Investors with a lot of money to spend have taken a bullish stance on Cameco (NYSE:CCJ).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CCJ, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 21 options trades for Cameco.

This isn't normal.

The overall sentiment of these big-money traders is split between 66% bullish and 23%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $29,700, and 20, calls, for a total amount of $1,684,061.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $41.0 to $55.0 for Cameco over the last 3 months.

Analyzing Volume & Open Interest

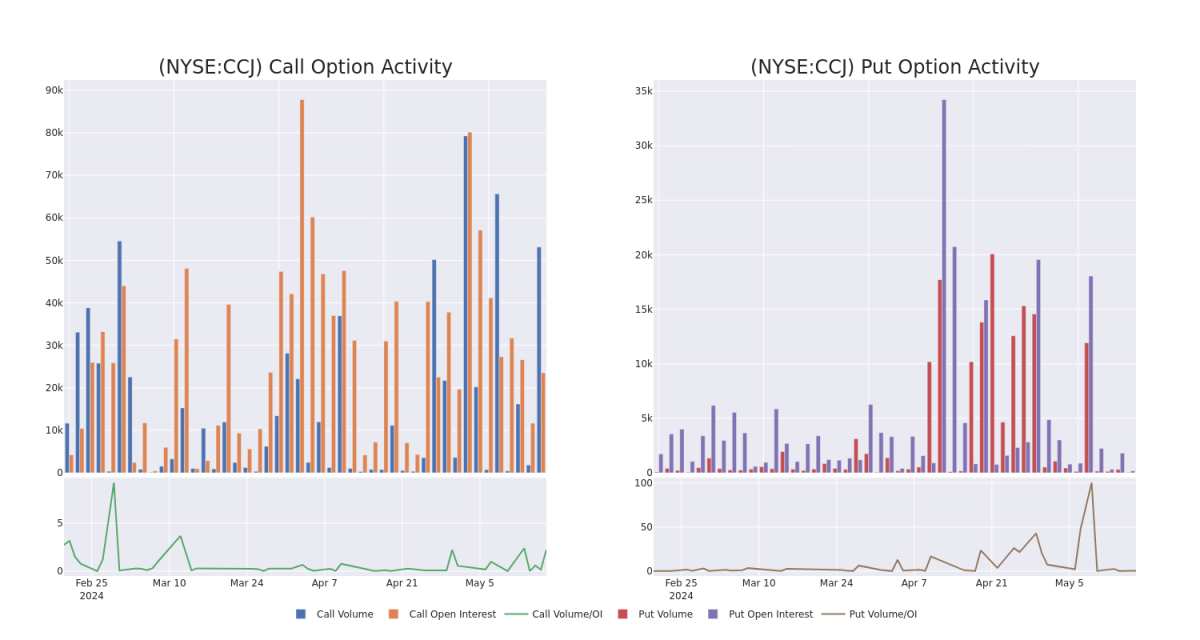

In terms of liquidity and interest, the mean open interest for Cameco options trades today is 2634.22 with a total volume of 53,175.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Cameco's big money trades within a strike price range of $41.0 to $55.0 over the last 30 days.

Cameco Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCJ | CALL | TRADE | BULLISH | 06/14/24 | $1.33 | $1.13 | $1.3 | $53.00 | $520.0K | 21 | 4.0K |

| CCJ | CALL | SWEEP | BULLISH | 06/14/24 | $2.04 | $1.97 | $2.05 | $53.00 | $102.5K | 21 | 4.6K |

| CCJ | CALL | TRADE | BULLISH | 06/21/24 | $1.54 | $1.54 | $1.54 | $55.00 | $77.0K | 16.1K | 4.5K |

| CCJ | CALL | SWEEP | BULLISH | 06/21/24 | $1.54 | $1.44 | $1.5 | $55.00 | $76.3K | 16.1K | 5.6K |

| CCJ | CALL | TRADE | BULLISH | 06/21/24 | $1.55 | $1.44 | $1.51 | $55.00 | $75.5K | 16.1K | 4.0K |

About Cameco

Cameco Corp is a provider of uranium needed to generate clean, reliable baseload electricity around the globe. one of those uranium producers. Cameco has three reportable segments, uranium, fuel services and Westinghouse. It derives maximum revenue from Uranium Segment. It has some projects namely; Millennium, Yeelirrie, Kintyre and Exploration. The company operates in Canada, Kazakhstan, Germany, Australia and United States.

After a thorough review of the options trading surrounding Cameco, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Cameco's Current Market Status

- Currently trading with a volume of 1,868,621, the CCJ's price is up by 5.22%, now at $52.43.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 75 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Cameco with Benzinga Pro for real-time alerts.