In recent months, Hong Kong stocks have seen a significant recovery. Hang Seng Tech Index ETF and Hang Seng Internet ETF have performed quite strongly.

However, after this round of continuous sharp increases, the valuation of Hong Kong stocks is still very cheap. The price-earnings ratio quantiles of the Hang Seng Index and the Hang Seng Technology Index are all at historically low levels, lower than the Shanghai Composite Index, and far lower than the NASDAQ and Nikkei 225 Index. It can be saidHong Kong stocks are now in a proper value depression. Technology companies, in particular, are extremely attractive to investors because they are light in assets, have impressive performance growth rates, and generally have poor valuations.

During this time, a company with internet and technological attributes — LianLianDigital — was officially listed on the Hong Kong Stock Exchange and became the “first stock for cross-border payments.” As of the close of trading on May 16, the digital price was HK$9.300 per share. The performance since the issuance was not surprising. The current trend is sideways after experiencing rapid bottoming out, which means that it is gaining momentum.

Looking at this situation, what about consecutive digital follow-up opportunities? It just so happened that it released its 2023 annual report not long ago, so maybe we can pay more attention to its value potential.

High growth track brings broad room for growth

To find out whether an investment target has valuable potential, the judgment often follows three elements: a good track, a good company, and a good price.

A good track can guide you on the right investment path. A good company can put you ahead of others on this path, and a good price allows you to get higher returns with less risk at the right time.

Following this logic, to evaluate the value of connected numbers, you first need to understand the future of the industry in which it is located.

China's cross-border payment industry has mainly benefited from the steady growth of the foreign trade market. In the first quarter of this year, the total value of foreign trade imports and exports exceeded 10 trillion yuan for the first time, an increase of 5% over the previous year. Specifically, when it comes to the new form of cross-border e-commerce, it is growing faster, reaching 9.6%.

At the policy level, the General Office of the State Council issued a document last year to support foreign trade enterprises to expand sales channels through new business formats and models such as cross-border e-commerce. The “14th Five-Year Plan” proposes that by 2025, cross-border e-commerce transactions will reach 2.5 trillion yuan.

As can be seen from this,To serve Chinese companies “going overseas,” China's cross-border payment industry is also a very obvious Chaoyang industry. Even digital is on a high growth track.

According to a research report, based on total payments, the market size of China's cross-border digital payment service industry reached 5.9 trillion yuan in 2023, with a compound growth rate of 27.97% from 2019 to 2023. In 2024, the market size of China's cross-border digital payment service industry will reach 7.5 trillion yuan.

Looking further, we also need to clarify the following three new understandings about the current model of Chinese companies “going overseas”:

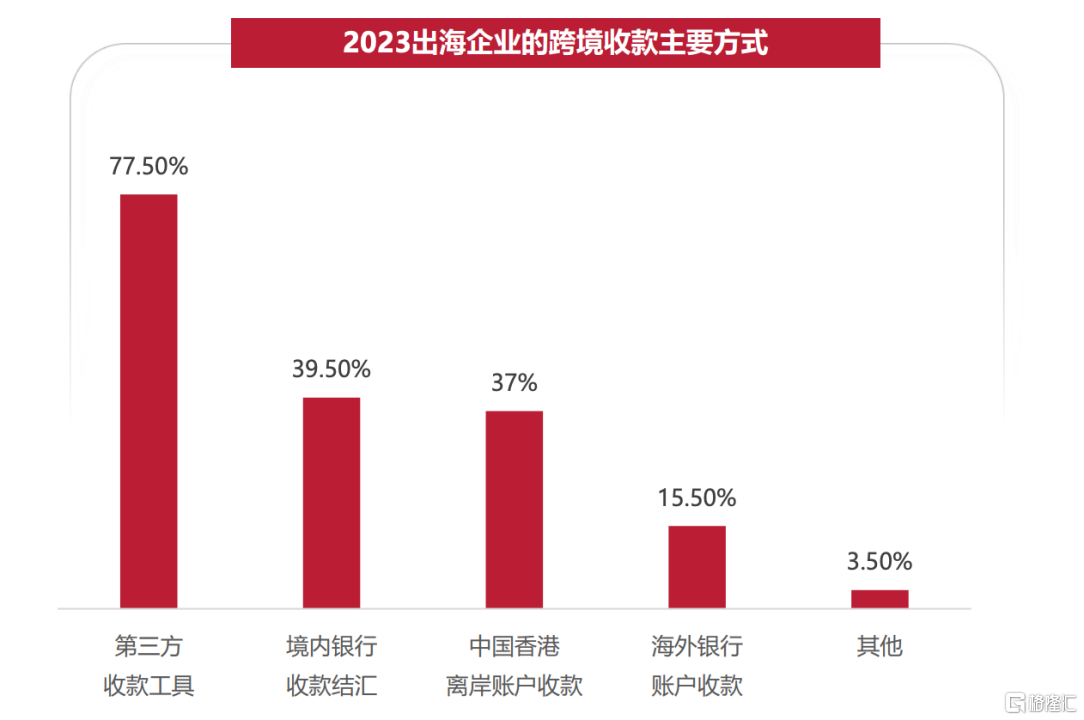

First, the current global layout of the cross-border e-commerce industry and China's production capacity are rapidly conquering overseas markets through cross-border e-commerce, fully supporting mature markets in Europe and the US, where consumer demand is growing rapidly, while also meeting the needs of rapidly emerging markets such as Southeast Asia, South America, and the Middle East. However, the “small amount+high frequency” online transaction scenario of cross-border e-commerce will more clearly drive the development of the third-party payment industry.

