High-rolling investors have positioned themselves bearish on Shopify (NYSE:SHOP), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in SHOP often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 9 options trades for Shopify. This is not a typical pattern.

The sentiment among these major traders is split, with 33% bullish and 44% bearish. Among all the options we identified, there was one put, amounting to $36,120, and 8 calls, totaling $357,417.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $50.0 to $115.0 for Shopify over the recent three months.

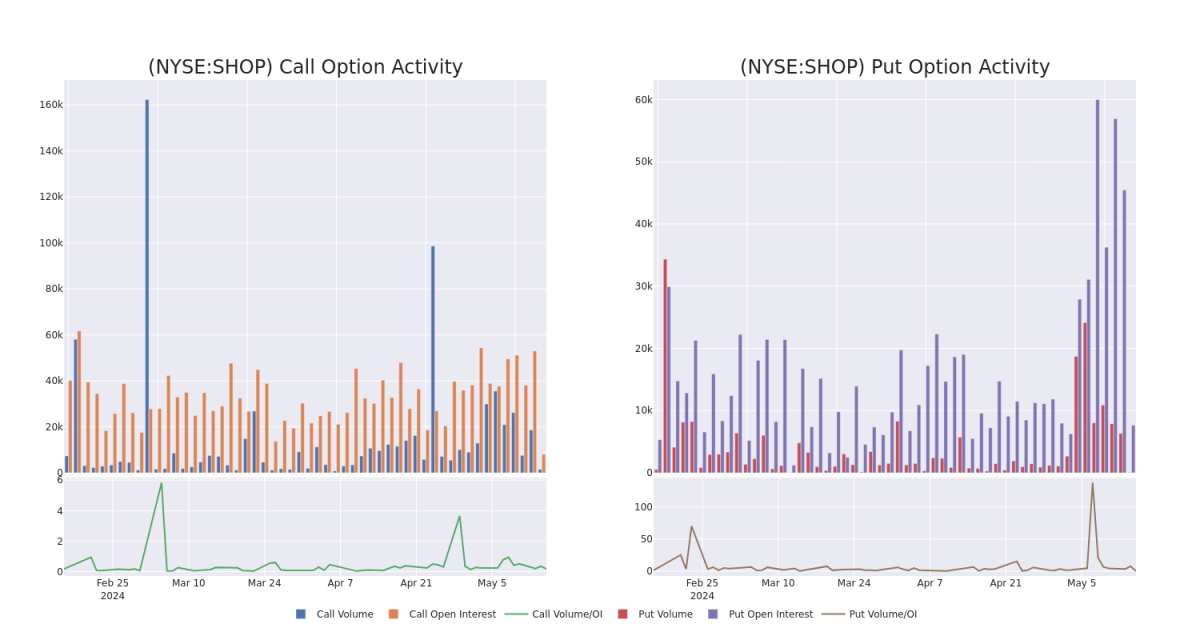

Volume & Open Interest Trends

In today's trading context, the average open interest for options of Shopify stands at 1963.75, with a total volume reaching 1,560.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Shopify, situated within the strike price corridor from $50.0 to $115.0, throughout the last 30 days.

Shopify Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SHOP | CALL | SWEEP | BEARISH | 06/20/25 | $4.4 | $4.3 | $4.25 | $90.00 | $133.6K | 1.0K | 316 |

| SHOP | CALL | TRADE | BULLISH | 01/16/26 | $4.0 | $4.0 | $4.0 | $115.00 | $42.8K | 1.2K | 112 |

| SHOP | PUT | SWEEP | BEARISH | 01/17/25 | $8.65 | $8.5 | $8.6 | $60.00 | $36.1K | 7.6K | 68 |

| SHOP | CALL | SWEEP | BULLISH | 07/19/24 | $3.5 | $3.35 | $3.45 | $60.00 | $34.5K | 3.2K | 280 |

| SHOP | CALL | TRADE | NEUTRAL | 07/19/24 | $3.5 | $3.4 | $3.45 | $60.00 | $31.0K | 3.2K | 506 |

About Shopify

Shopify offers an e-commerce platform primarily to small and medium-size businesses. The firm has two segments. The subscription solutions segment allows Shopify merchants to conduct e-commerce on a variety of platforms, including the company's website, physical stores, pop-up stores, kiosks, social networks (Facebook), and Amazon. The merchant solutions segment offers add-on products for the platform that facilitate e-commerce and include Shopify Payments, Shopify Shipping, and Shopify Capital.

In light of the recent options history for Shopify, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Shopify

- Currently trading with a volume of 2,008,098, the SHOP's price is up by 0.56%, now at $58.35.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 77 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Shopify options trades with real-time alerts from Benzinga Pro.