Financial giants have made a conspicuous bullish move on Barrick Gold. Our analysis of options history for Barrick Gold (NYSE:GOLD) revealed 8 unusual trades.

Delving into the details, we found 62% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $115,304, and 6 were calls, valued at $344,053.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $15.0 to $22.0 for Barrick Gold over the recent three months.

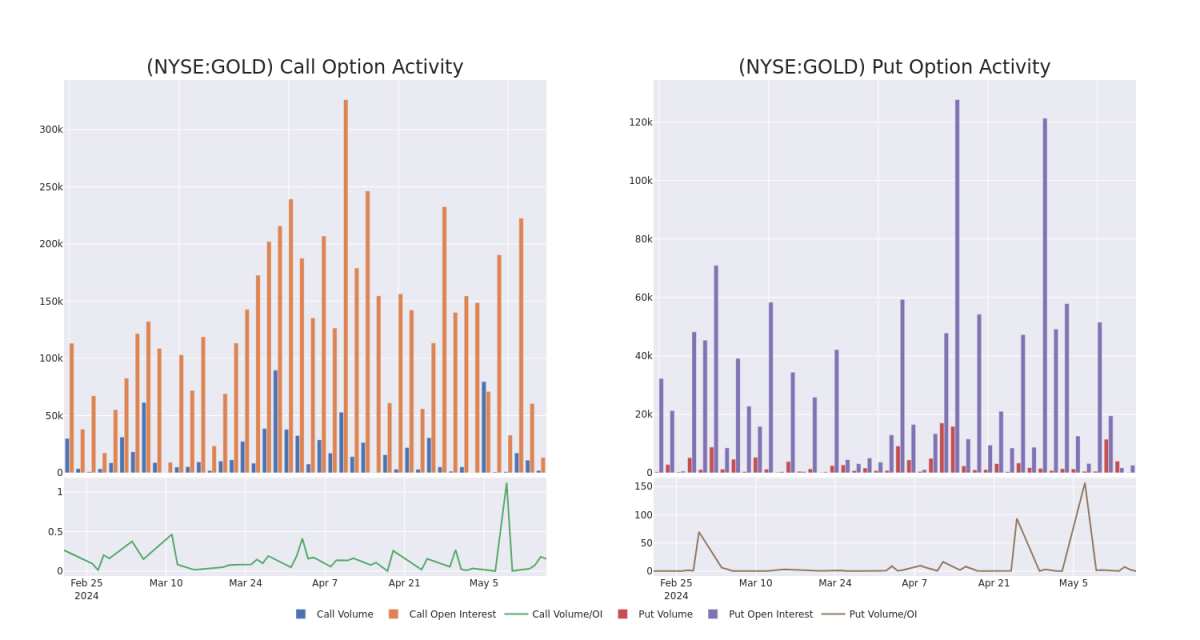

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Barrick Gold's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Barrick Gold's whale activity within a strike price range from $15.0 to $22.0 in the last 30 days.

Barrick Gold 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GOLD | CALL | SWEEP | BEARISH | 06/20/25 | $3.85 | $3.75 | $3.75 | $15.00 | $81.3K | 319 | 219 |

| GOLD | CALL | SWEEP | BEARISH | 02/21/25 | $3.55 | $3.45 | $3.45 | $15.00 | $72.8K | 148 | 213 |

| GOLD | PUT | SWEEP | BULLISH | 12/20/24 | $4.8 | $4.7 | $4.7 | $22.00 | $58.2K | 1.4K | 125 |

| GOLD | PUT | SWEEP | BULLISH | 01/17/25 | $4.8 | $4.75 | $4.75 | $22.00 | $57.0K | 1.1K | 0 |

| GOLD | CALL | SWEEP | NEUTRAL | 06/20/25 | $3.75 | $3.7 | $3.75 | $15.00 | $55.5K | 319 | 367 |

About Barrick Gold

Based in Toronto, Barrick Gold is one of the world's largest gold miners. In 2023, the firm produced nearly 4.1 million attributable ounces of gold and about 420 million pounds of copper. At year-end 2023, Barrick had about two decades of gold reserves along with significant copper reserves. After buying Randgold in 2019 and combining its Nevada mines in a joint venture with competitor Newmont later that year, it operates mines in 19 countries in the Americas, Africa, the Middle East, and Asia. The company also has growing copper exposure. Its potential Reko Diq project in Pakistan, if developed, could double copper production by the end of the decade.

In light of the recent options history for Barrick Gold, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Barrick Gold Standing Right Now?

- With a trading volume of 5,140,164, the price of GOLD is up by 0.4%, reaching $17.49.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 82 days from now.

What Analysts Are Saying About Barrick Gold

In the last month, 1 experts released ratings on this stock with an average target price of $26.0.

- Maintaining their stance, an analyst from BMO Capital continues to hold a Outperform rating for Barrick Gold, targeting a price of $26.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Barrick Gold options trades with real-time alerts from Benzinga Pro.