Second, the global economic and social environment has changed in recent years. Demand for online shopping, takeout, online games, online entertainment, etc. has exploded, individual and household consumption methods have accelerated “online”, and Chinese games and pan-entertainment products are also speeding up “going overseas.” And this part is mainly the target market for third-party payment institutions.

Third, the destinations for Chinese companies to “go overseas” are not only in the European and American markets; emerging markets such as the Middle East, Southeast Asia, and Latin America have also become everyone's main focus, and the range of markets covered by Chinese cross-border payment service agencies has further expanded.

This together determined that as Chinese enterprises accelerate globalization, a gradual increase in the scale and frequency of transactions is an inevitable trend when it comes to third-party cross-border payments. Well, it is foreseeable that there will be even more room for digital growth in the future.

A clear profit path supports high performance growth

Let's take another look at Lianlian's digital 2023 earnings report, and we'll find itIn terms of performance, it has emerged from a trend of continuous acceleration.

Judging from the core business structure, digital payment services are the main source of revenue connected to digital, while continuously expanding value-added services with payment as the core. With a business structure composed of payment services and value-added services, LianLianDigital creates its own technology platform, provides customers with one-stop solutions, and grasps customer needs more accurately. More importantly, once customers experience high-quality products and services, they often establish long-term cooperation, forming Lianlian Digital's core competitive barrier.

The above layout will lead to an expansion in customer size and increase in activity, and drive rapid growth in transaction volume and revenue.

Judging from consecutive digital financial reports, the total payment amount (TPV) for digital payment services reached RMB 2.0 trillion, an increase of 73.5% over the previous year. The number of active customers reached 1.3 million in 2023, with a year-on-year growth rate of 50.8%.The rapid growth rate shows strong customer recognition and customer stickiness.

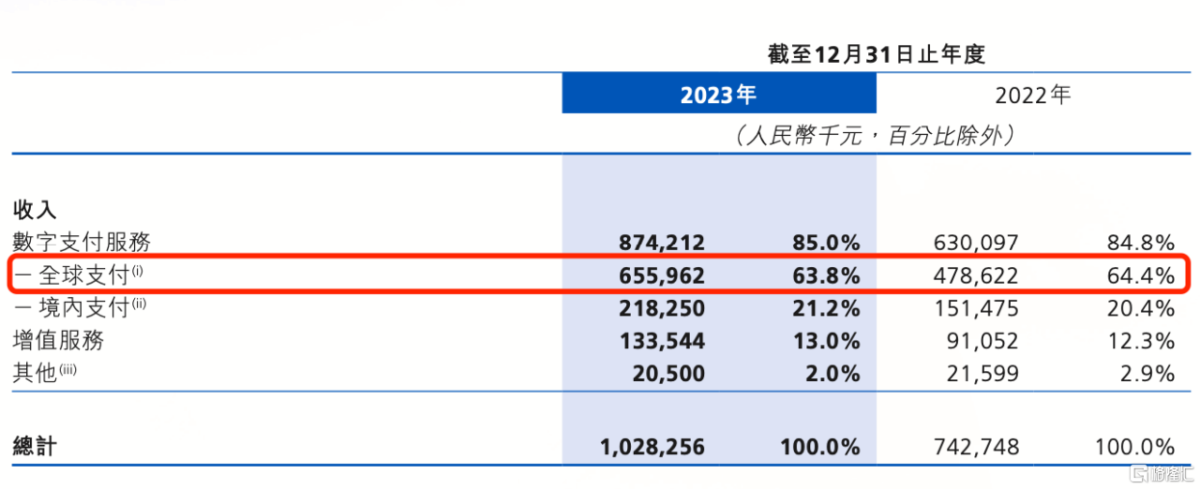

In terms of revenue, the consolidated revenue for 2023 was 1,028 million yuan. Looking back at 2020 to 2022, revenue was 589 million yuan, 644 million yuan, and 743 million yuan respectively, maintaining steady growth.

Among them, global payment services are the main source of revenue. In 2023, this portion of revenue was 656 million yuan, a significant increase of 37.1% over the previous year. Revenue from value-added services grew more rapidly, rising 46.7% year over year to $134 million.

(Source: Lianlian Digital 2023 Earnings Report)

In terms of profitability, consecutive digital earnings reports sent a very positive signal.

