China General Internet ETF, Hang Seng Internet ETF, and Hong Kong Stock Connect Internet ETF have risen more than 25% in the past 20 trading days.

Well-known Wall Street fund managers have increased their holdings in Chinese stocks, and US lawmakers are tempted by Chinese assets.

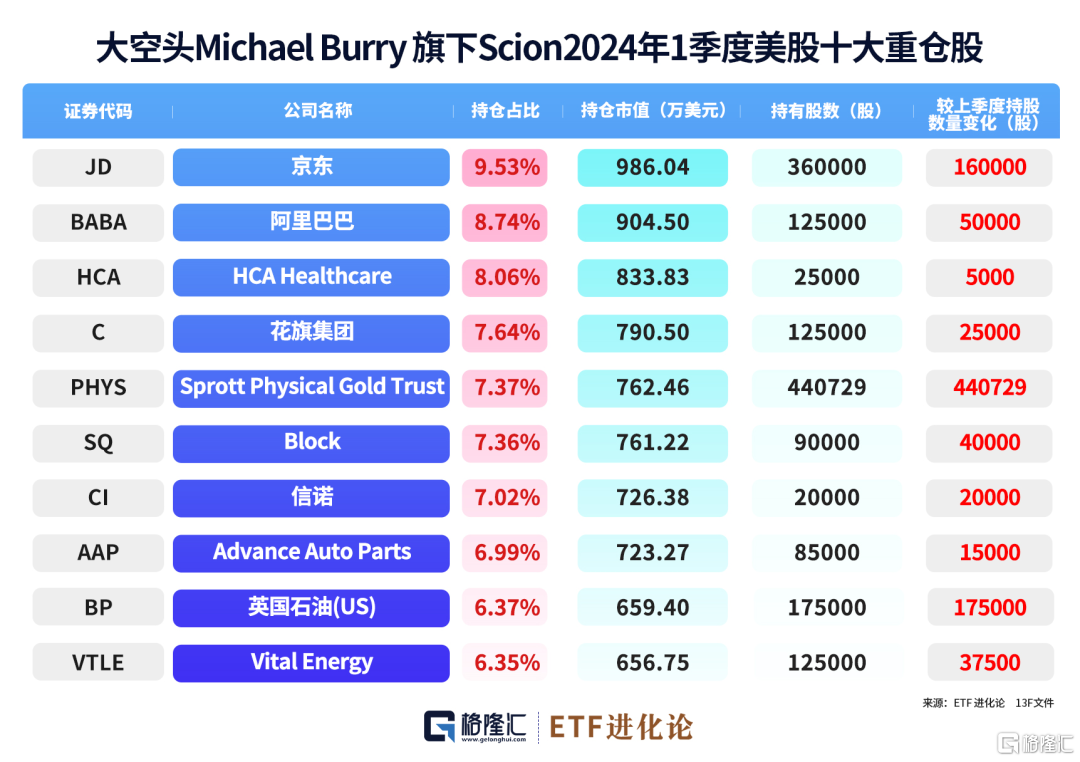

According to SEC documents, Michael Burry, the prototype of the movie “The Big Short,” increased Alibaba's holdings by nearly 67% in the first quarter, and Alibaba currently ranks as its second-largest stock.

