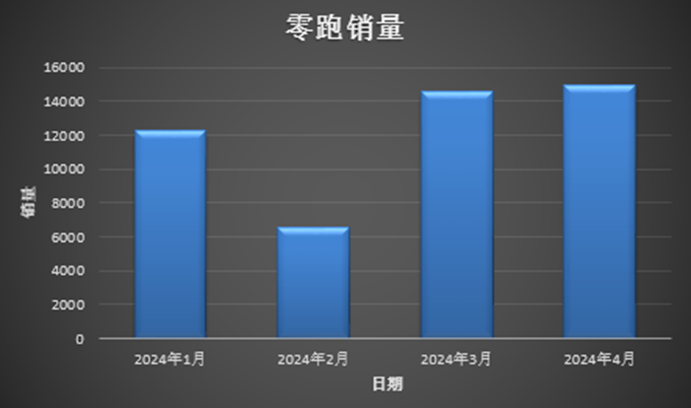

In the first quarter of this year, the total sales volume of Zero Sports cars reached 33,400 units, an increase of 217.9% over the previous year. This sales volume not only topped the ranks of the new second-tier car builders (24,000 Nacha units, 33,000 Krypton units), but also surpassed Xiaopeng's 22,000 units and NIO's 30,000 units.

Zero Sports Auto's annual sales target is 250,000 to 300,000 units, an increase of 73.6%-108% over the previous year.

This target is not low; in order for Zero Run to achieve its goal, it will require a month-on-month growth rate of more than 40% over the next three quarters.

Overseas markets are expected to provide some incremental contributions. In mid-May, Zero Sports Auto and Stellantis Group announced the formal establishment of a Leapmotor International B.V. (Zero Sports International) joint venture, where Zero Sports Auto will provide product technology, and Stellantis Group will provide global market resources and influence.

Specifically, as the fourth largest automobile group in the world, Stellantis has more than 10,000 dealers around the world, and Zero Sports is expected to directly use these ready-made overseas dealer channels to take the lead in bringing the TO3 and C10, the first two products under Zero Sports to overseas for sale.

At present, the overseas market of Zero Sports Auto has begun to enter the initial product introduction stage. Zero Sports Auto expects to fully complete overseas product certification and officially start sales in Europe in the third quarter of this year. It plans to expand the European sales network to 200 companies by the end of the year, and simultaneously enter the NEV markets in India, Asia Pacific, the Middle East, Africa, and South America.

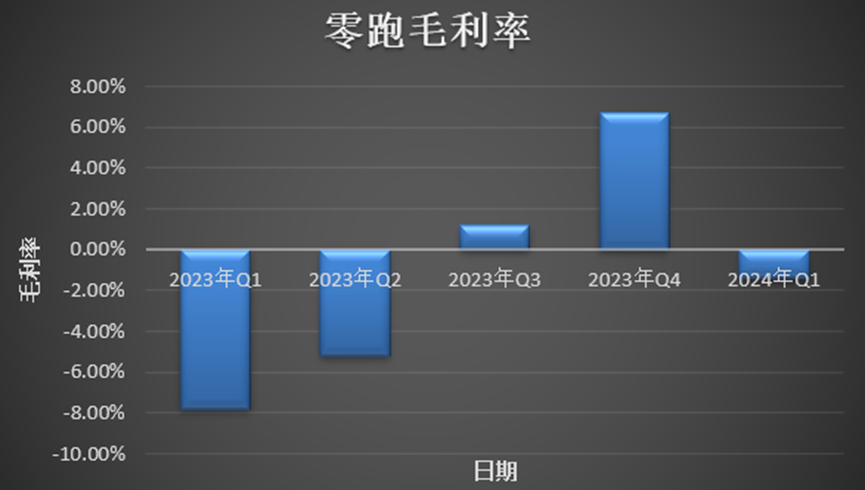

2. The gross margin changed from positive to negative again

Zero Sports Auto achieved a correction in gross margin for the first time in the third quarter of last year, and maintained it until the fourth quarter. However, in the first quarter of this year, Zero Sports Auto's gross margin returned to negative, falling 8.1 percentage points to -1.4% from the previous quarter.

