The latest action of the stock god

After the US stock market on Wednesday (May 15), Berkshire Hathaway, a subsidiary of “stock god” Buffett, submitted a position report (13F) for the first quarter of 2024.

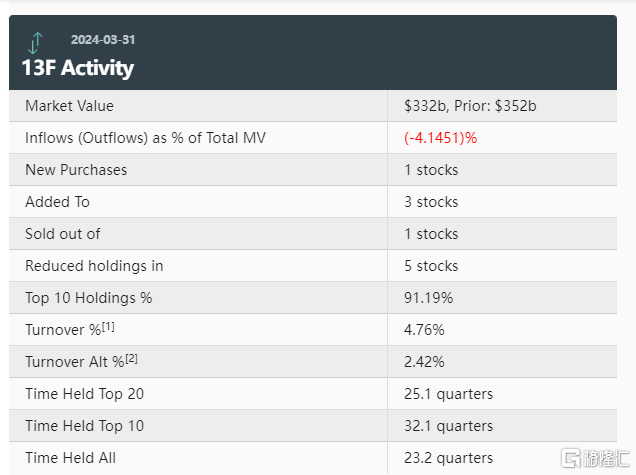

By the end of the first quarter, Berkshire's overall holdings reached US$332 billion, down about 4.15% month-on-month from US$352 billion in the previous quarter.

Berkshire Q1The concentration of the top ten major stocks was 91.19%.

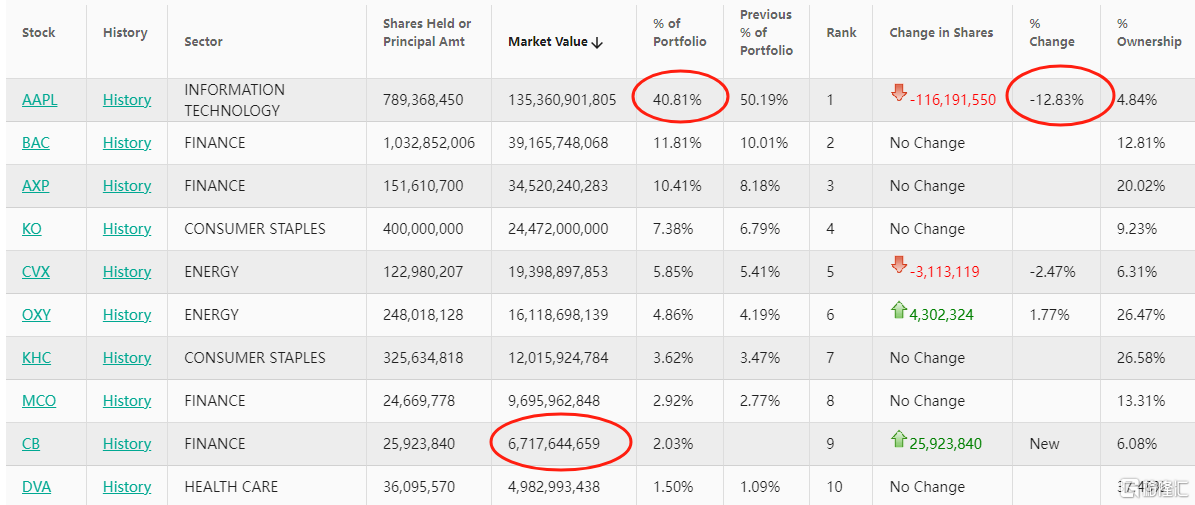

Among the top ten major stocks, Apple is still in the top position. Of these, it holds about 789 million shares, with a market value of 135.4 billion US dollars, accounting for about 41% of the portfolio, but the number of holdings is higher than in the previous quarterSignificant decrease of 12.83%.

The reduction in Apple holdings has actually been traced for a long time.

Earlier this month, Buffett revealed at the Berkshire Hathaway annual meeting that he had reduced his Apple holdings.

The reason is that the iPhone maker is facing a range of difficulties, including antitrust fines, declining sales in China, and a failed car project.

Bank of AmericaIt is still in second place, holding approximately 1,033 billion shares, with a market capitalization of US$3.9 billion, accounting for about 12% of the total market value of its holdings.

The positions of the third, fourth, and fifth positions have not changed, respectivelyAmerican Express, Coca Cola, ChevronThe holding ratio was approximately 10.41%, 7.38%, and 5.85%, respectively.

The sixth to tenth places are Occidental Petroleum, Kraft Heinz, Moody's, Anda Insurance, and Devitt, with holding ratios of 4.86%, 3.62%, 2.92%, 2.03%, and 1.50%, respectively.

In Q1 positions,Berkshire increased its holdings by 3 targets, reduced its holdings by 5 targets, added 1 new target (Anda Insurance), and cleared 1 target (HP).

Among them isIncrease holdingsOn the other hand, Berkshire has increased its bet on Occidental Petroleum. By the end of March, Berkshire's holdings had increased by nearly 2%, holding more than 248 million shares worth about US$16.1 billion.

In addition, Q1 also increased its holdings of Liberty Media Corporation Class A shares by about 13 million shares and about 22 million Class C shares. As of the end of March, the consolidated shares were worth approximately $2.9 billion.

Q1lesseningApple is about 13%, US energy giant Chevron about 2.5%, satellite broadcasting provider SiriusXM about 9%, building materials manufacturer Louisiana Pacific about 6%, and Paramount Global B about 88%.

Clearance HP.According to the documents, Berkshire Q1 completely emptied the shares of computer and peripheral manufacturer HP and sold more than 22 million HP shares.

Berkshire has been reducing its holdings in the stock in recent quarters.

It is worth noting thatBerkshire's “secret positions” have finally come to light.

According to documents, Berkshire has been increasing its holdings since the second half of 2023Adachi Insurance(Chubb) shares, but this position has been kept secret until now.

By the end of March 2024, Berkshire had purchased nearly 26 million shares of Chubb Insurance, with a cumulative shareholding value of approximately US$6.7 billion, accounting for 2.03% of the investment portfolio.

This also made Chubb Insurance Q1 the ninth largest stock in Berkshire.

According to reports, Chubb Insurance mainly provides products such as home insurance, car insurance, and liability insurance, and has now developed into one of the largest insurance companies in the world.

CFRA research analyst Cathy Seiffert said that since Chubb focuses on commercial and specialty insurance, this will be a perfect fit for Berkshire's insurance and reinsurance portfolios.

“Chubb Insurance is an attractive equity investment for Berkshire because it operates a business that Berkshire is familiar with — property and casualty insurance.”