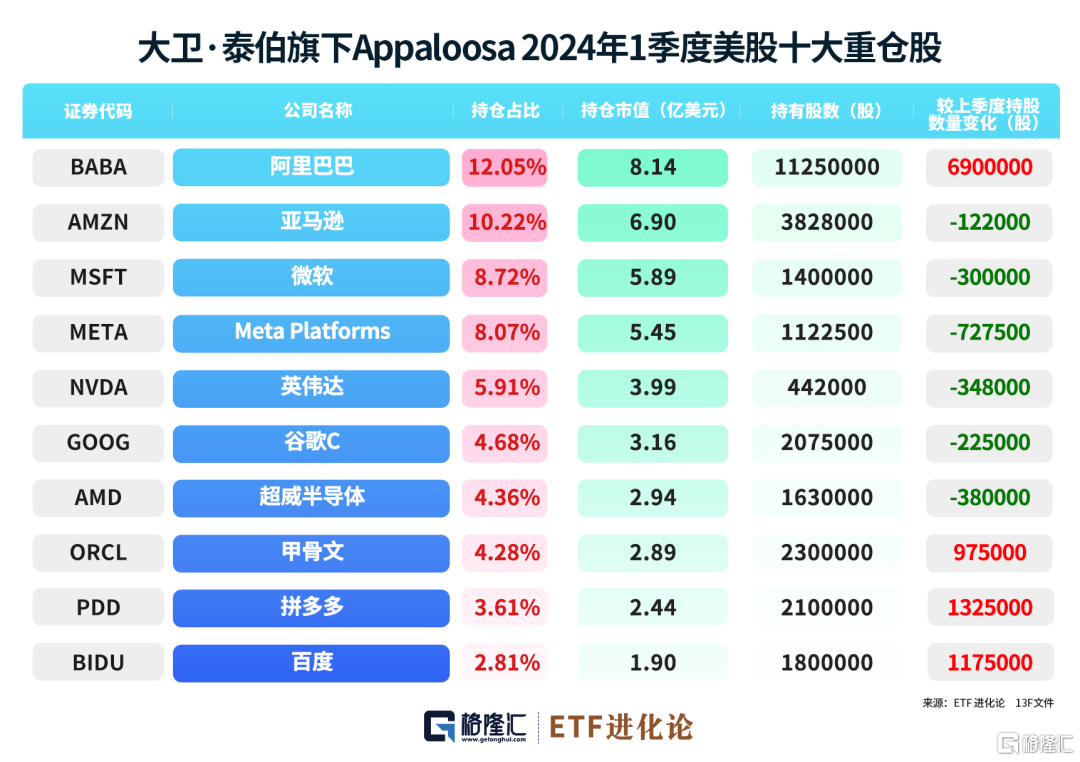

Appaloosa, managed by US billionaire investor and hedge fund legend David Tepper, increased its holdings in Alibaba to 11.25 million shares in the first quarter, with a market value of about US$814 million.

Specifically, Michael Burry, a well-known fund manager on Wall Street, continues to bet on physical gold and Chinese securities.

Michael Burry is a rare financial geek. Before the 2008 financial subprime mortgage crisis, he successfully predicted the US real estate bubble through his own deductive calculations. At a time when almost everyone was extremely optimistic about real estate, he began shorting the US real estate market through CDS credit default swaps in 2005, and eventually made a lot of profit.

From 2000 to 2008, the total return on the hedge funds managed by Michael Burry was 489.34%, and his story was made into the movie “The Big Short” in 2015.

In the first quarter, Burry substantially increased physical gold trusts and increased its holdings in the Chinese capital stock market, JD and Alibaba.

Burry has entered and left China Securities many times. Previously, it bought shares of Ali and JD, but once cleared Ali and JD in the second quarter of last year, then bought it again, and now it is the company in the top position.

Appaloosa Management, a hedge fund managed by billionaire investor David Tepper, continued to increase its holdings of Chinese assets in the first quarter.

Appaloosa, managed by David Tepper, increased positions on Alibaba, Pinduoduo, and Baidu in the first quarter to open positions in JD and two Chinese stock ETFs listed in the US. By the end of the first quarter, Chinese stocks and ETFs accounted for 24% of its stock portfolio; holdings of the top seven US tech companies, including Meta, Amazon, Microsoft, and Nvidia, had been reduced.

In the past, Air Force Citron Citron Research, which was famous for its aerial stock brokerage, publicly sang a lot about Alibaba on social media.

According to Citron, Alibaba's momentum is strong, and the stock price is expected to rise above $100. Citron pointed out that Alibaba is expected to replicate the success of Microsoft and Amazon in China, and that investors have recognized Ali's development prospects in “cloud+AI.” Citron said that Alibaba's model is a leader in China's big model field.

China's assets continued to rise, with China Securities Internet ETF, Hang Seng Internet ETF, and Hong Kong Stock Connect Internet ETF rising more than 25% in the past 20 trading days.

The US lawmakers were all moved.

US Representative Josh Gottheimer bought Tencent on April 30, according to a data website specializing in congressman stock trading research.

Gottheimer is a member of the House Intelligence Committee and Capital Markets Subcommittee. Over the past few years, he has traded Tencent shares many times. Since his current purchase, Tencent has risen by about 15%.

Wang Yajun, co-head of the stock capital market at Goldman Sachs Asia (excluding Japan), said that confidence in Chinese assets has increased in the international market. Looking at the reasons why Chinese assets have been favored recently: first, China's economic recovery, and improving economic data such as PPI and CPI; second, industry regulatory policies are clear and transparent, sending a clear signal to the market; third, benchmark projects have been listed and subsequent market transactions are remarkable, boosting market confidence.