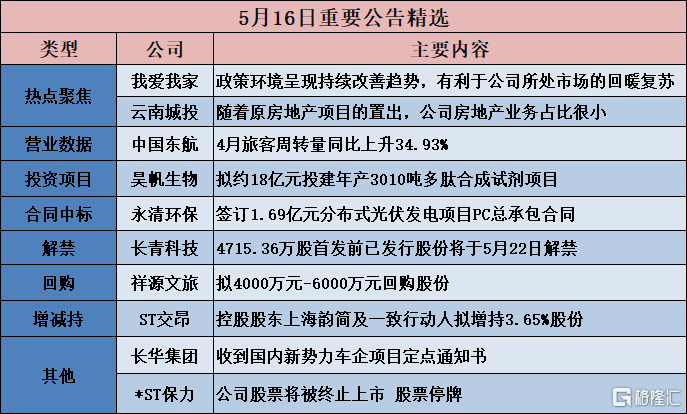

[Focus on hot topics]

Yunnan City Investment (600239.SH): With the placement of the original real estate project, the company's real estate business accounts for a very small share

Yunnan City Investment (600239.SH) announced abnormal fluctuations in stock trading. Currently, the company's main business is property services and commercial operations. With the placement of the original real estate project, the company's real estate business accounts for a very small share.

I love my family (000560.SZ): The policy environment shows a continuous improvement trend, which is conducive to the recovery of the company's market

I Love My Family (000560.SZ) announced abnormal fluctuations in stock trading. Recently, the policy environment in the company's industry has shown a continuous improvement trend, and some cities have further optimized or lifted purchase restrictions on housing transactions. On April 30, the Beijing Municipal Housing and Urban-Rural Development Commission issued the “Notice on Optimizing and Adjusting the City's Housing Purchase Restriction Policy”, which allows households or single adults who meet the relevant conditions to purchase 1 new commercial housing unit outside the 5th Ring Road (including newly built commercial housing and second-hand housing) on the basis of implementing the existing housing purchase restriction policy; on May 9, the Hangzhou Housing Insurance and Housing Administration issued the “Notice on Optimizing and Adjusting the Real Estate Market Regulation Policy” to completely abolish housing purchase restrictions. Housing purchases within Hangzhou will no longer review housing purchase eligibility; strengthen housing credit support and optimize credit settlement policies At the same time, some city government departments issued notices related to the acquisition of existing housing. For example, the Housing and Urban-Rural Development Bureau of Lin'an District of Hangzhou issued the “Call for Purchasing Commercial Housing as Public Rental Housing Suppliers” on May 14 to purchase a batch of commercial housing for public rental housing within Lin'an District. Many of the above policies and measures conducive to increasing market confidence and housing consumption have been introduced one after another, helping to further stimulate the trading vitality of the second-hand housing market and facilitate the recovery of the company's market. Other than the above situation, the company has not found any recent major changes in the business situation or internal and external business environment.

[Investment projects]

Haofan Biology (301393.SZ): Plans to invest about 1.8 billion yuan to build a peptide synthesis reagent project with an annual output of 3010 tons

Haofan Biotech (301393.SZ) announced that in order to further resolve the company's production capacity bottlenecks and better meet the needs of downstream customers, Suzhou Haofan Biotech Co., Ltd. and the Jiangsu Huai'an Industrial Park Management Committee signed an “Investment Framework Agreement” on May 16, 2024. The company plans to invest in the construction of a peptide synthesis reagent project with an annual output of 3010 tons in Huai'an Industrial Park in Jiangsu. The total investment of the project is about 1.8 billion yuan, of which the first phase has an investment amount of about 1 billion yuan. The company will coordinate funding arrangements and reasonably determine funding sources and payment arrangements.

[Contract won the bid]

Shenzhou Digital (000034.SZ): Shenzhou Kuntai plans to win the bid for China Mobile's 2024-2025 new intelligent computing center procurement (package 1)

Shenzhou Digital (000034.SZ) announced that recently, China Mobile Procurement and Bidding Network released the “Announcement of Successful Candidates for Procurement of China Mobile 2024-2025”. Shenzhou Kuntai (Xiamen) Information Technology Co., Ltd. (“Shenzhou Kuntai”), a holding subsidiary of Shenzhou Digital Group Co., Ltd., was one of the successful candidates for bid package 1 of the project. The bid price was 19.117 billion yuan (excluding tax), with a bid share of 10.53%.