The consecutive annual losses narrowed sharply by 28.5%, from RMB 916.9 million for the year ended December 31, 2022 to RMB 654.2 million for the year ended December 31, 2023. Among them, Contiguous figures accounted for Connected's net loss of RMB 664 million, equity incentive expenses of RMB 191 million, and listing expenses of RMB 59 million, while Contiguous's own non-GAAP profit was RMB 16 million. This shows that aside from strategic investment, share payments and listing fees, even figures actually turned a loss into a profit in the main business last year.

In other words,Lianlian Digital's business conditions are gradually improving. Combined with the current industry development prospects and the company's performance growth trend, Lianlian Digital's self-hematopoietic ability will be further enhanced.

At the same time,Continuous numbers continue to increase investment in research and developmentIn 2023, R&D expenses increased 27.5% year-on-year to 268 million yuan, which will help the company innovate in technology, products and services.

Coupled with the successful digital listing and obtaining stronger financing capabilities, there will also be more sufficient capital to invest in R&D, innovation and global layout in the future. This is expected to strengthen LianLianDigital's competitiveness in the third-party cross-border payment market and provide strong support for long-term business development.

Therefore, under the general logic of Chinese companies “going overseas,” the digitally targeted racetrack has huge market opportunities, and the path of performance growth is quite clear. At the same time,The company is also continuously proving its ability to make money to the outside world, which is very attractive for capital that favors value investment.

Three value opportunities emerge

At present, it is obvious to all that emerging markets are speeding up the pace of digital transformation, and the global digital payment market will open up unprecedented room for imagination.

In the Middle East, changing the original single industry structure, which was mainly oil and gas, has become a trend. Digital and technology industries such as ICT, digital infrastructure, intelligent manufacturing, and AI are expected to become the pillars of their future economy. In Latin America, the digital economy has become a highlight of economic growth in the post-pandemic era, and there is huge demand for digitalization. Institutions predict that the value of the digital economy will reach 700 billion US dollars by 2025. In Southeast Asia, the digital economy GMV continues to rise, and the share of digital payments in transactions has officially exceeded 50%. And these are all key regions and markets linked to the future layout of the digital world.

(Picture: E-commerce scale in major Southeast Asian countries, unit: billion US dollars)

In the context of the accelerated development of global technology and the digital economy, third-party cross-border payment service agencies that serve Chinese companies “go overseas” and are embracing the unprecedented opportunities of the times, represented by Connected Digital.

Unlike industry competition, Lianlian Digital clearly has a leading edge in terms of licenses.

By the end of 2023, Lianlian Digital had obtained 64 payment licenses worldwide and built a global payment service network covering 100 countries and regions. More importantly, Lianlian Digital is currently the only Chinese payment company licensed in all 50 US states, and is also a fully licensed third-party payment institution at home and abroad.

Currently, as China's foreign trade market continues to expand and supervision is becoming more and more perfect, the “supervisory-led” payment industry has ushered in an accelerated reshuffle. From a demand perspective, compliant management has long been a necessary condition for Chinese companies to “go overseas.”

Looking at it this way,The scarce value of LianLianDigital will be further highlighted. The license advantage will help it expand its global market share, and LianLianDigital can seize the opportunity of the payment industry's trend towards full compliance regulation.

Furthermore, at present, the demand for Chinese enterprises to “go overseas” continues to escalate. Instead of simply seeking a single service, they need one-stop cross-border professional services to cover the entire growth cycle and drive business growth. whereasLianlian Digital already has strong one-stop service capabilities, and is also expected to seize incremental opportunities in more industries.

Last year, Lianlian Digital successfully joined hands with COSCO SHIPPING Logistics and Putai Technology to establish a joint venture to provide customers with better logistics services, once again enhance one-stop service capabilities, and enhance customer recognition, so that Lianlian Digital can hold more market resources and further consolidate its leading position in the industry.

Judging from the current performance, Lianlian Digital already has a scale advantage, and once an enterprise gains an advantage in scale, the market will accelerate towards resource concentration. The “decisive victory” time among players will soon arrive, and companies with scale effects will often win.

Therefore, the author believes that consecutive numbers are likely to achieve brilliant results in emerging markets. simultaneouslyContinuous numbers will soon pass the stage of high investment and enter the harvest period, and future profit flexibility may be even stronger.

Leaving aside the losses, listing fees, and equity incentive expenses of associated companies, Lianlian Digital itself achieved profit last year. If Lianlian Digital can continuously verify its growth potential in terms of performance, the above value opportunities and growth logic have also been verified. Look back,Continued figures showing a sustainable increase in value will also be a probable event.

epilogue

Overall, the author believes that now may be the right time to focus on consecutive numbers.

As a third-party cross-border payment institution in China, Lianlian Digital has a good business content, and has formed a core barrier, gradually grasping the competitiveness that only a few leading players have.

Continuous numbers have already pressed the button to accelerate performance. Coupled with the current positive internal and external environment facing a favorable internal and external environment, the future performance is likely to break through and break out of an upward curve.