Against the backdrop of a fierce price war, Zero Sports Auto's gross margin fell by more than 8 percentage points month-on-month, exceeding market expectations. Wall Street Insights and Insight Research suggests the main reasons are as follows:

First, the main sales volume of Zero Sports cars is shifting from less than 100,000 to the 200,000 yuan price range, but in the first quarter of this year, Zero Sports offered a significant price reduction promotion, which curbed the increase in bicycle revenue.

In the first quarter of this year, Zero Run implemented a cash discount of 15,000 to 32,000 yuan for all models, and the price of the new 2024 models was reduced by 10,000 to 50,000 yuan compared to the old models.

Despite this, through a shift in sales power, Zero Sports cars switched from T-series models with a unit price range of 50,000 to 200,000 yuan to C-series models with a unit price range of 50,000 to 200,000 yuan.

Specifically, the delivery volume of the Zero Run T03 in the first quarter of this year was 9,433 units, and its sales volume fell by nearly 10 percentage points compared to the previous quarter to 28%. At the same time, delivery volumes of C-series models such as the C11, C01, and C10 were 12,122, 3,998, and 7857 units, respectively, up 129% and 209% year-on-year, respectively. The C-series models already accounted for more than 70% of sales.

This strategy effectively offset some of the decline in revenue due to price cuts. Compared with the fourth quarter of last year, bicycle revenue actually increased, rising 80,000 yuan to 10,000 yuan by 104,000 yuan.

Second, in the first quarter of this year, there was a month-on-month decline in sales of Zero Sports cars, causing amortization and bicycle manufacturing costs to rise accordingly.

At the same time, the prices of some raw materials for lithium batteries, such as battery-grade lithium carbonate, also picked up in the first quarter, rising from around 90,000 yuan/ton to over 110,000 yuan/ton. This has also led to an increase in bicycle costs for Zero Sports cars, which is much higher than the increase in bicycle revenue. In the first quarter of this year, the bike cost for Zero Sports cars was 105,800 yuan, a year-on-year decrease of 43,200 yuan, but a month-on-month increase of 16,800 yuan.

Fortunately, the subsequent shift of Zero Sport's focus from pure electric models to extended-range models will also have a positive effect on gross margin.

Compared with the pure electric version, the battery capacity of the C11 extended range version has been reduced by more than half. Based on the current average price of ternary lithium battery cells (power type), the fuel engine is around 5,000 yuan. This will reduce the cost of Zero Sports cars by nearly 20,000 yuan, but the price of the C11 extended range version is only 30,000 yuan cheaper than the pure electric version.

3. Increased investment in R&D, short-term ammunition is not a problem

After 8 years of global self-research, in addition to core components such as three-electric systems (battery, motor, electronic control), Zero Sports Auto has also significantly increased its investment in intelligent driving technology in recent years in order to quickly catch up with the leading level of the industry.

In the first quarter of 2024, Zero Sports introduced its first OTA (Over-the-Air) upgrade, introducing new features including high-speed intelligent piloting, which significantly improved the vehicle's level of intelligence. In addition, an intelligent driving version based on high-precision maps has also been introduced to the market, and the urban NOA (Navigation Assisted Driving) function is expected to be officially launched in the second quarter. At the same time, the development of cloud-based vehicle networking solutions has also been put on the agenda and has become a new focus of the company's research and development.

In the first quarter of 2024, the company's R&D expenditure reached 520 million yuan, an increase of 26.1% over the previous year. Although such investment is difficult to reduce in the short term, it is essential to enhance the competitiveness and market position of Zero Sports in the field of intelligent driving.

However, in terms of sales expenses, Zero Run intended to control them. Sales expenses for the first quarter were 430 million yuan, up only 8.8% year on year and down 19.8% month on month. This is reflected in a month-on-month decrease in the number of stores from 50 to 510.

Cash flow also improved. Compared with the same period last year, it increased by 8.7 billion yuan and decreased by 1.8 billion yuan over the same period last year. By the end of the first quarter, the amount of the company's cash and cash equivalents, restricted cash, and bank term deposits was 17.58 billion yuan.

Leading cars are getting closer to the front line, but currently competition in the new energy market is still fierce, and leading cars need to make profits as soon as possible.