Huashen Technology (000790.SZ): Huashen Steel plans to undertake a professional steel structure subcontract project for the Jiangsu Liansheng Heterojunction (HJT) solar cell production project contracted by Rongji Construction

Huashen Technology (000790.SZ) announced that the company's wholly-owned subsidiary, Sichuan Huashen Steel Co., Ltd. (“Huashen Steel Structure”), intends to undertake the professional steel structure subcontract project for the Jiangsu Liansheng Technology Co., Ltd. heterogeneous junction (HJT) solar cell production project, which is generally contracted by Emeishan Rongji Construction Co., Ltd. (“Rongji Construction”), and signed the “Jiangsu Liansheng Technology Co., Ltd. Heterogeneous Junction (HJT) Solar Cell Production Project Steel Structure Professional Subcontract” with conditions. The total price of the contract is RMB 210 million (including tax), the final settlement price is The amount of work calculated on the completed plan and the pricing principles agreed in the contract are approved.

Yongqing Environmental Protection (300187.SZ): Signed a 169 million yuan PC general contracting contract for distributed photovoltaic power generation projects

Yongqing Environmental Protection (300187.SZ) announced that recently, Yongqing Environmental Protection Co., Ltd. and Yunnan Pengdao New Energy Co., Ltd. (“Pengdao New Energy”) signed the “PC General Contract for the C6 Market Rooftop Photovoltaic Power Generation Project Phase I, Phase II and Phase III of the Junfa Xinluojiewan International Trade City, Guandu District, Kunming City, Yunnan Province”. The total contract amount was RMB 169.48 million.

[[Ban lifted]

Huazhong CNC (300161.SZ): The ban on 259.314 million restricted shares will be lifted on May 20

Huazhong CNC (300161.SZ) announced an indicative announcement on lifting restrictions on issuing shares to specific targets and listing and circulation. The unrestricted shares are shares issued by Wuhan Huazhong CNC Co., Ltd. to specific targets. The number of shares that have been lifted this time is 259.313.55 million shares, accounting for 13.05% of the company's current total share capital. The listing and circulation period for the unrestricted shares was May 19, 2024 (Sunday). Since that day is not a securities trading day, the listing and circulation date of the unrestricted shares was postponed to May 20, 2024 (Monday).

Evergreen Technology (001324.SZ): The ban on 47153,600 shares issued before the initial launch will be lifted on May 22

Changqing Technology (001324.SZ) announced an indicative announcement regarding the listing and circulation of some of the shares issued prior to the initial public offering. The shares that have been lifted are some of the shares already issued by Changzhou Changqing Technology Co., Ltd., before the initial public offering. The number of shares that have been lifted this time is 471536 million shares, accounting for 34.1693% of the company's total share capital. The stock listing and circulation date for which sales restrictions have been lifted is May 22, 2024 (Wednesday).

[Business data]

China Construction (601668.SH): The total number of new contracts signed in January-April was 1478.5 billion yuan, up 11.9% year-on-year

China Construction (601668.SH) announced the operating conditions for January-April. The total number of new contracts signed was 1478.5 billion yuan, an increase of 11.9% over the previous year.

China Eastern Airlines (600115.SH): Passenger turnover increased 34.93% year-on-year in April

China Eastern Airlines (600115.SH) announced that in April 2024, the company's passenger capacity investment (in terms of available seat kilometers) increased 20.06% year on year; passenger turnover (in passenger carrier kilometers) increased by 34.93% year on year; passenger occupancy rate was 81%, up 8.93 percentage points year on year. In April 2024, cargo and mail turnover (measured in tons and kilometers carried by cargo and mail) increased by 88.03% year-on-year.

China Southern Airlines (600029.SH): Passenger turnover increased 19.79% year on year in April

China Southern Airlines (600029.SH) announced that in April 2024, passenger capacity investment (in terms of usable seat kilometers) of the company and its subsidiaries increased 9.52% year on year, with a year-on-year decrease of 5.59% in China and 31.29% and 120.17% year on year respectively; passenger turnover (in terms of passenger kilometers revenue) increased 19.79% year on year, with domestic, regional and international increases of 3.12%, 42.20%, and 143.80%, respectively; the passenger occupancy rate was 83.08%, up 7.12 percentage points year on year, and within China , regions, and the world increased by 7.03, 6.00, and 8.05 percentage points, respectively, over the same period last year. In terms of freight, in April 2024, freight capacity investment (in terms of usable tonnes kilometers - freight and mail traffic) increased 8.84% year on year; cargo and mail turnover (in terms of tons of revenue - freight and mail traffic) increased 23.47% year on year; and cargo and mail carrying rate was 55.10%, up 6.53 percentage points year on year.

[Repurchase]

Xiangyuan Cultural Tourism (600576.SH): Plans to repurchase shares for 40 million yuan to 60 million yuan

Xiangyuan Cultural Tourism (600576.SH) announced that the amount of shares to be repurchased is not less than RMB 40 million, not more than RMB 60 million, and that the share repurchase price is not higher than RMB 8.69 per share.

