Morgan Stanley raised Dell's target price by 19%, and the stock price is expected to rise more than 10% from Tuesday. It regards it as the preferred individual stock, saying that Dell's AI server momentum is stronger than any other OEM.

Artificial intelligence (AI) concept stocks are booming again, and Dell, which is moved by investors optimistic about strong demand for AI servers, is a leader among them.

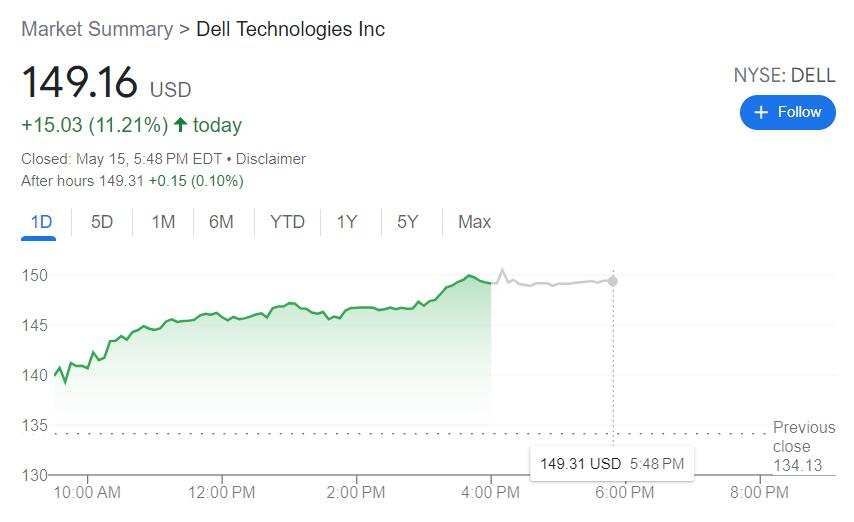

On Wednesday, May 15, EST, Dell (DELL) rose to $150.28 in midday trading, rising about 12% during the day and closing 11.2%, setting a record high in mid-session and closing, with a cumulative increase of nearly 95% this year.

Although Dell itself did not release any positive news on Wednesday, Morgan Stanley analyst Erik Woodring released a bullish Dell report on the same day. It is expected that the market's uninterrupted demand for AI servers will increase Dell's sales, saying Dell is its preferred individual stock.

Woodring raised Dell's target price from $128 to $152 per share, an increase of nearly 18.8%, which means Woodring expects the next year's stock price to rise more than 13% from Tuesday's closing.

Woodring's report stated that Dell's upward momentum is accelerating, particularly in terms of winning the business of building AI servers, which has given the stock a new reason to be bullish. According to the report, it was learned that Dell is the original equipment manufacturer (OEM) with the strongest growth in AI server products:

“All in all, we've heard that Dell's AI servers are gaining more momentum than any other OEM.”

Woodring expects Dell's AI server revenue to reach about $10 billion in fiscal year 2025, which ends in February next year. This expected revenue is approximately 3.4 times that of the previous fiscal year.

Wall Street News once mentioned that after rising through the heatwave of personal computers (PCs) in the millennium, Dell fell silent for many years until the explosion of AI technology in 2016 Dell realized this was an opportunity to turn around. It began to vigorously deploy AI: in 2018, the high-end storage PowerMax with a built-in machine learning engine was released, and in 2020, the AI server PowerEdge and AI PC were released. From AI servers to AI storage platforms to personal computer products with built-in AI functions, Dell can be described as arming itself to the teeth with AI.

In fact, since early March this year, when it released its impressive financial report for the fourth fiscal quarter of the previous fiscal year, Dell has entered the eyes of more investors betting on AI, and its stock price has accelerated since then. On March 1, the first trading day after the release of earnings reports, Dell surged 31.6% on one day.

In the fourth fiscal quarter of fiscal year 2024 ending February of this year, Dell's revenue fell 11% year over year, the decline was lower than expected, and net profit surged 89% year over year. Thanks to AI optimization of the server business, Dell's Infrastructure Solutions Group (ISG) business base revenue declined 6% year over year during the quarter, but increased 10% month over month.

Dell CEO Jeff Clarke said at the time of the earnings release that the strong momentum of AI-optimized servers continued. Orders increased by nearly 40% month-on-month, backlog orders almost doubled, and sales reached 2.9 billion US dollars at the end of the 2024 fiscal year.

Although the fiscal quarter is expected to decline by 12% to 16% year over year, Dell is optimistic that the company will resume growth in the 2025 fiscal year, fueled by the AI boom.

Dell Technology's chief financial officer Yvonne McGill said Dell's decision to increase its annual dividend by 20% “demonstrates our confidence in the business.” McGill also anticipates that revenue from the computer business should grow at a “low single digit,” while the infrastructure sector will achieve medium ten-digit growth driven by AI.