May 16, 2024

SBI Securities Co., Ltd.

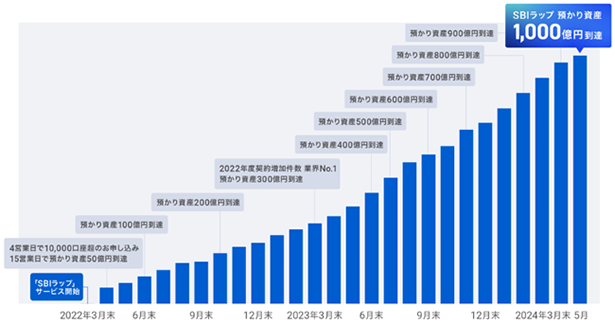

SBI Securities Co., Ltd. (Headquarters: Minato-ku, Tokyo; President and CEO: Masato Takamura; hereinafter “the Company”) is pleased to announce that the discretionary investment service “SBI Wrap” has surpassed 100 billion yen in over 2 years and 1 month since service provision began on 2022/3/31 (Thursday).

“SBI Lap” uses the platform “4RAP (4RAP)” provided by FOLIO to provide high-quality operation services that make the most of the know-how possessed by operators at low cost. Starting with the provision of the SBI Wrap in March 2022, we are currently providing the following 4 discretionary investment management services.

| Delivery start date | Service name |

| March 31, 2022 | SBI Lap (currently SBI Wrap AI Investment Course) |

| October 20, 2022 | SBI Rap x SBI Shinsei Bank |

| July 15, 2023 | SBI Rap Takumi Operation Course |

| July 18, 2023 | SBI Lap x Investment Trust Consultation Plaza |

By expanding our services to meet the diverse needs of our customers, it has been used by a wide range of customers regardless of age, such as becoming the industry No. 1 (*) in the number of fund wrap robo-advisor contracts increasing in fiscal 2022 until the 3rd quarter of fiscal 2023. Going forward, we will continue to study so that we can provide new management services utilizing management strategies different from existing services, and we will endeavor to contribute to asset formation according to customer needs.

External site: Japan Investment Advisors Association website https://www.jiaa.or.jp/toukei/

The major feature of the “SBI Wrap (AI Investment Course, Takumi's Management Course)” is that it is possible to “have both” using a combination of both courses simultaneously while simultaneously using discretionary investment services with completely different management strategies with a single securities account on an online channel. Both courses have in common that investment allocations are changed once a month with the aim of responding to all market situations, but the method for determining the investment strategy and investment targets are different. The “AI Investment Course” aims for performance that surpasses people by utilizing AI for asset management, anticipating market trends, and responding to all market situations. Meanwhile, in the “Takumi Management Course,” Nomura Asset Management Co., Ltd. provides investment advice, and aims to obtain stable profits that are less likely to be affected by the investment environment through unique investment strategies.

“SBI Lap × (SBI Shinsei Bank, Investment Trust Plaza)” is a fund wrap service for face-to-face channels, and is characterized by the fact that customers can perform fully automated asset management while receiving follow-up from the person in charge. Through face-to-face consulting that is close to the needs of each customer, it is possible to select an optimal portfolio from 5 management styles, and the cost is set at a relatively low level for a fund wrap for face-to-face channels.

The reason we were able to achieve a balance of 100 billion yen in 2 years and 1 month from the start of service provision was evaluated by the fact that fully automated asset management can be performed with low cost (discretionary investment fee (tax included, annual rate): AI Wrap: 0.66%, Takumi Wrap: 0.77%, SBI Wrap x SBI Shinsei Bank and SBI Wrap x Investment Trust Consultation Plaza: 1.21%).

Going forward, we will continue to strive to expand our products and services in order to provide “the highest level of service in the industry with the lowest fees in the industry.”

| Campaign name | [Commemorating SBI lap balance surpassing 100 billion yen] Equals 1,110 people! SBI wrap purchase campaign |

| Campaign content | A total of 1,110 people will receive a maximum of 100,000 yen (100,000 yen for 10 people, 10,000 yen for 100 people, 1,000 yen for 1,000 people) for those who enter during the campaign period and have a “total purchase price” — “total sale amount” of 200,000 yen or more of SBI Lap (AI investment course, Takumi management course) |

| Who is eligible for the campaign | Individual customers of the internet course (adult account) |