[Increase or decrease holdings]

Ling Steel Co., Ltd. (600231.SH): Hongyun Capital plans to reduce its holdings by no more than 2%

Ling Steel Co., Ltd. (600231.SH) announced that the stock pledged repurchase transaction handled by Hongyun Capital at Dongwu Securities Co., Ltd. has triggered a breach of the agreement and may passively reduce its holdings. It plans to reduce its holdings by no more than 2% of the company's total share capital through centralized bidding transactions and bulk transactions within 90 consecutive natural days between June 11 and September 8, 2024, that is, no more than 57,043,280 shares. Among them, it is proposed to reduce holdings by no more than 1% through centralized bidding, that is, no more than 28,521,640 shares; it is proposed to reduce holdings by no more than 1% of the company's total share capital through bulk transactions, that is, no more than 28,521,640 shares.

ST Jiaonang (600530.SH): Controlling shareholder Shanghai Yunjian and co-actors plan to increase their shares by 3.65%

ST Jiaonang (600530.SH) announced that the controlling shareholder of the company, Shanghai Yunjian Industrial Development Co., Ltd. (“Shanghai Yunjian”), and co-actors Shanghai Shijie Decoration Design Engineering Co., Ltd. (“Shanghai Shijie”) and Shanghai Yushi Trading Co., Ltd. (“Shiji Trading”) increased their holdings of the company by a total of 1.482,000 shares on May 16, 2024, accounting for 0.1912% of the company's total share capital. Shanghai Yunjian and its co-actors plan to increase the company's shares by 3.65% (including the amount of initial increase) within 6 months from the date of the initial increase in holdings (that is, May 16, 2024 to November 15, 2024) with their own capital.

Oriental Jiasheng (002889.SZ): Chairman Sun Weiping plans to reduce holdings by no more than 4.824 million shares

Dongfang Jiasheng (002889.SZ) announced that due to her financial needs, Ms. Sun Weiping, the controlling shareholder, actual controller, and general manager of the company, plans to reduce her holdings of the company's shares by no more than 4,824,005 shares through centralized bidding transactions and/or bulk transactions within 3 months after 15 trading days from the date of disclosure, accounting for 2.50% of the company's current total share capital, accounting for 2.51% of the company's total share capital after excluding the number of shares in the company's dedicated repurchase account. Among them, the holdings were reduced by no more than 1,929,602 shares through centralized bidding transactions, which in total did not exceed 1.00% of the company's total share capital; no more than 2,894,403 shares were reduced by a total of no more than 1.50% of the company's total share capital (if dividends, dividends, stock transfers, capital reserve transfers to share capital, allotment of shares during the reduction period, etc., the number of shares reduced will be adjusted accordingly).

Shengtai Group (605138.SH): Youngor Apparel plans to reduce its holdings by no more than 3%

Shengtai Group (605138.SH) announced that within 3 months from the date of the announcement of this reduction plan, Youngor Apparel plans to reduce its holdings by no more than 1% of the company's total share capital through centralized bidding transactions, that is, no more than 5,555,600 shares, and within any 90 consecutive days, reduce its holdings by no more than 1% of the company's total share capital, or 5,555,600 shares, through centralized bidding transactions; that is, reduce its holdings by no more than 2% of the company's total share capital through bulk trading within 3 months after the announcement of this holdings reduction plan The quantity shall not exceed 11,111,200 shares, and the holdings shall be reduced by no more than 2% of the company's total share capital, or 11,111,200 shares, through bulk transactions within any 90 consecutive calendar days.

[Other]

Changhua Group (605018.SH): Received a designated notice for a new domestic car company project

Changhua Group (605018.SH) announced that the company recently received a fixed notice from a new domestic car company (limited to a confidentiality agreement and unable to disclose its name, hereinafter referred to as the “customer”) regarding welding parts for new energy models. According to the customer plan, there are a total of 64 targeted projects, with a life cycle of 5 years, with a total lifetime sales amount of about RMB 226 million. Mass production of this targeted project is expected to gradually begin in the first quarter of 2025.

*ST Baoli (300116.SZ): The listing of the company's shares will be terminated and stock trading suspended

*ST Baoli (300116.SZ) announced that according to the relevant provisions of section 10.2.1 of the “Shenzhen Stock Exchange GEM Stock Listing Rules (2024 Revision)”, the daily stock closing price of listed companies was below 1 yuan for 20 consecutive trading days, and the Shenzhen Stock Exchange terminated their stock listing transactions. Stocks that have been terminated due to mandatory delisting in the trading category will not enter the delisting period. As of May 16, 2024, the closing price of the company's stock was below 1 yuan for 20 consecutive trading days. It has already touched upon the mandatory delisting situation stipulated in section 10.2.1 of the “Shenzhen Stock Exchange GEM Stock Listing Rules (2024 Revision)”. The listing and trading of the company's shares will be terminated by the Shenzhen Stock Exchange. Trading of the company's shares will be suspended from the opening of the market on May 17, 2024.