| Campaign period | 2024/5/22 (Wed) to 2024/7/31 (Wed) (planned) |

| Single Investment Agent | FOLIO Inc. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Term of discretionary investment agreement | 1 year (no procedure required because it is automatically renewed every year thereafter) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How to apply | From our website after logging in, the application is completed in 3 steps, such as agreeing to the terms and conditions relating to the provision of customer personal information to third parties and the terms and conditions relating to discretionary investment services. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Minimum investment | Purchases can be made from 10,000 yen or more. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Purchase units | First-time/additional purchases: 10,000 yen or more in units of 1,000 yen Accumulated purchases: 1,000 yen or more in units of 1,000 yen | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings function | It can be set in units of 1,000 yen or more of 1,000 yen. We carry out funded investments at a frequency of once a month. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exchange/Cancellation※ | It is possible to partially redeem 10,000 yen or more in units of 1,000 yen. * If the balance of assets under management after exchange becomes less than 10,000 yen, or when exchanging 95% or more of the assets under management, it is necessary to cancel (sell all). | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SBI Lap Account Deposit and Withdrawal Routes | Funds at the time of purchase, exchange, and cancellation are automatically transferred to and from the General Securities Account. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Discretionary Investment Fee | [SBI Wrap AI Investment Course] 0.66% (annual rate, tax included) [SBI Rap Takumi Operation Course] 0.77% (annual rate, tax included) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment target funds | SBI Wrap AI Investment Course Through 8 types of dedicated mutual funds, we invest in ETFs listed in the US and make diversified investments in assets around the world.

*All prices include tax. *All funds are uniform, no purchase/cancellation fees, and no trust asset retention amounts. *Trust remuneration (and actual trust remuneration) is an expense incurred by holding an investment target fund. Since it is deducted from trust property, no separate payment is required. * “Substantial trust remuneration” refers to a numerical value obtained by adding trust rewards determined for each of the 8 types of investment target funds and the expense ratio of ETFs invested through the investment target fund. Note that the cost ratio of ETFs invested through investment target funds varies from stock to stock, and falls within the range of 0.030% to 0.490% (annual rate). Contract company: SBI Asset Management Co., Ltd.[SBI Rap Takumi Operation Course] We will invest in 9 types of active funds dedicated to SBI Rap Takumi's management courses, and we aim for management results that exceed the market average for each.

*All prices include tax. *All funds are uniform, and there are no purchase/cancellation fees. *Trust remuneration is an expense incurred by holding an investment target fund. Since it is deducted from trust property, no separate payment is required. Outsourced company: Nomura Asset Management Co., Ltd. |

| Single Investment Agent | FOLIO Inc. | |||||||||||||||||||||||||||

| Term of discretionary investment agreement | 1 year (no procedure required because it is automatically renewed every year thereafter) | |||||||||||||||||||||||||||

| How to apply | Written procedures at the SBI Shinsei Bank, Ltd. storefront | |||||||||||||||||||||||||||

| Minimum investment | Purchases can be made from 2 million yen or more. | |||||||||||||||||||||||||||

| Purchase units | Initial purchase: 2 million yen or more in units of 10,000 yen (additional purchases of 500,000 yen or more in units of 10,000 yen) Accumulated purchases: 10,000 yen or more in units of 1,000 yen | |||||||||||||||||||||||||||

| Savings function | It is possible to set 10,000 yen or more in units of 1,000 yen. We carry out funded investments at a frequency of once a month. | |||||||||||||||||||||||||||

| Exchange/Cancellation※ | A portion of 10,000 yen or more can be redeemed in units of 1 yen. * If the balance of assets under management after exchange is less than 2 million yen, or when exchanging 95% or more of the assets under management, it is necessary to cancel (sell all). | |||||||||||||||||||||||||||

| SBI Lap Account Deposit and Withdrawal Routes | Funds at the time of purchase, exchange, and cancellation are automatically transferred to and from the General Securities Account. | |||||||||||||||||||||||||||

| Mode of operation | Select 1 course from 5 management courses with optimized asset allocation by risk tolerance | |||||||||||||||||||||||||||

| Discretionary Investment Fee | 1.21% (annual rate, tax included) | |||||||||||||||||||||||||||

| Investment target funds | With the “SBI Wrap x SBI Shinsei Bank” discretionary investment account, investments are made in ETFs listed in the US through 8 types of dedicated investment trusts, and diversified investments are made in assets around the world.

*All prices include tax. *All funds are uniform, no purchase/cancellation fees, and no trust asset retention amounts. *Trust remuneration (and actual trust remuneration) is an expense incurred by holding an investment target fund. Since it is deducted from trust property, no separate payment is required. * “Substantial trust remuneration” is a numerical value obtained by adding trust rewards determined for each of the 8 types of investment target funds and the expense ratio of ETFs invested through the investment target fund. Note that the cost ratio of ETFs invested through investment target funds varies from stock to stock, and falls within the range of 0.030% to 0.490% (annual rate). Contract company: SBI Asset Management Co., Ltd. | |||||||||||||||||||||||||||

| Service Details | https://www.shinseibank.com/retail/swrap/swrap_tempo/ |

| Single Investment Agent | FOLIO Inc. | |||||||||||||||||||||||||||

| Term of discretionary investment agreement | 1 year (no procedure required because it is automatically renewed every year thereafter) | |||||||||||||||||||||||||||

| How to apply | Face-to-face written acceptance by Fan Co., Ltd. | |||||||||||||||||||||||||||

| Minimum investment | Purchases can be made from 2 million yen or more. | |||||||||||||||||||||||||||

| Purchase units | Initial purchase: 2 million yen or more in units of 10,000 yen (additional purchases of 500,000 yen or more in units of 10,000 yen) Accumulated purchases: 10,000 yen or more in units of 1,000 yen | |||||||||||||||||||||||||||

| Savings function | It is possible to set 10,000 yen or more in units of 1,000 yen. We carry out funded investments at a frequency of once a month. | |||||||||||||||||||||||||||

| Exchange/Cancellation※ | A portion of 10,000 yen or more can be redeemed in units of 1 yen. * If the balance of assets under management after exchange is less than 2 million yen, or when exchanging 95% or more of the assets under management, it is necessary to cancel (sell all). | |||||||||||||||||||||||||||

| SBI Lap Account Deposit and Withdrawal Routes | Funds at the time of purchase, exchange, and cancellation are automatically transferred to and from the General Securities Account. | |||||||||||||||||||||||||||

| Mode of operation | Select 1 course from 5 management courses with optimized asset allocation by risk tolerance | |||||||||||||||||||||||||||

| Discretionary Investment Fee | 1.21% (annual rate, tax included) | |||||||||||||||||||||||||||

| Investment target funds | With the “SBI Lab x Mutual Fund Consultation Plaza” discretionary investment account, investments are made in ETFs listed in the US through 8 types of dedicated investment trusts, and diversified investments are made in assets around the world.

*All prices include tax. *All funds are uniform, no purchase/cancellation fees, and no trust asset retention amounts. *Trust remuneration (and actual trust remuneration) is an expense incurred by holding an investment target fund. Since it is deducted from trust property, no separate payment is required. * “Substantial trust remuneration” is a numerical value obtained by adding trust rewards determined for each of the 8 types of investment target funds and the expense ratio of ETFs invested through the investment target fund. Note that the cost ratio of ETFs invested through investment target funds varies from stock to stock, and falls within the range of 0.030% to 0.490% (annual rate). Contract company: SBI Asset Management Co., Ltd. | |||||||||||||||||||||||||||

| Service Details | https://toushin-plaza.jp/sbi-wrap-x/ |

| Trade name, etc. | SBI Securities Co., Ltd. Financial Instruments Brokers, Commodity Futures Traders |

| registration number | Kanto Finance Bureau Director (Gold Trading) No. 44 |

| Join an association | Japan Securities Dealers Association, Financial Futures Dealers Association, General Incorporated Association Type 2 Financial Instruments Dealers Association, Japan STO Association, Japan Commodity Futures Trading Association |

| Trade name, etc. | FOLIO Co., Ltd. Financial Instruments Dealers |

| registration number | Kanto Finance Bureau Director (Financial Services) No. 2983 |

| Join an association | Japan Securities Dealers Association, Japan Investment Advisors Association |

<Fees and Risk Information at SBI Securities>

There are no account opening fees and management fees for SBI Securities' comprehensive securities account. When investing in products, etc. handled by SBI Securities, you may be charged prescribed fees and necessary expenses for each product. Also, there is a risk that losses will occur due to price fluctuations, etc. for each product (there is a risk that losses will exceed the secured deposit/margin (principal) pledged in margin transactions, commodity futures transactions, foreign exchange margin transactions, and exchange CFDs (Kurikku Stock 365)). Fees, etc. and risks to be borne when investing in each product, etc. vary from product to product, so for details, please check the relevant product page on the SBI Securities website, signs relating to the Financial Instruments and Exchange Act, etc., or documents issued before signing a contract.